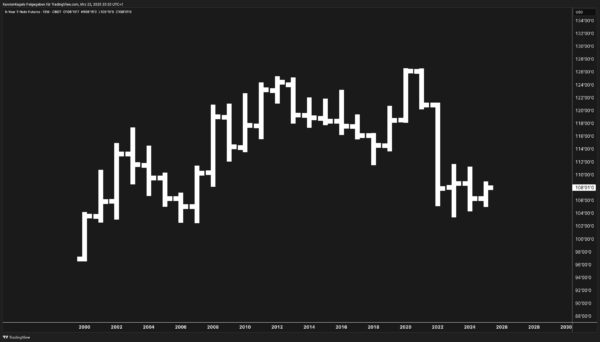

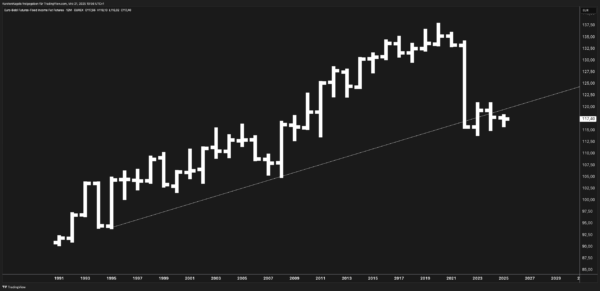

2-Year T-Note Futures (ZT) Price Forecast: Technical & Fundamental Outlook for Traders

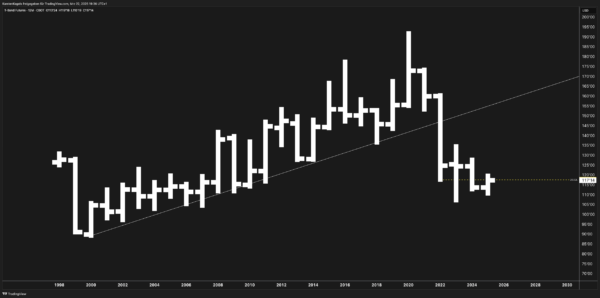

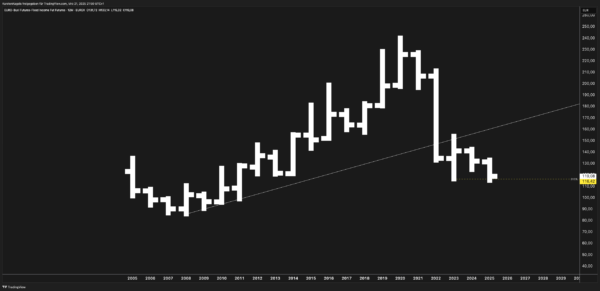

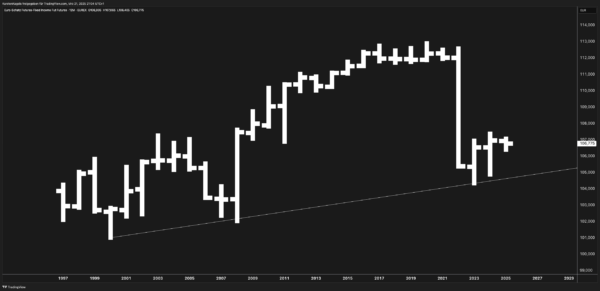

Introduction The chart shows the historical price action of the 2-Year T-Note futures from approximately 2000 to the current period in 2025, with a projection line extending to 2032. This analysis will examine key technical patterns, macroeconomic influences, and provide multi-scenario forecasts to help traders navigate this important interest rate market. Technical Analysis Major Support …