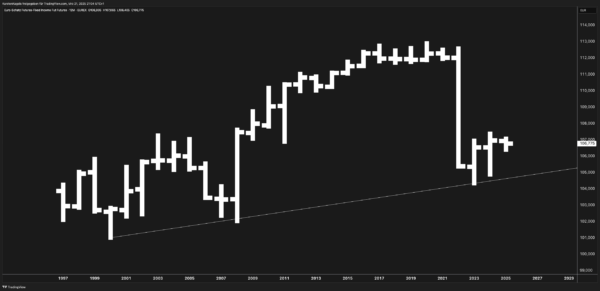

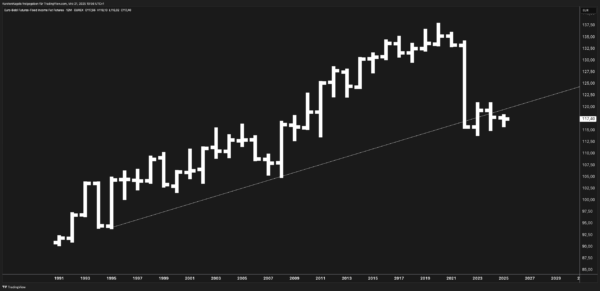

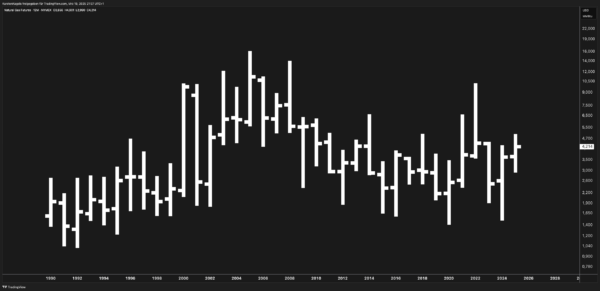

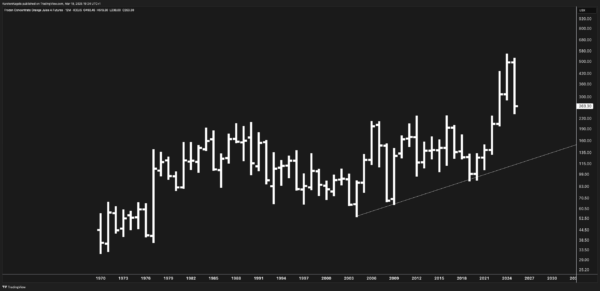

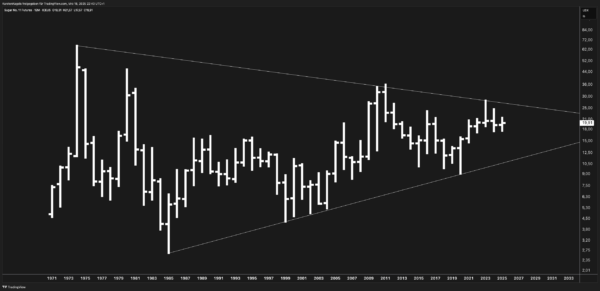

Comprehensive Euro-Schatz Futures Analysis: Technical and Fundamental Outlook for 2025-2027

Executive Summary The Euro-Schatz futures (FGBS) have completed a major corrective cycle from the 2019 highs, with current price action suggesting a potential bottoming process near the 106.775 level. This analysis identifies key inflection points for traders, probable price targets based on technical patterns, and critical fundamental factors that will drive short-term German bond futures …