Introduction: Understanding the VIX and Its Importance The CBOE Volatility Index (VIX) is a crucial tool for traders and investors looking to gauge market sentiment and volatility. Often referred to as the “fear gauge,” the VIX reflects expectations of S&P 500 volatility over the next 30 days. As markets navigate economic uncertainty, Federal Reserve policies, inflation, and geopolitical risks, understanding the VIX is essential for both short-term traders and long-term investors.

This forecast will provide short-term and long-term VIX price projections, analyze macroeconomic influences, compare the VIX to key assets like gold, silver, S&P 500, Nasdaq, and treasury bonds, and outline volatility hedging strategies.

Historical Trends and Technical Overview

Long-Term Volatility Trends

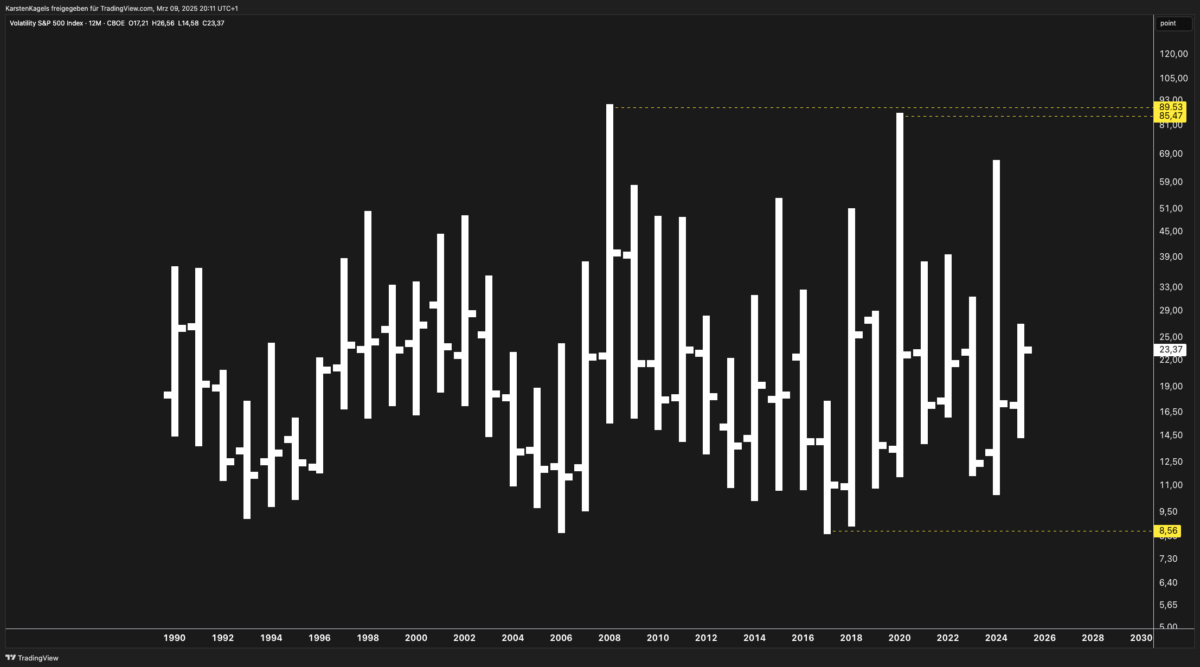

The historical VIX chart (see image) shows distinct cycles of volatility spikes, typically coinciding with economic crises and market downturns:

- 2008 Global Financial Crisis: VIX surged to 89.53

- 2020 COVID-19 Crash: VIX reached 85.47

- Current (2025) Levels: Trading around 23.37 (as of March 2025)

Key support and resistance levels:

- Long-term support: 8.56 (historical low)

- Major resistance: 85.47 – 89.53 (crisis peaks)

These historical patterns indicate that while low-volatility periods persist, market shocks can rapidly push the VIX above 40+ levels.

Short-Term Volatility Outlook (Next 3-6 Months)

- Bullish Scenario: A Fed-induced recession or geopolitical tensions could drive the VIX above 35-40.

- Neutral Scenario: A stable economy with mild fluctuations keeps VIX in the 18-26 range.

- Bearish Scenario: A risk-on environment, strong economic growth, and Fed rate cuts push VIX below 15.

Macroeconomic Factors Impacting VIX

Federal Reserve Policy & Interest Rates

- If the Fed continues its tightening cycle, we could see increased volatility, sending the VIX higher.

- A pivot to rate cuts could lower volatility and stabilize markets, suppressing the VIX.

Inflation & Economic Growth

- Higher-than-expected inflation often leads to hawkish Fed policies, spooking markets and lifting the VIX.

- Economic contraction typically drives volatility as investors rush for safe-haven assets.

Geopolitical Risks

- Global conflicts, trade wars, or supply chain disruptions increase market uncertainty, leading to VIX spikes.

Comparative Analysis: VIX vs. Major Asset Classes

VIX vs. S&P 500 & Nasdaq

- The VIX has an inverse correlation with the S&P 500 and Nasdaq.

- A strong bull market suppresses VIX, while sell-offs push it higher.

VIX vs. Gold & Silver

- Gold and silver act as safe havens during high-volatility periods.

- When VIX rises, gold and silver prices tend to rally due to increased risk aversion.

VIX vs. Treasury Bonds

- Bond yields drop during crises, pushing bond prices higher as investors flee to safety.

- A higher VIX often signals a move into Treasuries, reinforcing the flight-to-safety trend.

Short-Term, Medium-Term, and Long-Term VIX Forecast

Short-Term (3-6 months)

- Expected range: 18-35, with potential spikes due to economic or geopolitical events.

- Key catalyst: Fed policy decisions, earnings season volatility, inflation reports.

Medium-Term (6-18 months)

- Expected range: 15-40, depending on macroeconomic developments.

- Potential market correction could push the VIX towards 40+ levels.

Long-Term (2-5 years)

- Expected range: 10-50, but major crises could send it towards 80+ levels.

- Stock market cycles will dictate whether the VIX remains subdued or experiences major spikes.

Volatility Hedging Strategies

1. Trading VIX ETFs and ETNs

- Short-term traders: Utilize VXX (VIX Short-Term Futures) or UVXY (Ultra VIX Short-Term Futures) to profit from volatility spikes.

- Long-term investors: Consider hedging portfolios with long positions in VIX instruments.

2. Options Strategies on VIX Futures

- Buying VIX calls as a hedge against market downturns.

- Selling VIX puts during periods of high volatility to capture premium decay.

3. Diversification with Precious Metals and Bonds

- Holding gold and Treasuries can mitigate risks associated with VIX fluctuations.

Beginner’s Guide: What is the VIX and How to Use It?

- What is the VIX? The CBOE Volatility Index measures expected S&P 500 volatility.

- How is it calculated? Based on S&P 500 options pricing.

- Why does it matter? A rising VIX signals market fear, while a falling VIX suggests stability.

- How to trade the VIX? Using VIX ETFs, futures, and options.

Conclusion: Key Takeaways for Traders and Investors

- Short-term VIX range: 18-35 with potential spikes.

- Long-term volatility cycles suggest VIX levels between 10-50, with extreme cases reaching 80+.

- Macroeconomic risks (Fed policy, inflation, geopolitical issues) will dictate volatility trends.

- VIX has strong inverse correlations with stocks and positive correlations with gold, silver, and bonds.

- Hedging with VIX ETFs, options, and safe-haven assets is crucial for risk management.