Order Book Trading: DOM, Level 2, Time & Sales (2022)

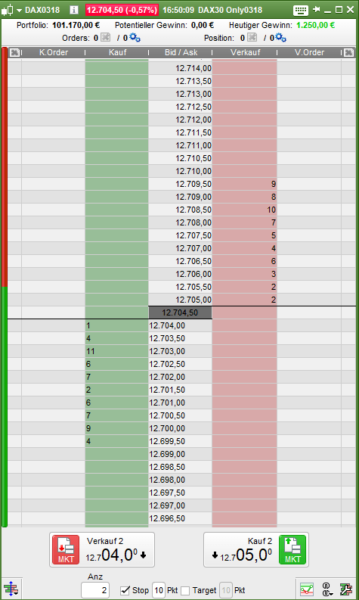

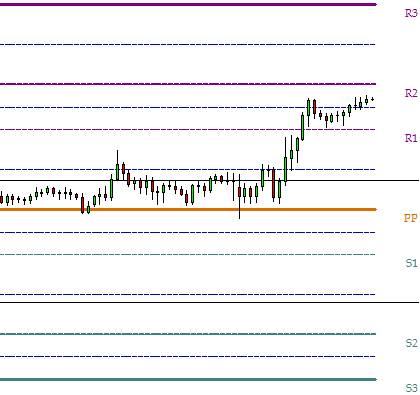

In this article I’d like to take a closer look at the terms “DOM,” “Level 2” and “Time & Sales.” I’d also like to describe order book trading. The most common order types All buy and sell orders are collected and matched in the order book. In this way, market price is continually established. Order …