Broker comparison – who is the best? In this article, we are introducing AGORA direct.

Inhaltsverzeichnis

About AGORA direct

Agora direct is an online broker headquartered in Derby, Great Britain. Agora directTM is part of Agora direct Ltd, which has developed into the provider of exchange trading services we know today by way of various stages. As an international online broker, Agora direct offers a real-time trading system for exchanges in Europe, the USA, Canada and Asia.

One unique feature of this provider is the possibility of worldwide trading in fractions of a second using just one so-called multicurrency account. Agora direct clients are thus able to choose from millions of trade instruments in 24 countries at over 125 exchanges altogether.

The history of AGORA direct

The roots of this online broker go back to the year 1886, namely to the banker Oskar Petersohn, who set great store by the principles of being an honourable merchant, and took care to pass this on to later generations of his family. As direct descendants of this family, the current management of Agora direct claims to try to follow these principles, offering its clients reliable services and transparency.

The online broker itself was then finally established in the year 2001, making it one of the pioneers in the online broker business.

How is the online broker regulated?

In the search for a suitable online broker, one should always look at the regulation of the provider in question first, and the type of deposit protection. The statutory requirement of being regulated by a competent financial supervisory authority also applies to Agora direct, and is seen to by the British FCA (Financial Conduct Authority) as well as the Federal Financial Supervisory Authority of Germany, BaFin,with this online broker.

In addition to this, the online broker relies on a 5-pillar protection system designed to provide Agora direct’s clients with a particularly high measure of safety.

- Pillar 1: Segregating client deposits

The provider first and foremost ensures that all client deposits are kept in segregated accounts, i.e. separately from the company’s capital. This is designed to ensure that clients can still get their money back in the event that Agora direct should go insolvent.

- Pillar 2: FSCS – Financial Services Compensation Scheme

With Agora direct being a member of the British FSCS, its clients‘ savings are protected up to a maximum of £ 75,000, while securities transactions are also protected up to a maximum of £ 50,000.

- Pillar 3: Financial loss liability

A payment protection insurance by HCC International Insurance Company Plc. additionally secures £ 1.5 m per insured event (3.0 Millionen auf der englischen Website). This concerns all financial losses attributable to the conduct of the online broker’s staff.

- Pillar 4: Protection by the SIPC

Further protection of client funds is provided by the SIPC (Securities Investor Protection Corporation), which will pay for the first US$ 500,000 per customer.

- Pillar 5: Lloyd´s of London Insurers (Lloyd´s)

Lloyd´s of London is the final pillar of Agora direct. This kicks in where insurance claims cannot be fully covered by way of the SIPC.

Awards won by the online broker so far

Agora direct has already been able to garner a variety of awards since its inception in 2001. A full list of all the prizes won from 2005 to 2016 is available on the provider’s website. For more recent honours, one could refer to a rating provided by the Webwiki ranking portal, giving the online broker 4.8 of 5.0 possible stars. In addition to which the company was highlighted as a professional online broker with fair and inexpensive conditions.

See below for a brief mention of another two awards from the year 2016.

- Rated 4.5 of 5 stars overall by the American weekly Barron´s

- WSL Institutional Trading Awards: Winner in the categories „Best Trading Platform for Options“ and „Best Broker-Dealer for Futures“

Which tradable instruments can I choose from at AGORA direct?

Let us now turn to the various tradable instruments clients can choose from at Agora direct. The online broker has been continuously expanding its range of trade instruments since 2001, enabling it to offer a great number of different products these days.

Shares

First of all, interested investors and traders can use Agora direct for very classic stock trading in over 125 markets distributed across the world’s largest exchanges. This means that various charges and particularities will apply, depending on the stock exchange. Stock trading at XETRA in Germany is possible from as little as € 3.85, and US shares can be traded at NYSE or NASDAQ from a mere US$ 2.50.

Options

Another trade instrument in the product range of Agora direct are Options. Clients can trade more than 1 million options available at the world’s leading option exchanges, enabling a vast range of different trade combinations. The provider woos with favourable conditions in The USA and Europe, starting from as little as € 1.90 (including all fees) in the latter case. Besides buying options, this online broker will also let you enter into covered deals.

CFDs

Many traders will also take a great interest in trading contracts for difference (CFDs) at Agora direct. Clients can trade index, stock and currency CFDs here, with the possibility to bet on both rising and falling prices. The margin required for this merely reflects a percentage of the actual trade volume.

Futures

The futures available at Agora direct provide clients with another trade instrument for diversifying their securities portfolio, with Futures trading possible at 35 markets worldwide. In Germany, this is available from as little as € 1.90 per contract.

