Broker comparison – who is the best? In this article, we are introducing Swissquote.

Inhaltsverzeichnis

Swissquote – what’s behind it

This article looks into the online broker Swissquote, which is part of the Swissquote Group Holding Ltd. The Swissquote Group is headquartered in Switzerland (Gland). Clients in Europe are being looked after by a subsidiary called Swissquote Ltd, which is based in London.

The company currently employs 722 staff. At the time of writing, it also maintains a variety of other national and international branches in Zurich, Berne, London, Luxembourg, Malta, Dubai, Singapore and Hongkong.

The history of Swissquote

The Swissquote Group Holding Ltd was founded in the year 1999, with its bank licence and listing at the SIX Swiss Exchange following on 29 May 2000. By and by, the online broker then expanded its range of financial products and services, also by the acquisition of a number of other companies such as the information portal Tradejet AG in 2010, for example.

Cooperations with important companies in its industry such as UBS, Goldman Sachs, Commerzbank, Vontobel and Deutsche Bank were also tackled next in 2014.

In the year 2017, Swissquote was ultimately able to realize another milestone by becoming one of the first companies to enable cryptocurrency trading on its own website.

Regulation of the online broker

If you’re looking for a suitable online broker, you should always also delve into the question of how it is regulated. Swissquote Ltd comes under the supervision of the British Financial Conduct Authority (FCA), which is known for its strict requirements. This means that the provider needs to ensure a correspondingly high level of transparency and safety for its clients‘ deposits.

Apart from this the group holds a banking licence issued by the Swiss Financial Market Supervisory Authority (FINMA) too. As such, it is also a member of the Swiss Bankers Association.

Tradable assets to choose from at Swissquote

Let us now turn to the actual services provided by the online broker. First and foremost, some details about the tradable instruments Swissquote clients can choose from. This provider can basically be used to trade two product groups: forex and CFDs.

The range in this respect embraces more than 130 forex and CFD instruments available for trading in various trading platforms. See below for more details of the individual tradable markets.

Forex

With a daily transaction volume in excess of US$ 6,6 trillion, the Currency market is the world’s largest financial market, available for trading around the clock on five days a week.

According to the information provided by the online broker, Swissquote can score with the following benefits in forex trading, amongst others:

- 16 liquidity providers

- Regular high-quality market analyses

- Flexible transaction volumes

- Expert advisors and the optional algorithm trading

The forex rubric on the Swissquote website meanwhile includes currency trading as well as precious metals.

Currency pairs

With over 80 different currency pairs, the online broker offers its clients a relatively broad choice. Currencies are particularly suitable for Day trading, which is why they are also becoming ever more popular among retail investors and speculators.

Swissquote will let you trade all the popular major currency pairs as well as a variety of minor and exotic currency pairs.

Precious metals

Precious metals also count as currencies on the forex market and can therefore also be traded in pairs with other currencies. They offer traders an opportunity to diversify their portfolios and hedge them accordingly. The product range available for trading at Swissquote meanwhile includes the precious metals gold (XAU), silver (XAG), platinum (XPT) and palladium (XPD).

CFDs

Besides currencies, Swissquote clients can also trade CFDs based on a variety of underlying assets. In doing so, various leverages enable investors to trade efficiently with little capital outlay. The online broker will let you trade CFDs based on bonds, stock indices and commodities.

The provider summarizes the benefits of using Swissquote for CFD trading as follows:

- Broad selection of underlying assets

- Flexible transaction volumes

- Low capital requirements

- No custody fees

- Transparent price structures

Stock indices

First and foremost, investors can use Swissquote to trade a variety of stock indices, including the SP500, NAS100 or DE30, for example. In this regard, the online broker will neither restrict its clients‘ day trading nor Regulate their short selling, enabling them to make better use of downtrends.

Commodities

Apart from this, Swissquote also permits its clients to additionally diversify their portfolios with commodity CFDs. These make commodities like crude oil, natural gas and copper available for trading too.

Bonds

And last but not least, Swissquote will also let you trade bond CFDs based on US Treasury, UK Long Gilt and Deutscher Bund bonds, for example. The long-term interest earnings in bond trading can help investors hedge their positions in the process.

Which trading platforms are available at Swissquote?

Having detailed the various trade instruments in Swissquote’s product range above, this section is about the trading platforms they provide for their clients. At this online broker, you can either opt for Swissquote’s proprietary trading software called Advanced Trader, or for the popular platforms called MetaTrader 4 and MetaTrader 5.

MetaTrader 4

The MetaTrader 4 (MT4) software is the most popular trading platform in the world and offers a great number of helpful plug-ins, tools and expert advisors. In addition to which investors can also benefit from efficient analysis tools and diagrams here. Using this platform will not only enable you to customize its many selectable (free or chargeable) indicators, but also tailor your charts to your individual requirements, including 9 timeframes.

The automated trading in MetaTrader 4 by way of robots and/or copy trading is also of interest for many traders.

The software can meanwhile either be used as a web platform or as a mobile version on your smartphone or other mobile device.

MetaTrader 5

MT4’s successor software, MetaTrader 5 (MT5) is also available for use at Swissquote. In comparison with its predecessor, MT5 offers a whole range of additional helpful functions and trading tools.

With MetaTrader 5, traders can rely on even more pre-installed indicators, analytical objects and customizable charts, helping them to become even more flexible in their trading.

Just like its predecessor, the MT5 trading platform is also available in a desktop version, mobile version or web version.

In addition, Swissquote clients can be optionally provided with the MetaTrader Master Edition as a plug-in for MT4 or MT5. This is designed to help you optimize your trading processes with expanded tools and indicators.

Advanced Trader

With Advanced Trader, the online broker also provides a proprietary trading software that is specifically tailored to Swissquote’s trading range.

This platform’s trading interface is easily manageable and can be customized to your own needs. In addition to which Advanced Trader offers many powerful pre-installed tools, for example including 27 Indicators (MACD, stochastic, etc.), 17 overlays (Bollinger bands, Ichimoku, etc.), and integrated news (from Dow Jones & Swissquote in real time).

Another interesting feature is the automatic pattern recognition of the 17 most frequently used Chart patterns. This is a particularly helpful Chart analysis tool for novices as the strength of the individual patterns is indicated by how dark they are highlighted.

Last but not least, Advanced Trader also provides Swissquote clients with the most important Order types to choose from (OCO, if done, etc.). This trading platform also comes with a corresponding mobile version enabling clients to trade around the clock from wherever they choose.

Further tools at Swissquote

In addition to the trading platforms available to choose from at Swissquote, the online broker also has various tools to offer for improving your own trading processes even further. These include one called Autochartist and another referred to as Trading Central, for example. Please see below for more details of both these trading tools

Autochartist

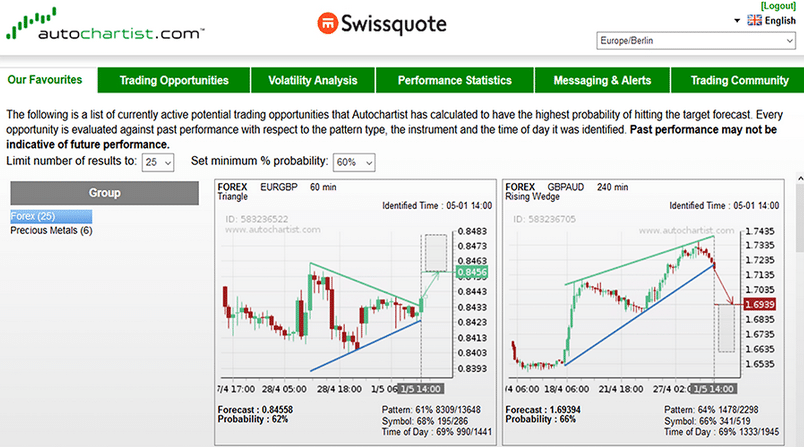

With their Autochartist, the online broker provides its clients with an effective tool for technical analysis, and that for free, to boot. See the screenshot below for a look at this tool’s user interface.

Inter alia, the benefits of this tool include an automated technical analysis (using Fibonacci patterns as well as horizontal levels) and an integrated Risk Calculator that will help you calculate your real capital risk and risk-adjusted position sizes. Another benefit is an analysis function that supports traders in the evaluation of economic events and their impact on specific trade instruments.

According to the online broker’s own claims, this tool is just as suitable for novices as it is for more advanced traders.

Trading Central

The Trading Central plug-in is a pattern recognition software for the MT4 and MT5 trading platforms which provides the investor with daily market reports. In addition to which the success chances of any trading strategies you develop can be tested in real time based on the “expert analyses of an award-winning market research company“.

This plug-in is essentially composed of three different indicators that are shown directly in the charts of the MT4 or MT5 platforms and can be included by drag & drop. Please see below for more details of these indicators and their functions.

Analyst Views

The Analyst Views indicator primarily serves to keep an eye on the movements of the forex market, stock market indices, and commodities. In the course of this, corresponding TC analysts will also provide their own opinions on and forecasts for the most frequently traded assets.

Adaptive Candlesticks

Adaptive Candlesticks analyses charts for the 16 most important Candlestick patterns. This is designed to help you identify relevant position changes in order to determine the best time for entering and/or exiting the respective market.

Adaptive Divergence Convergence (ADC)

Adaptive Divergence Convergence is based on the trend-tracking technical indicator MACD (moving average convergence/divergence). This indicator is designed to ensure the required adjustments and extensions in sideway movements.

It supplies investors with relevant signals that are mostly designed to simplify short-term trading (entry/exit signals, slow and fast price indicators, oscillators, etc.).

What are the trading conditions like at Swissquote?

One aspect that often has a major role to play in the search for a suitable online broker are the trading conditions at the respective provider. In this respect, the next sections will first take a look at the various account types at Swissquote, and then at the spreads for the respective trading products.

Account types

Swissquote clients can basically choose from four different account models: Premium, Prime, Elite and Professional. The Prime account model is presented as the most popular and thus most frequently used account type of these. For maximum transparency, the table below lets you directly compare the various account types with one another.

| Premium | Prime | Elite | Professional | |

| Spreads | from 1.3 pips | from 0.6 pips | from 0.0 pips | from 0.0 pips |

| Commissions | No commissions | No commissions | € 2.50 per side per traded lot | € 2.50 per side per traded lot |

| Minimum deposit | US$ 1,000.00 | US$ 5,000.00 | US$ 10,000.00 | US$ 10,000.00 |

| Maximum leverages | 1:30 for forex 1:20 for indices & gold 1:10 for commodities | 1:30 for forex 1:20 for indices & gold 1:10 for commodities | 1:30 for forex 1:20 for indices & gold 1:10 for commodities | Up to 1:400 |

| Margin requirements | 100% | 100% | 100% | 100% |

Swissquote will accept the following 9 currencies: GBP, EUR, USD, CHF, PLN, HUF, CZK, AUD, JPY.

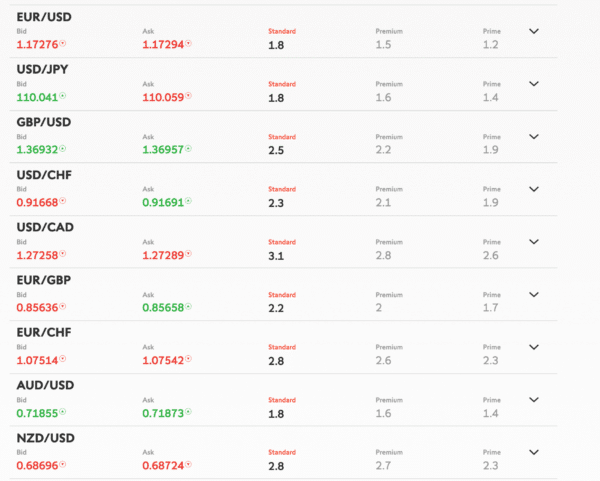

Spreads

The spreads payable for their various tradable assets make up a large part of the fees with many an online broker. As we have seen already, they depend on the selected account type at Swissquote. Which is why the spreads of a number of popular trade instruments are briefly detailed below for the various account types.

If you want to find out more, the swap rates for various overnight positions are additionally also available on the Swissquote website for viewing.

Besides the spreads, it is always worthwhile to look at information concerning the execution of trades by the respective online broker. The average execution time at Swissquote is a mere 27 milliseconds, with an execution rate of 97 %. And the slippage parameters look rather good too:

- 63 % no slippage

- 15 % positive slippage

- 12 % negative slippage

Deposits and withdrawals at Swissquote

Where deposits and withdrawals are concerned, Swissquote has a so-called ePortal for its clients. This provides an overview of all accounts with simultaneous direct access to the trading platforms.

See the table below for a brief overview of the available deposit and withdrawal options.

| Deposit | Withdrawal | Processing period | |

| Bank transfer | free | free | 1-3 working days |

| Visa* | free | n/a | Immediately (2 hrs max.)* |

| Mastercard* | free | n/a | Immediately (2 hrs max.)* |

* Monday to Friday, 8 a.m. – 6 p.m. CET

Deposit and withdrawal options at Swissquote

The minimum deposit for all this is € 1,000.00, as mentioned above.

Customer service at the online broker

The customer service at Swissquote is not very different from that of its competitors. Besides the classic contact form, interested parties and clients can also use a customer email or their telephone to contact the Swissquote support team if they have any questions or problems. The online broker states the following opening times for this: Monday to Friday, 8 a.m. to 6 p.m. (GMT).

Another aspect to be emphasized are the education services available from the Swissquote website. On the one hand, the online broker lets interested investors access a learning centre featuring a great number of video tutorials delving into various subjects. And on the other, Swissquote also offers webinars and seminars at regular intervals.

The Swissquote demo account

Swissquote’s demo account is available to interested investors for free. This way they can try out the online broker and its range of services without running any financial risks at first. This includes all the provider’s three trading platforms, which can be tested without entering into any commitments. The demo account will let you test-trade more than 130 financial instruments with a virtual capital of up to US$ 100,000.00.

Online user ratings of Swissquote so far

In conclusion, just a brief look at Swissquote’s online reviews so far. Although something of a mixed bag, the user ratings of this online broker in the world wide web tend to be rather positive overall. Swissquote apparently offers a satisfactory number of tradable assets, while the MetaTrader platforms are supplemented by their own and advanced proprietary trading software.

The trading conditions are generally judged to be fair, with clients able to choose from four different account models. And for anyone preferring to try out this provider without risking any losses to start with, their easily manageable demo account is always available for this.

Further reading: