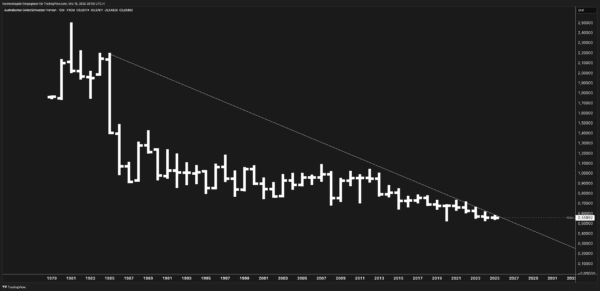

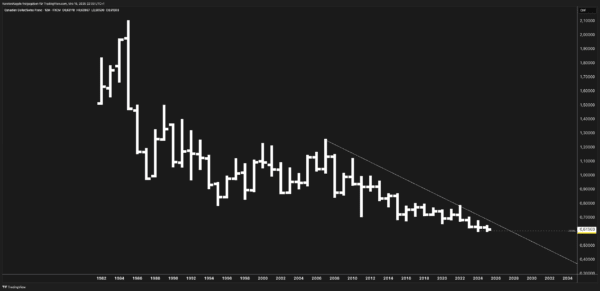

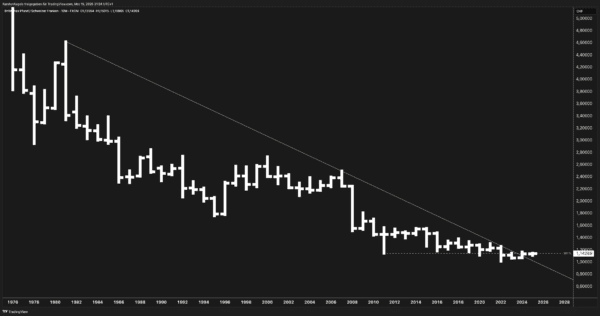

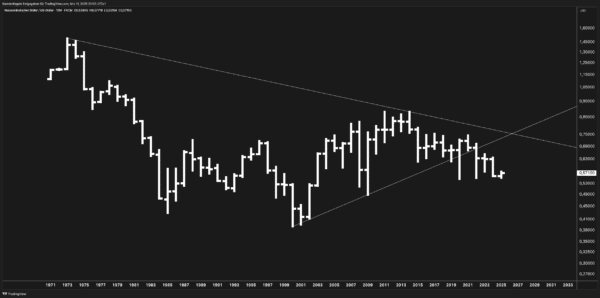

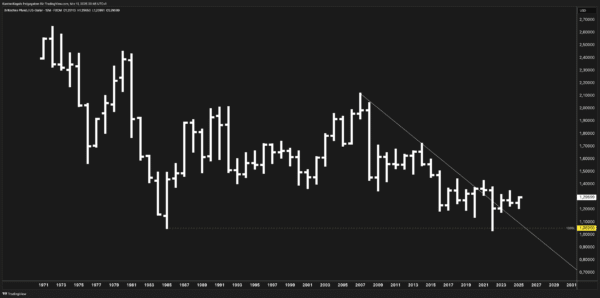

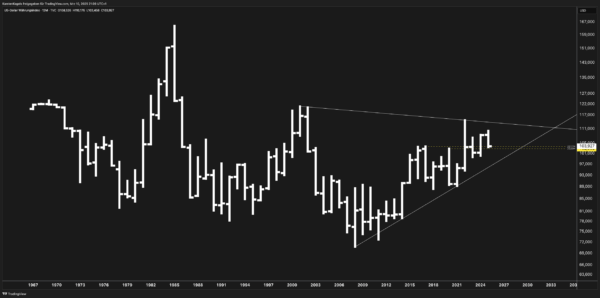

AUD/CHF Long-Term Forecast & Analysis (2025 & Beyond)

Introduction The AUD/CHF currency pair represents the exchange rate between the Australian Dollar (AUD) and the Swiss Franc (CHF). Historically, this pair has been in a long-term downtrend, reflecting Australia’s commodity-driven economy against Switzerland’s status as a safe-haven currency. As we move into 2025 and beyond, traders and investors are closely watching whether AUD/CHF can …