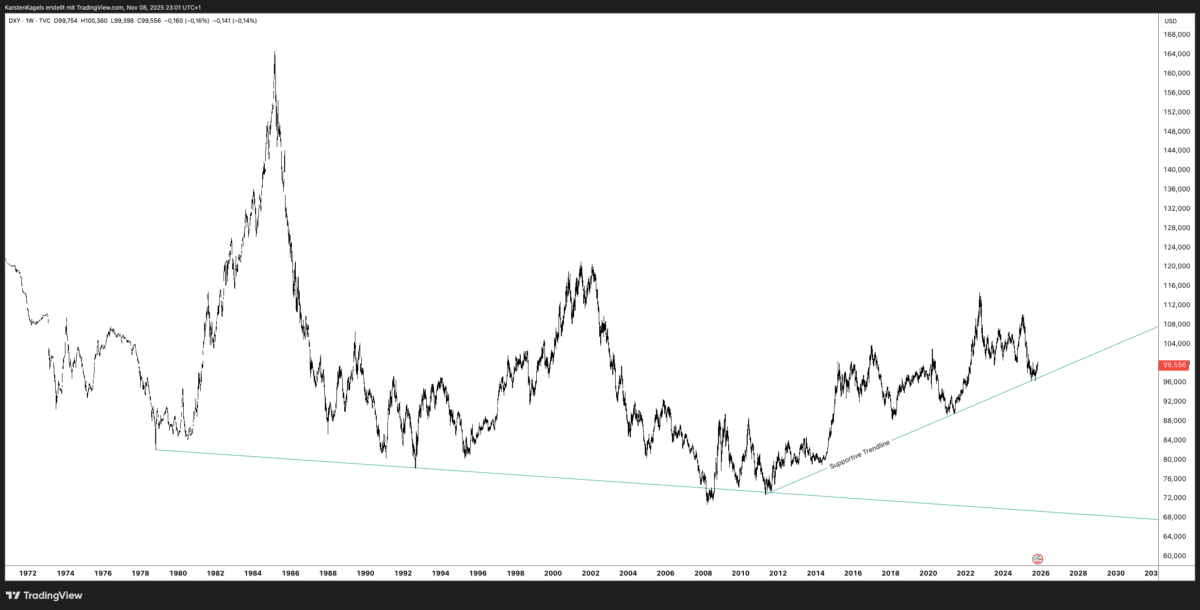

Date: November 8, 2025

Current Level: ~99.89

Critical Support Test: Trendline Holds!

The DXY is well above the key ascending trendline from 2012 (connecting 72 in 2012 and 89 in 2020). This support line currently sits at approximately 96.50 – and with price at 99.89, there’s still a comfortable buffer of over 3 points above this critical support.

Technical Picture: Bullish

Why the Bulls Are in Control:

- 2012 uptrend trendline (~96.50) still intact

- Price 3+ points above support = healthy distance

- 13-year trendline proven reliable

Key Levels:

- Critical Support: 96.50 (2012 trendline – THE KEY LEVEL)

- Immediate Support: 99.00 (psychological)

- Resistance: 102, 105, 108, 112-115

Price Forecast

Short-Term (1-3 Months) – 70% Bullish

- Support at 96.50 provides strong floor

- Target 1: 103-105

- Target 2: 108-110

- Timeline: Rally into Q1 2026

Medium-Term (6-12 Months) – 65% Bullish

- Target: 112-115 (retest 2022 highs)

- Extension: 118-120

- Timeline: By Q3-Q4 2026

Long-Term (2027-2030) – 60% Bullish

- Triangle breakout above 120

- Target: 130-140+

- Bull market continuation

Bear Case (30-35%)

- Only if weekly close below 96.50

- Then test 92-93

- Further targets: 88-90

Bottom Line

At 99.89, the DXY maintains a healthy 3+ point cushion above the critical 2012 trendline at 96.50. As long as this support holds, the bullish structure remains intact with targets at 105-115+. Only a weekly close below 96.50 would invalidate this setup. Risk/reward favors bullish positioning.

Not financial advice. Trade at your own risk.