Software comparison – which one is the best? In this article we introduce the StereoTrader.

Most CFD traders end up using the standard MT4 or MT5 trading platform developed by Metatrader, but even beginners soon realize that it’s much too slow for effective trading. StereoTrader solves this problem. It transforms the MetaTrader trading platform from a Mack truck into a Formula 1 racing car. In this article I explain how, drawing on my own experience with the software.

Dirk Hilger programmed the app. A passionate trader with many years of experience, he quickly realized himself that the MT4 was much too slow. Because he knew how to program, he developed his own app called the StereoTrader to professionally speed up CFD trading. The app was officially launched in June 2016 in cooperation with Thorsten Helbig.

But there’s more to the story than this. Hilger gave his software many extremely useful features. In addition to quick trading from the chart, it supports automated trading, different order specifications, order editing, strategic orders, and numerous settings ranging from individual layouts to selections for each planned order.

Describing his motivation for programming the app, Hilger says:

“I tried out many platforms and never found automated functions that were able to adjust to the market independently and support my manual trading. The limit pullback order, for example, is a feature that was there from the start. It gives you a proven edge in trading.”

“Unconventional approaches such as cluster trading are another feature I’ve always wanted but haven’t found in any other platform. Trading doesn’t always have to be entry + SL + TP. It can use entirely different strategies, with much better probabilities. Such features form the core of StereoTrader, along with many simpler functions not found on other platforms.”

Dirk Hilger from Stereotrader

Inhaltsverzeichnis

What makes StereoTrader unique

In addition to providing a detailed overview of a trading session on a given day or over a several week period, StereoTrader has a special feature that sets it apart from all other trading platforms on the market and that is worth emphasizing here: the limit pullback order, which Hilger mentions above. I will go into this in greater detail below.

The appeal of StereoTrader is easy to understand. After you install the software, you can continue to use the MT4 or MT5 platform with all its basic features. However, Dirk Hilger’s tool handles the trading itself. It makes CFD trading professional and incredibly fast, even for beginners.

StereoTrader works just as well for futures trading. Under the Chart tab in the main panel, you’ll find the DOM (Depth of Market) button, which can be activated for futures trading. Currently this is only possible with AMP Futures, but there are plans to add additional futures brokers in the near future.

Installation and setup

Installation is easy. Just go to Hilger’s website at stereotrader.de and download the Installation Manager. By double-clicking the small 75 KB file, you start the fast, user-guided installation. The Installation Manager automatically creates a MetaTrader folder and installs the software in it.

After installation, StereoTrader will initially appear as an entry under “Experts” in the MetaTrader navigator window. If you drag the entry to the desired chart window and confirm the subsequent query with an OK, the tool will be implemented in that window.

You will also find a StereoTrader entry in the Indicator section of the navigator. It contains a few special tools that I’ll discuss later.

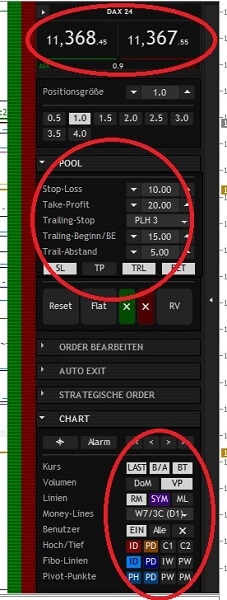

The first thing you see is the largely self-explanatory main panel with two colored vertical strips on the left. Using these colored strips, you can place limit and stop orders directly in the chart by click and drag. Long or short market orders can be executed by clicking the appropriate price display areas at the top of the panel. However, you first need to activate “One-Click Trading” in MetaTrader.

Using the Pool panel, you can select basic settings for your orders. The values entered here apply to all executed orders. These values can of course be changed in the chart whenever a position is opened. The SL, TP, Trail, and BE Save buttons allow you to activate or deactivate the desired settings.

“Trail” activates stop loss trailing according to the chosen method. “BE Save” defines the level at which your stop loss automatically secures open positions at breakeven. The stop loss is set at a distance above the entry point that has been defined under “BE Save Add” in the Trading tab in the setup panel.