Precious metals

Agora direct will also let you trade precious metals such as Gold and silver. The minimum fee for this amounts to US$ 6.00 per order, with the commission coming to 0.3 % of the trade’s value.

Forex

In addition to all the above, investors at Agora direct can also trade in the world’s most liquid market – the Forex market. In detail, clients can choose from a whopping 94 different Currency pairs for this, including the popular majors, as well as minors and many exotics. The prices for this come from the interbank market.

This makes the spreads relatively reasonable, but the broker also charges a separately charged commission. This fee comes to 0.01 % of the respectively traded sum. Forex trading is subject to a minimum fee of US$ 5.00.

Bonds

Another tradable instrument featured by the online broker are bonds. Clients can trade European and US corporate and government bonds as well as fixed-income futures and options, by way of one and the same multicurrency account. The minimum fee for trading European bonds amounts to € 6.00 (plus external fees).

Certificates

Not least of all, Agora direct can also be used to trade Certificates. In this context, investors can choose from issuers like the Deutsche Bank, Commerzbank or UBS, for example.

The trading platforms at AGORA direct

Having briefly outlined the online broker’s trading products above, this section is about the trading platforms available to investors at Agora direct.

MetaTrader 4 and MetaTrader 5

The first to be mentioned here is the globally popular MetaTrader trading platform, which investors particularly prefer for currency trading, but also for trading other trade instruments. The reasons for this include its specialized trading and information tools for currency trading.

Agora direct offers the tried-and-tested MetaTrader 4 platform as well as its successor MetaTrader 5.

To be used at Angora direct, the client’s MetaTrader software needs to be linked up with the respective trading account by way of a software bridge.

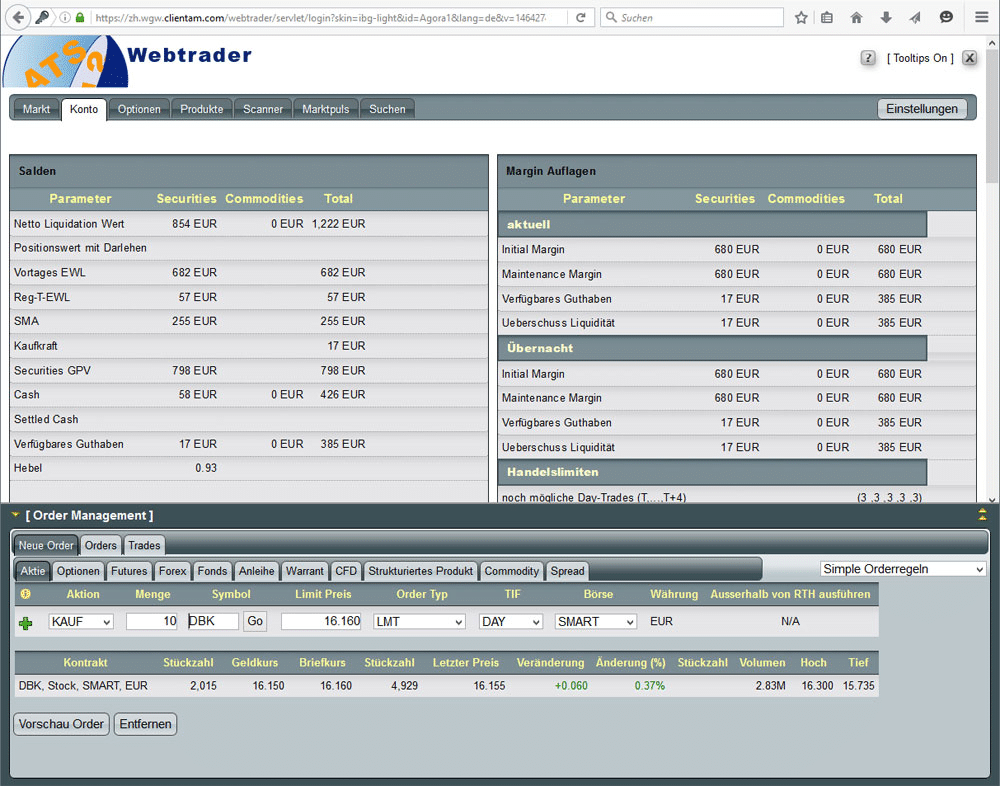

AGORA Web Trader

Another option provided by Agora direct is their AGORA Web Trader. This lets clients access their trading platform in their browser at any time by means of an encrypted internet connection, all without needing to install any software. The following screenshot will give you an idea of the Web Trader.

AGORA Mobile

In addition to the above, the online broker also offers a mobile version, enabling investors to trade around the clock from anywhere using their mobile devices. The software is available for Android devices as AGORA Trader and from the App Store as AGORA Mobile.

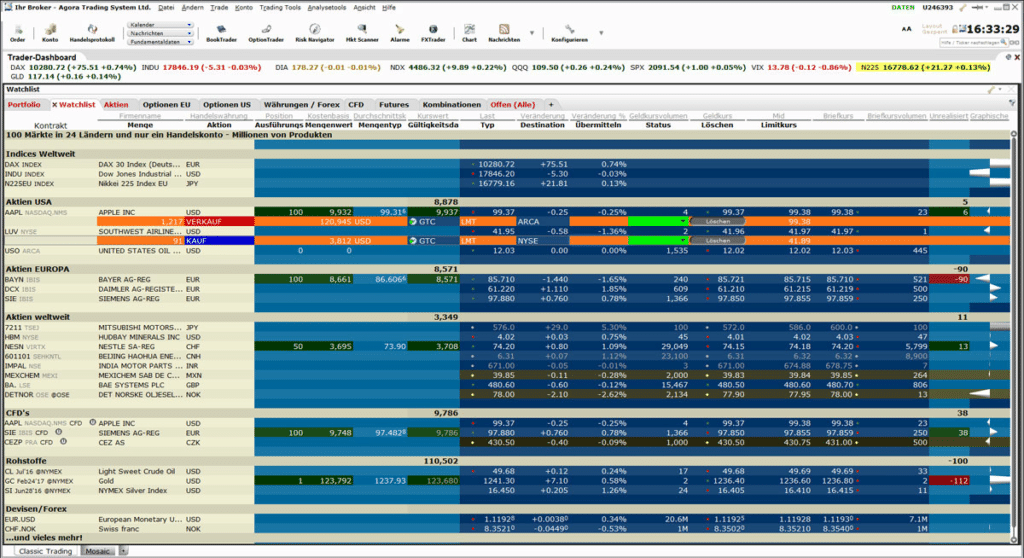

ATS trading software

Last but not least, Agora direct also has an efficient proprietary platform enabling the online broker’s clients to trade, which goes by the name of ATS. The provider recommends this platform for novices as well as more advanced investors and professionals; the software is available for Windows, Mac or UNIX/Linux.

This trading platform will not only let you trade all the available instruments, but also offers a number of helpful functions. These include the provision of real-time exchange rates that are accurate down to the second, and the creation of Watchlists, for example. See below for a screenshot of the ATS program:

Minimum deposits at AGORA direct

There is no minimum deposit for opening a client account at Agora direct. It could therefore also be meaningful to use the account as a savings account or pure Stock portfolio.

A minimum deposit only comes into play if you wish to benefit from leveraged trading at Agora direct. The threshold in this case amounts to € 2,000.00.

In- and outpayments at AGORA direct

The options provided by the broker in question for making deposits and withdrawals are also of a certain relevance for many investors. Agora direct appears to have its mind elsewhere, however, as the only method available for deposits is the classic bank transfer.

The „U“ account number needs to be entered in the reference line for this, along with the first and last name.

Bank transfer is moreover the only option available for making withdrawals. The money will usually be credited to your house bank from your trading account within 1-3 banking days.

Is there a demo account at AGORA direct?

As trading tends to be associated with high financial risks, testing the Demo account of the respective provider first is usually recommended. Apart from which such an account will always also give you an opportunity to try out your Trading strategies without financial losses and examine the online broker’s services more closely.

Agora direct unfortunately fails to offer such a demo account on the website.

Neither are the training services particularly ample at Agora direct. While many online brokers provide interested investors and traders with extensive materials such as video tutorials or training sections, this is not the case here.

So if you’re relatively new to the field of trading, you will need to procure most the key information from other sources.

The online broker’s customer service

At this point, a few words about the quality of the customer service provided by Agora direct. Especially because the availability and competence of the customer support are never to be neglected as criteria for rating an online broker.

One positive aspect is first and foremost provided by the fact that German clients can also benefit from customer services in their native language, as Agora direct has a branch in Germany (Berlin).

If questions or problems arise, there are various ways for contacting the online broker’s support. One of the options being to broach the subject in a contact form provided on the website for this.

But you can also contact the online broker’s staff on the telephone. And then Agora direct not least of all also offers TeamViewer as an aid for providing its clients with effective and optimal support, should they have any questions or encounter problems.

Online reviews of AGORA direct so far

In conclusion, a quick round-up of the experiences made with this online broker by various users so far. The vast majority of them are largely satisfied with the services of Agora direct, with aspects like the fair cost structures and competent customer service as particular highlights.

One aspect of this online broker that some clients rate negatively is the lack of a demo account. Many others miss a corresponding training section at the same time.

But on the bottom line, Agora direct is an online broker with many years of experience in its industry, where a wide range of tradable instruments can be traded at fair conditions.

Further reading: