Introduction

The EUR/USD, the world’s most traded currency pair, is currently at a crucial phase. With a current rate of approximately 1.05 USD, the Euro is in a critical technical position within a multi-year downward trend channel. This constellation creates a fascinating starting point for investors and traders planning long-term positions in the foreign exchange market.

The past few months have been characterized by a consolidation phase near the psychologically important mark of 1.05 USD. This development follows a longer downward movement from highs of over 1.20 USD in 2021. Particularly noteworthy is that the price is currently near a long-term support zone that has played a significant role multiple times in the history of the currency pair.

The current market situation is significantly influenced by the interest rate policies of both central banks – the European Central Bank (ECB) and the Federal Reserve (Fed). The divergence between the monetary policy orientations of both institutions has substantially determined the direction of the EUR/USD in recent years and will continue to be a decisive factor.

In this comprehensive analysis, we will examine the technical aspects of the EUR/USD chart, consider historical cycles, analyze interactions with other markets, and evaluate fundamental influencing factors. The goal is to create a well-founded forecast for the medium to long-term development of the currency pair that provides valuable insights to both experienced and less experienced market participants.

Technical Chart Analysis

Long-term Trend Structure

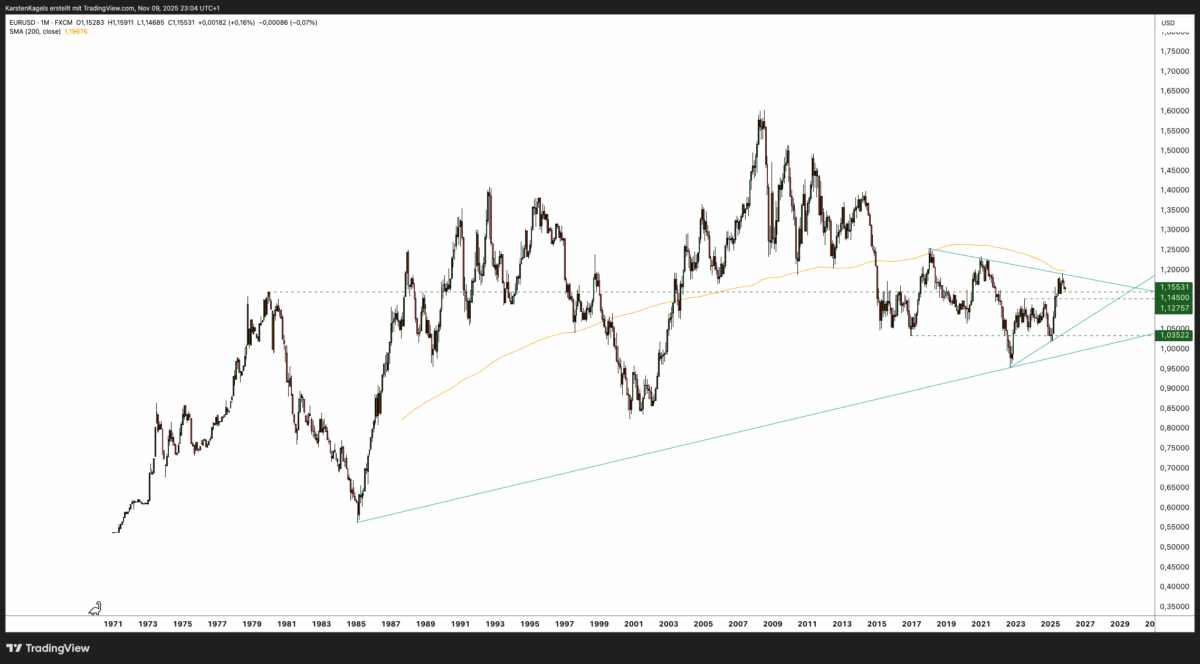

The present yearly chart of the EUR/USD reveals a remarkable long-term structure that is crucial for understanding the current market situation. We recognize a clearly defined downward trend channel that has confined price development since the all-time high in 2008 at approximately 1.60 USD. This channel is characterized by parallel trendlines, with the upper trendline connecting the high points of 2008, 2014, and 2021, while the lower trendline links important low points such as 2000, 2015, and 2022.

Particularly striking is that the EUR/USD is currently trading near the lower boundary of this long-term trend channel. This zone around 1.03-1.05 USD represents a critical support region that has functioned as a turning point multiple times in the past. A breakthrough below this support would generate a strongly bearish signal, while a bounce from this area could initiate a potential trend reversal or at least a significant upward correction.

Support and Resistance Levels

Several critical price levels can be identified from the present chart:

- Primary Support: 1.03 USD (current support line, marked by the yellow horizontal line in the chart)

- Secondary Support: 0.95-0.98 USD (historical low points from 2000-2002)

- Primary Resistance: 1.12-1.15 USD (medium-term downward trendline)

- Secondary Resistance: 1.20-1.25 USD (resistance area tested multiple times from 2018-2021)

The zone around 1.03 USD deserves special attention as it not only represents the lower boundary of the long-term trend channel but also coincides with historical support levels. This overlay of multiple technical factors reinforces the significance of this price area.

Chart Patterns and Formations

The yearly chart shows some noteworthy formations:

- Downward Trend Channel: The dominant formation in the chart is the long-term downward trend channel since 2008 that limits price development.

- Potential Reversal Formation: In recent years, a possible long-term bottom formation has developed. This structure could be interpreted as an incomplete inverse head and shoulders formation, with the left shoulder area around 2020, the head in 2022, and the right shoulder area currently in development.

- Consolidation Pattern: Since 2022, the EUR/USD has been moving in an increasingly narrow price range, indicating a consolidation phase. This compression of volatility is often a precursor to larger price movements.

Technical Indicators

Although no classic indicators are displayed in the presented chart, important insights can be gained from the price structure itself:

- Moving Averages: The 200-month average, an extremely long-term indicator, is currently around 1.18 USD and functions as a significant resistance zone. The fact that the EUR/USD has predominantly traded below this average since 2014 underscores the long-term downward trend.

- Momentum: The downward momentum has decreased in recent years, which is evident in the flattening structure of the trend channel. This momentum weakening could indicate an impending trend reversal.

- Fibonacci Retracements: Calculated from the all-time high of approximately 1.60 USD to the 2022 low of about 0.95 USD, the current price is near the 23.6% retracement level, while the 38.2% level (approx. 1.20 USD) coincides with the important resistance area.

Cycle Analysis

Seasonal Patterns

Historically, the EUR/USD shows some seasonal tendencies that could be relevant for the coming months:

- Year-End Strength: Traditionally, the Euro often tends to strengthen against the US dollar in the last months of the year, especially in November and December.

- Q2 Weakness: The second quarter (April to June), however, often shows a relative weakness of the Euro, which could be a risk factor for the immediately upcoming period.

These seasonal patterns are not deterministic, however, and are overlaid by stronger fundamental and technical factors.

Long-term Market Cycles

The EUR/USD undergoes recognizable long-term cycles that typically last 7-10 years:

- 1985-1995: Long-term downward trend of the USD predecessor (DM/USD)

- 1995-2001: Depreciation phase of the Euro/EMU currencies

- 2001-2008: Long-term upward trend of the Euro

- 2008-2016: Primary depreciation phase of the Euro

- 2016-2018: Recovery phase

- 2018-2022: Renewed depreciation phase

- 2022-present: Potential bottom formation phase

Considering these cycles, the EUR/USD may be at the end of a long-term downward cycle and could be facing the beginning of a new multi-year upward cycle. The period 2023-2025 could represent a decisive transition phase.

Current Cycle Position

In the current long-term cycle, we are most likely in a late downward phase or early bottom formation phase. This is supported by the following observations:

- The decreasing downward momentum since 2022

- The multiple tests of the lower trend channel boundary

- The historical duration of EUR/USD cycles, suggesting an impending reversal

Intermarket Analysis

Correlations with Related Markets

The EUR/USD shows significant correlations with other financial markets that are relevant for the forecast:

- US Dollar Index (DXY): An inverse correlation to the DXY is naturally pronounced. Currently, the DXY shows signs of a possible top formation after a multi-year uptrend, which is potentially positive for the EUR/USD.

- Gold: Historically, there is a moderate positive correlation between gold and EUR/USD. The strong rise in the gold price in recent months could be a positive signal for the Euro.

- US Treasury Yields: The yields of 10-year US Treasury bonds correlate negatively with the EUR/USD. The current tendency toward declining US yields could therefore support the Euro.

Influence of Other Asset Classes

- Stock Indices: The S&P 500 and European indices like the DAX show different correlations to the EUR/USD in certain market phases. Currently, the relative strength of European stocks compared to US stocks suggests a potential strengthening of the Euro.

- Commodities: The prices of industrial metals and energy commodities indirectly influence the EUR/USD through their effects on the economic performance and trade balance of the Eurozone.

- Cryptocurrencies: The increasing importance of cryptocurrencies as an alternative asset class could influence traditional correlation patterns, with a strong Bitcoin often associated with a weaker US dollar.

Basic Fundamental Analysis

Macroeconomic Factors

The fundamental landscape for the EUR/USD is shaped by several macroeconomic factors:

- Growth Differential: The relative economic performance of the US and the Eurozone remains a decisive driver. While the US economy continues to show robust growth, the European economy has stabilized in recent quarters, reducing the growth gap.

- Inflation Dynamics: Inflation rates in both economic regions have cooled from their peaks, with the Eurozone tending to have lower core rates. The future development of inflation will significantly influence interest rate expectations and thus the EUR/USD.

- Trade Balances: The Eurozone has a structural current account surplus, while the US has a chronic deficit. This fundamental difference speaks for a stronger Euro in the long term.

Monetary Policy Developments

The divergence in monetary policy between the ECB and the Fed is currently one of the most important influencing factors:

- Interest Rate Differential: The Fed began rate hikes earlier and more aggressively than the ECB, leading to a significant interest advantage for the US dollar. However, this gap is beginning to close as the Fed started rate cuts in 2024, while the ECB is pursuing a more cautious approach.

- Balance Sheet Reduction: Both central banks are in the process of reducing their inflated balance sheets, with the Fed being further advanced in this regard. The relative speed of this normalization will have implications for the EUR/USD.

- Long-term Interest Rate Policy: The longer-term interest rate perspectives suggest a convergence of key interest rates in both currency areas, which should tend to support the Euro.

Geopolitical Factors

Several geopolitical developments could influence the EUR/USD in the coming months:

- European Integration: Progress in fiscal union and joint debt issuance potentially strengthens the structural position of the Euro.

- Global Trade Relations: Trade relations between the US, Europe, and China remain complex and can have significant effects on relative currency strength.

- Energy Situation: Europe’s energy security has improved after the crises of recent years, which is a positive factor for the Euro.

Scenarios and Forecast

Based on the technical, cyclical, and fundamental analysis, three main scenarios can be derived for the EUR/USD in the coming 6-12 months:

Bullish Scenario (40% Probability)

In this scenario, the EUR/USD overcomes the current consolidation phase upward and begins a new medium-term upward trend:

- Triggers: Beginning rate cut cycle of the Fed with a simultaneously more cautious ECB; economic recovery in Europe; weakening of US growth

- Technical Development: Overcoming the medium-term downward trendline at approx. 1.12 USD

- Initial Price Targets: 1.15 USD (short-term), 1.20-1.25 USD (medium-term)

- Long-term Potential: In a complete trend reversal, prices of 1.30-1.35 USD could be reached by the end of 2025

Bearish Scenario (30% Probability)

In this scenario, the EUR/USD breaks through the critical support at 1.03 USD downward:

- Triggers: Persistent economic weakness in Europe; unexpectedly robust US economy; geopolitical crises with stronger influence on Europe

- Technical Development: Breakthrough below the lower trend channel boundary and the horizontal support at 1.03 USD

- Price Targets: 0.98 USD (short-term), 0.92-0.95 USD (medium-term)

- Worst-Case Scenario: In the extreme case, a movement toward parity (1.00 USD) or even below could follow

Neutral/Sideways Scenario (30% Probability)

In this scenario, the EUR/USD continues its consolidation in a relatively narrow trading range:

- Triggers: Balanced economic development in both currency areas; parallel monetary policy steps by the Fed and ECB

- Technical Development: Continuation of the sideways movement between 1.03 USD and 1.12 USD

- Time Horizon: This scenario could last 3-6 months before a clearer directional decision is made

Trigger Points for the Scenarios

The following key levels should be observed as they could activate the various scenarios:

- Bullish Trigger: Sustainable breakthrough above 1.12 USD with subsequent successful retest of this level from above

- Bearish Trigger: Closing prices below 1.03 USD for several weeks without significant counter-movement

- Continuation of Sideways Movement: Repeated bounces at the upper (1.10-1.12 USD) and lower (1.03-1.05 USD) sides of the consolidation range

Recommendations

Based on the analysis and scenarios, different recommendations emerge depending on the type of investor:

For Long-term Investors

- Strategic Positioning: The current price range near the long-term support offers an attractive risk-reward ratio for building Euro positions with a multi-year investment horizon.

- Diversification: Regardless of the preferred scenario, a balanced currency diversification is advisable, with the Euro potentially deserving an overweighting due to its cyclical position.

- Cost-Average Approach: In case of high uncertainty, a gradual entry over several months is recommended to benefit from possible short-term fluctuations.

For Active Traders

- Bullish Strategy: Long positions on pullbacks toward 1.05 USD with stop-loss just below 1.03 USD and target at 1.12-1.15 USD.

- Bearish Strategy: Short positions on a confirmed breakthrough below 1.03 USD with initially tight stop-loss and target at 0.98 USD.

- Range Trading: In the expected consolidation phase, traders could try to use the boundaries of the trading range for repeated entries.

Risk Management

- Position Sizes: Due to the historical volatility of the EUR/USD, position sizes should be chosen conservatively, especially with leveraged positions.

- Diversification: Hedging the EUR/USD position through complementary positions in correlating markets can reduce overall risk.

- Time Horizon: The strategy should correspond to the investment horizon – short-term traders should orient themselves to technical signals, while long-term investors should give more weight to fundamental and cyclical factors.

Summary

The EUR/USD is currently in a decisive technical position near the lower boundary of a long-term downward trend channel. The technical analysis shows a potential bottom formation with critical support at 1.03 USD, while the cycle analysis indicates a possible end to the long-term downward cycle.

The fundamental situation is characterized by the changing interest rate differential between the Fed and the ECB, with the expected rate cuts by the Fed tending to be positive for the Euro. The intermarket analysis, particularly the developments in gold and US yields, tends to support a bullish scenario for the EUR/USD.

For the coming 6-12 months, we see a bullish scenario with a 40% probability with price targets in the range of 1.15-1.25 USD, followed by a bearish scenario (30%) with possible movements below 1.00 USD and a neutral sideways scenario (30%) with consolidation between 1.03 and 1.12 USD.

Investors and traders should closely observe the critical levels 1.03 USD (support) and 1.12 USD (resistance), as breakthroughs through these levels could trigger significant trend movements. The current position of the EUR/USD offers interesting opportunities for both long-term and tactical positioning, with prudent risk management remaining crucial.

In our next monthly analysis, we will continue to follow the development of the EUR/USD and update our forecast based on the latest technical, cyclical, and fundamental developments.Wiederholen