The buttons below this – Reset, Flat, X (with different colors for long and short), and RV – are Dirk Hilger’s solution to a common MetaTrader problem that has plagued CFD traders for years. These buttons make it possible to close or reverse multiple positions or a specific type of position immediately and simultaneously.

Incidentally, Dirk Hilger has included an additional, slightly hidden feature in this panel that makes a great deal of sense for CFD trading. If you click the Flat button while pressing the CTRL key, only half of an open position will be closed. If you hold down the Shift key, you close 1/3 of the position. There is no faster way to perform these actions, and I use this feature very often.

Before we leave the main panel, it’s worth taking a closer look at the Chart tab. If the chart window is reduced in size and you want to ensure that the Chart tab remains visible, you first have to close the Pool tab because StereoTrader doesn’t have a scroll function. The Chart tab offers a variety of options, allowing you to display a tick-based volume profile, market open and close, highs and lows, Fibo lines, and pivot points. This can be done on an intraday, daily, weekly, or monthly basis. In addition, intraday pivot points can be displayed on an hourly basis.

The heart of StereoTrader – the setup panel

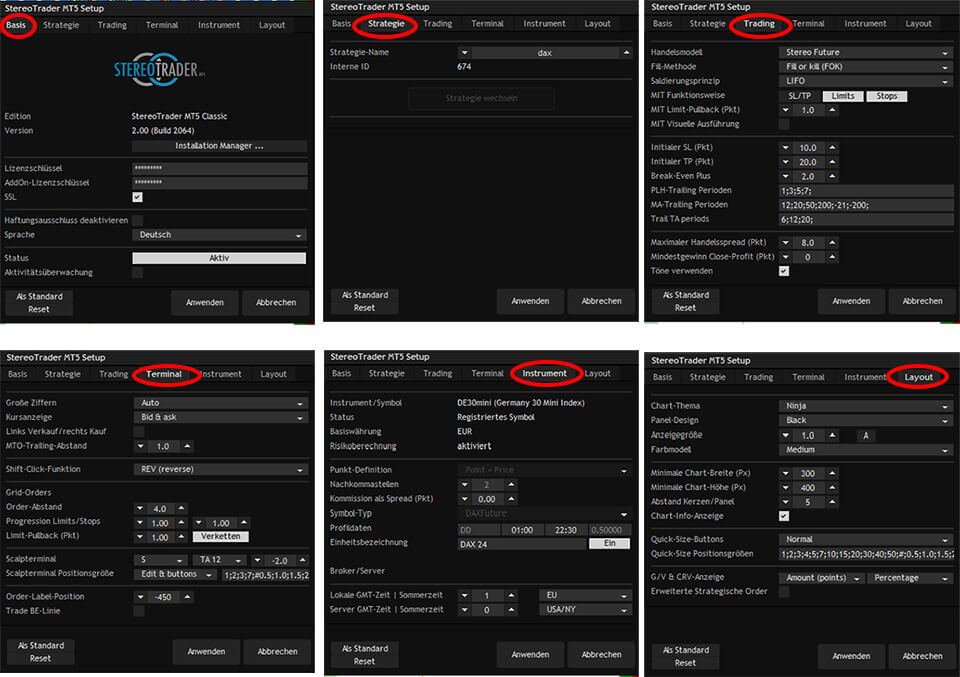

To open the setup panel, click the logo in the upper left-hand corner of the chart. Several basic settings can be selected here. Most settings can be left as is, but some should be adjusted to meet your individual needs. Even the first tab „Basis“ provides interesting information.

The first tab shows the software version currently in use. By clicking the Installation Manager, you can update to the latest version. If an update is available, StereoTrader will alert you directly in the program.

The second tab, Strategy, is just as important, despite its unassuming design. Under “Strategy name,” you can enter a name for the current active chart and save it by clicking “Switch strategy.” This makes it possible to create an additional modified strategy in another chart for the same underlying asset and the same time frame. You can, for example, use different settings for strategic orders, automated trading, or specially designed charts for scalping.

Under the third tab, Trading, you can define different trading modes. “Stereo Future” is the default mode; with it, simultaneous long and short positions are not possible. StereoTrader manages the opening and closing of positions like in futures trading. If you want to use a hedge, select “Single orders with hedging” or “Stereo hedge.” This hedging mode corresponds to standard MT4 or MT5 trading.

In the middle, you can adjust the values for the trailing stop rules that are displayed in the main panel.

The additional settings are largely self-explanatory, but I’d like to say a few words about “Chart theme” and “Panel design” in the Layout tab. Dirk Hilger has generously provided us with a large number of layouts. Because chart themes and panel designs can be combined in many different ways, you have an extremely large number of design options to choose from. Everyone can choose the best layout to meet their needs.

In order to show you how the StereoTrader works, I’d like to return to the main panel and discuss some of its features. Looking under the hood, we see that there are many useful ways to make CFD trading more exciting and efficient.

Professional features for successful trading

The software has many special features that take us beyond rote trading, including:

- Intelligent orders

- Strategic orders

- Automatic orders

- Grid orders

- Automated exiting

- Backtesting

- Limit pullback order

Let’s begin by taking a look at the intelligent orders.

Intelligent Orders

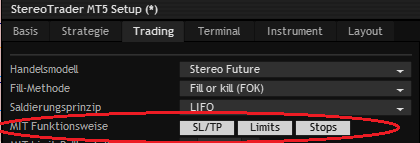

Part of this functionality can be found under the settings in the setup panel. Click the logo in the upper left-hand corner and go to “MIT functionality” under the Trading tab. The purpose of this setting is easily explained. When you open a position in MT4 or MT5 and define a stop loss (SL) and a take profit (TP), these price levels are transmitted to your broker. However, in CFD trading, it can be advantageous to withhold these levels from your broker.

If you activate these buttons, the SL, TP, or limit and stop orders will not be transmitted to your broker’s server. StereoTrader witholds them until the price levels are reached. Only then are they converted to market orders that are transmitted to your broker’s server and executed. This is why they fall under the heading of an MIT (market if touched) order.

But be careful: as Dirk Hilger explains, this type of order can work with slower Internet connections with a latency of over 100 ms, but StereoTrader must constantly be running. This means that if you want to hold positions overnight and hide the SLs, TPs, or limit and stop orders from your broker, you have to run the system continuously. Otherwise it’s better to deactivate these buttons and then place the orders.

The other intelligent order types can be found under the Edit Order tab in the main panel. Here you have the option to use the CS button to delete sibling orders after execution. “CO” cancels opposite orders and “RV” closes all opposite positions after a position is opened. Pressing the NT button defines a position that will compensate for any possible opposite positions in terms of size. However, this only works in hedge mode. The function is deactivated in Stereo Future mode because all orders are defined this way anyway.

Incidentally, under Edit Order, you can trail an order the same way you trail a stop loss! For example, if you want to place a buy stop order and enter the value “PLH 1” next to Trail Order, the long order will follow the price upward at the distance above the last candle that has been entered under “Trail distance.” It does so as long as the price falls, and vice versa.

At this point, let me say a word about how several simultaneously opened positions are displayed in the chart. As is common in futures trading, StereoTrader calculates an average price in Stereo Future mode and displays it with a position line. The different entry points are indicated by small squares.

The strategic order – a huge advantage but not the holy grail

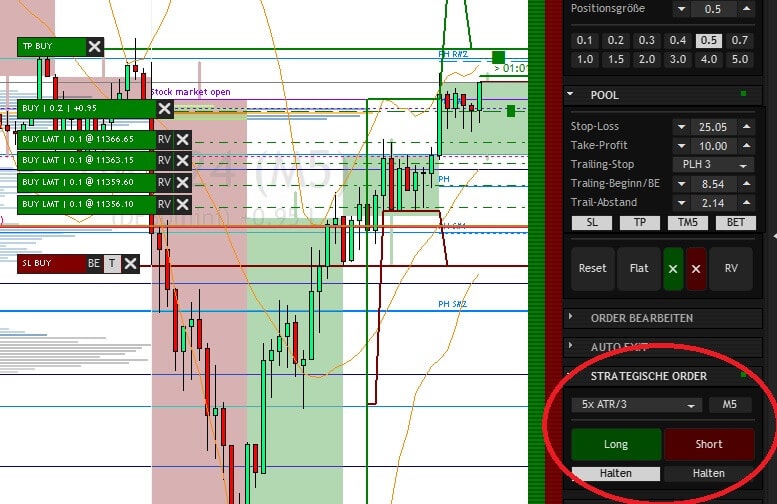

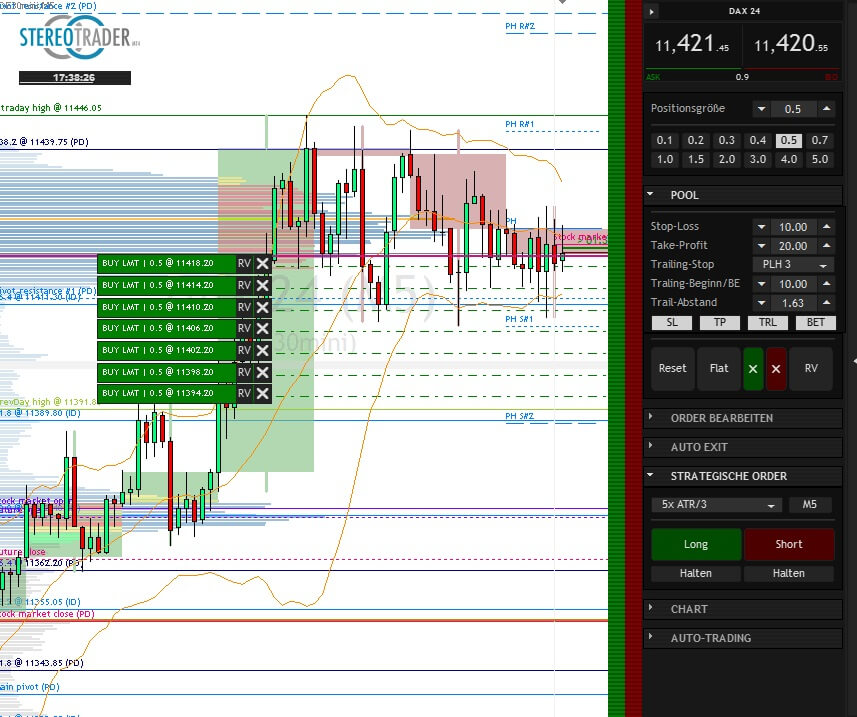

The strategic order combines manual and automated trading and makes StereoTrader into an “Expert Advisor” program. I use the strategic order fairly often because it works well in trending and range-bound markets. However, you have to know what you’re doing!

In fact, it’s quite simple. You first enter a strategy in the Strategic Order tab. I’ve had good experiences with the volatility-dependent parameter “5x ATR/3.” It would go beyond the scope of this article to explain this strategy in detail. There are many others to choose from, including scalping, swing trading, and even the Martingale.

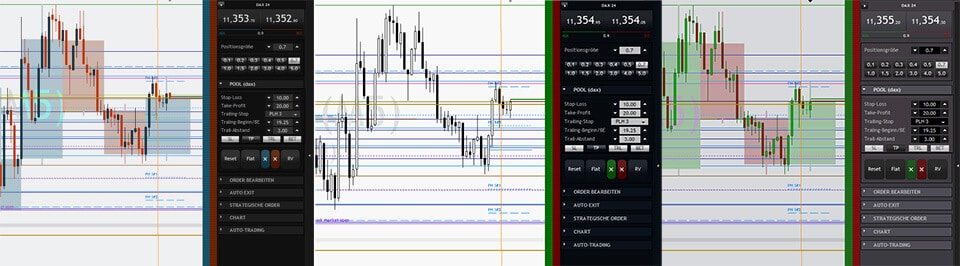

Once you’ve selected a strategy, you now need to decide whether to go long or short. In hedge mode, you can of course choose both – that’s up to you. In a trending market, I normally trade in the direction of the trend. After you click “Long” or “Short,” StereoTrader automatically opens five limit orders and one stop order.

The software also sets a stop loss based on the selected strategy (if activated in the main panel) and initiates a trailing stop. In my case, with the setting “5x ATR/3,” the respective distances are adjusted to reflect volatility within the defined time frame. From this point on, you don’t have to take any additional actions and can just monitor the trade. Of course, you can intervene any way you like.

If you want to execute the strategic order over several hours or even over the entire day, you should activate the Hold button. Generally, if an open position reaches the SL or TP, it’s closed and nothing else happens. The strategic order is then completed and you need to restart it if you wish to continue. However, if you activate the Hold button, the strategic order will automatically restart after the completion of the last candle. In this way, you can capture a trend over practically any length of time.

The principle is simple: the strategic order begins by dividing up the specified position size. For example, it will split up an order of five CFD contracts into 5 x 1 contracts. These are opened in a correction phase with the software calculating the average price. Because we never know how long a correction will last, we’re always in the market. At the same time, the average price decreases as more positions are opened by the strategic order. In some cases, only the first order or the first two orders are filled before the price reaches the TP. The remaining open orders are then automatically canceled.

One minor disadvantage of the strategic order is that, theoretically, many relatively small gains may at some point be wiped out by a somewhat larger loss. This can happen when a trend reverses. However, in the end, such small losses are acceptable. In my experience, the consistent, intelligent use of this feature is more likely to result in a gain.

If you’d like to learn more about how strategic orders work and what potential they offer, you should watch the video by Dirk Hilger. It’s a bit long – over one hour – but definitely worth it!

Automated trading

This is one of the features that makes StereoTrader into an Expert Advisor. Because I like to have full control over all aspects of my trading, I don’t have much experience with it myself. For this reason, I’d only like to point out that for anyone well versed with automated trading, StereoTrader offers the opportunity to create specific filters and strategies and implement them in automated trading mode.

You enter the parameters into the corresponding slots in the main panel. When the defined signals are generated, the software opens positions fully automatically. Information about this feature can be found in the StereoTrader manual or on YouTube.

Grid orders – trading in a noisy environment

At first glance, the grid order resembles the strategic order. To place one, you press the CTRL key and click the Long or Short bar to the left of the main panel above or below the current price. This creates a stack of orders that can be canceled individually. However, there is an important difference between a grid order and a strategic order. The grid order is not based on a strategy and does not adjust the SL or TP, which are taken from the specifications in the main panel.

It is also possible to enter all the orders manually – the grid order merely accelerates the process. So what’s the purpose?

With the grid order, you can profitably trade an unclear or noisy market – e.g. one that is moving sideways. Because we never know when the price will turn, we accumulate a position within a range, and this position will ideally move in our favor at a later point in time.

Under the Terminal tab in the setup window, you can set order distances and a progression of order sizes. However, I advise caution. Generally speaking, I always prefer the strategic order to the grid order.

Other features worth mentioning

The main panel contains an additional tab, Auto Exit, which can be used to define when StereoTrader will close both positions and unfilled orders based on different criteria: maximum growth in percent, maximum reduction in percent, or equity. You can also specify a trading period.

StereoTrader allows you to backtest your own strategies or trade CFDs in a specified historical period (“historical trading”).

StereoTrader’s unique feature: the limit pullback order

I’ve saved one of StereoTrader’s best features for the end because it builds not only on the usual limit and stop order but also on grid and strategic orders. The “limit pullback order” – LPO for short – is unique to CFD trading with StereoTrader. How does it work?

As an example, let’s take the following situation: you place a short limit order at 11,000 in the Dax with a SL of 10 points because you expect the price to turn at this point. The price reaches this level and the position is opened, but then it peaks at 11,020 and you’re stopped out for a loss.

The LPO prevents this from happening by continuing to raise your limit order until the price falls back by the value entered under “Limit pullback” in the Terminal tab of the setup window (Standard 1). In this case, your order wouldn’t have been opened until 11,019, the SL would have been set at 11029, and the gain would have been 19 points.

This is just one rough example, but spread over the entire day, positive slippage can often be in the double digits, especially since the LPO can be used not only for entries but also for exits with a gain. If we replace the take profit order with a limit order, the gain can be even greater.

Naturally, you also have to consider that the slippage caused by a LPO can be negative. If the price reaches our level and immediately falls back, we might get a worse execution. In the long run, though, LPOs almost always pay off.

StereoTrader comes with many useful add-ons

The following add-ons help you unlock all the potential of StereoTrader:

- Scalping Terminal

- Trade Session panel

- Add-ons from the navigator section

- Add-ons from the Installation Manager

Scalping Terminal

The Scalping Terminal is ideal for quick trading. You can minimize the main panel by clicking the small arrow in the upper left-hand corner. All that’s left is a small bar at the top of the chart window with the most important elements for scalping: position size, display area for market orders, buttons for quickly closing positions, and a reverse button. By clicking the small arrow on the right, you can display the main panel again. What more does a scalper need?

Trade Session panel

The Trade Session panel is an extremely useful tool that allows you to constantly monitor your trades and display profit and loss. It can be opened by clicking the small arrow on the right edge of the main panel. To close it, click the arrow at the top.

Using this panel, you can view numerous statistics, including the current trade and all the trades you’ve entered intraday or during the current week, month, or year. You can also keep an eye on the number of trades and the slippage. There are three handy buttons at the bottom: “Reset” completely resets all the collected data, “Trades” displays the results in a chart, and “Export” sends all data to a CSV file.

Under the StereoTrader entry on the MT4 or MT5 navigator, you’ll find additional useful tools. I regularly use TraceSLTP, for example, which allows you to display the trajectory of your stop loss with a line on the chart.

After you install StereoTrader, you’ll see additional add-ons in the Installation Manager. These include:

- Sport add-on

- Forex Pro Edition

- Market Value Profiles add-on

- XFrame

You have to pay for the first three add-ons, but they can be very useful tools. Forex Pro Edition is based on Thorsten Helbig’s Forex Pro System and can only be used if you trade with it.

XFrame is free. After installation, you’ll find it under Indicators in the MT4 or MT5 navigator. It lets you visualize two time frames in a single chart. I always use candles for my one-hour chart in MT5, and in the module at the bottom, I can adjust the coloring as desired – a very helpful option.

Where you can install and use StereoTrader

The brokers JFD Bank, Tickmill, and FXFlat offer the Classic Edition of StereoTrader. At JFD, you can rent the software for 29.90 EUR a month. You can cancel your subscription on a monthly basis.

Tickmill makes the StereoTrader available free of charge if you’ve funded your account with a minimum of 1,000 EUR.

FXFlat provides account holders with StereoTrader free of charge without further conditions.

According Dirk Hilger, StereoTrader can in principle be used “with almost all CFD and future brokers that offer MT4 or MT5.”

As he explains: “There are only restrictions for CFD trading if the broker has introduced barriers such as minimum distances for SLs or TPs. But we don’t recommend these brokers for StereoTrader anyway, because traders have no clear advantage with them. That goes against our philosophy.”

However, for brokers other than those listed above, you must rent the license directly from the website stereotrader.de for 29.90 EUR a month. It can be canceled on a monthly basis. You should always contact Dirk Hilger beforehand to clarify whether the platform is compatible with other brokers.

StereoTrader Traders Club: support and community on Facebook

Since Dirk Hilger founded his own Facebook group, it has grown to over 2,400 members. It’s called “Traders Club StereoTrader” and offers competent support and live CFD trading every day in a friendly environment.

Dirk Hilger has taken it upon himself to post his live trades here and to support community members with their trading. You don’t have to use StereoTrader to learn from the community. Incidentally, Hilger has produced a large number of videos for his StereoTrader channel on YouTube.

StereoTrader review: conclusion

The software has many more features than I’ve described here. A glance at the additional files in the navigator window shows just how much there is to discover and explore, including the Estimator and historical trading.

With the help of StereoTrader, retailer traders can take their CFD trading to a whole new dimension. I can no longer imagine trading without this fast, powerful, and professional tool. The MT4/MT5 platform provides the perfect foundation. It makes no difference whether you trade index, currency, gold, or even stock CFDs. You can use StereoTrader for everything that can be traded with CFDs.

Finally, there’s Dirk Hilger, who stands out from the crowd not only as a programmer, but also with his daily live trading. His StereoTrader has presumably made his trading what it is today: professional and profitable.

Based on my own experience, I can wholeheartedly recommend this tool to anyone who wants to immerse themselves in CFD trading.

Read more: