📌 Introduction: Why is CAD/CHF Important for Traders?

The exchange rate of the Canadian Dollar (CAD) against the Swiss Franc (CHF) is crucial for forex traders, investors, and businesses. While the Canadian Dollar is heavily influenced by oil prices and Bank of Canada (BoC) monetary policy, the Swiss Franc is considered a safe-haven currency, gaining value during economic uncertainty.

The long-term trend of CAD/CHF has been consistently bearish, yet the pair is now approaching critical support levels that could define its future direction. In this analysis, we will examine technical indicators, macroeconomic factors, and potential price scenarios for CAD/CHF in 2025.

1️⃣ Technical Analysis – Long-Term Trend & Chart Patterns

📉 CAD/CHF Long-Term Trend

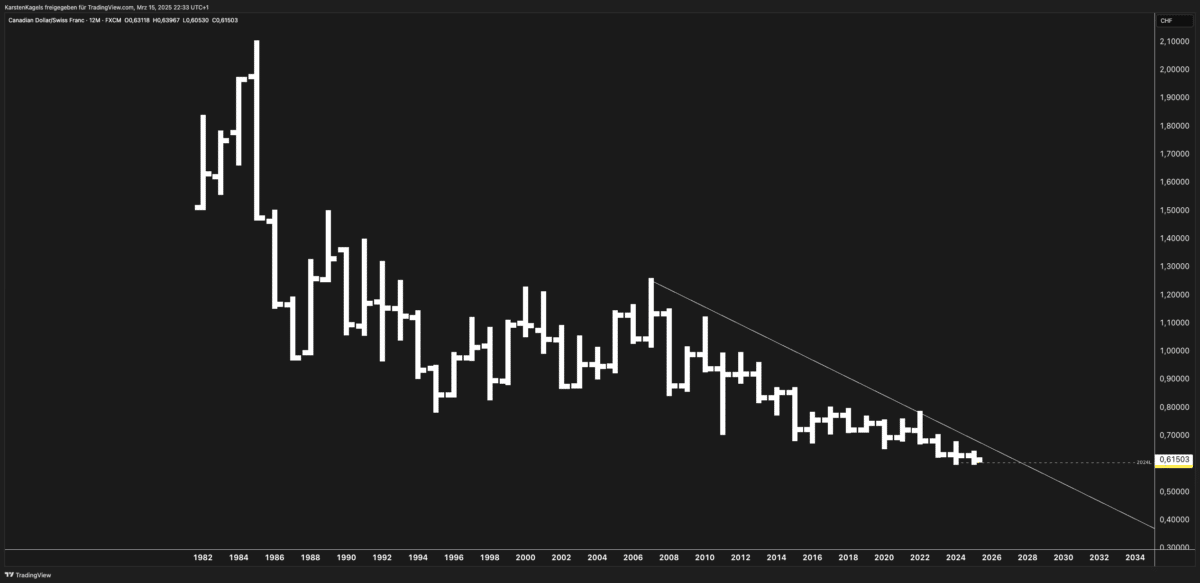

The long-term yearly chart reveals:

- A clear downtrend since the 1980s, with consistent lower highs and lower lows.

- A descending trendline, acting as a major resistance level.

- The pair is currently near historical lows around 0.61 – 0.62.

Possible Market Movements:

- A break above 0.70 could signal a trend reversal.

- A drop below 0.60 would confirm a continuation of the decades-long downtrend.

🔎 Key Support & Resistance Levels

| Level | Significance |

|---|---|

| 0.80 | Long-term resistance (2008 high) |

| 0.70 | Key reversal zone |

| 0.61 – 0.62 | Current support level |

| 0.50 | Potential next downside target |

| 0.40 | Historical lows |

📊 Technical Indicators

- Trendlines: Clear bearish trend structure.

- Fibonacci Retracement: Key retracement targets at 0.70 and 0.80.

- Moving Averages (SMA/EMA): CAD/CHF is likely trading below long-term moving averages, reinforcing the bearish outlook.

2️⃣ Fundamental Analysis – Key Macroeconomic Drivers

🇨🇦 Canadian Dollar (CAD) – Bullish & Bearish Factors

- Oil Prices: Canada is one of the largest oil exporters. Higher oil prices support CAD, while falling oil prices weaken it.

- Bank of Canada (BoC) Monetary Policy: Higher interest rates strengthen CAD, lower rates weaken it.

- Economic Growth: A strong Canadian economy supports CAD, while a recession could weaken it.

🇨🇭 Swiss Franc (CHF) – Bullish & Bearish Factors

- Safe-Haven Currency: CHF benefits from market turbulence, inflation concerns, and geopolitical risks.

- Swiss National Bank (SNB) Monetary Policy: Low interest rates and interventions can weaken CHF.

- Interest Rate Differentials (BoC vs. SNB): The greater the interest rate gap, the more attractive CAD becomes for investors.

3️⃣ Scenario Analysis – CAD/CHF Price Forecasts

🐂 Bullish Scenario (Target: 0.70 – 0.80)

Possible Catalysts: ✔ Rising oil prices → CAD strengthens.

✔ BoC rate hikes → Attracts capital inflows.

✔ Global economic recovery → Less demand for CHF.

🔹 Price Targets:

- Short-Term: 0.70 (breakout confirmation).

- Medium-Term: 0.80 (Fibonacci retracement).

😐 Neutral Scenario (Range Between 0.60 – 0.70)

Possible Causes: ✔ Balanced BoC & SNB monetary policies → No clear advantage for CAD or CHF.

✔ Moderate oil prices ($60–$80 per barrel) → CAD remains stable.

✔ Ongoing global uncertainty, but no extreme risk-off movement.

🔹 Expected Price Movement:

- CAD/CHF trades between 0.60 and 0.70, without a clear breakout in either direction.

🐻 Bearish Scenario (Target: 0.50 – 0.40)

Possible Catalysts: ✔ Global recession / economic crisis → CHF strengthens as a safe haven.

✔ SNB keeps CHF strong via monetary policies and interventions.

✔ Oil prices fall below $50 per barrel, significantly weakening CAD.

🔹 Price Targets:

- Short-Term: 0.58 (new low).

- Medium-Term: 0.50 (strong support).

- Long-Term: 0.40 (historical lows from the 1980s).

4️⃣ Comparative Market Analysis

| Asset | Correlation with CAD/CHF |

|---|---|

| Gold (XAU/USD) | Negative correlation – When gold rises, CAD/CHF often falls. |

| S&P 500 (US500) | Positive correlation – When equities rise, CAD benefits. |

| USD/CHF | Indirect correlation – A strong USD can pressure CHF lower. |

5️⃣ Conclusion & Trading Strategy

📌 Current Situation: CAD/CHF is at a key support zone (~0.61 – 0.62).

📌 Breakout Potential: A move above 0.70 would be bullish.

📌 Bearish Risk: A break below 0.60 could send CAD/CHF to 0.50 or lower.

📌 Recommended Strategy: Monitor BoC & SNB interest rate decisions and oil price movements closely.

6️⃣ FAQ – Frequently Asked Questions

1. Is CAD/CHF a good trade for 2025?

CAD/CHF presents an opportunity for a strong trend reversal or further downside, depending on monetary policies and global economic conditions.

2. How do oil prices affect CAD/CHF?

Higher oil prices strengthen CAD, as Canada is a major oil exporter. Lower oil prices weaken CAD, reinforcing the bearish trend.

3. What happens if the SNB raises interest rates?

A Swiss National Bank (SNB) rate hike could further strengthen CHF, pushing CAD/CHF lower.

4. What is the best trading strategy for CAD/CHF?

- Bullish: Buy a breakout above 0.70.

- Bearish: Sell if CAD/CHF drops below 0.60.

- Neutral: Range-trading between 0.60 – 0.70.