Skilling.com is a still relatively young fintech company founded in the beginning of 2016 by the Scandinavian technology experts Henrik Persson Ekdahl, André Lavold and Mikael Riese Harstad. Interested investors and traders can use this online broker, whose head office is in Cyprus, to trade over 800 currencies and CFDs at this point in time.

Inhaltsverzeichnis

Benefits and drawbacks of Skilling.com

To start with, a brief look at the benefits and drawbacks of this rather young online broker, before going into the details of the provider’s contents and services further down in this article.

Benefits:

- Extensive selection of tradable financial instruments with over 800 assets in the forex and CFD area

- Low minimum deposit of just US$ 100.00

- Regulated and licensed online broker with deposit protection

- Free, non-committal demo account

- Easy-to-operate trading app

- Live chat and email support

- No hidden fees

Drawbacks:

- The Skilling platform is only available in Germany, England, Sweden and Norway

- Limited range of payment options

The history of Skilling.com

Skilling was established in spring 2016 with the opening of a first office in Malta. In May 2017, this was followed by the founding of the Cypriot investment firm Skilling Ltd, entailing the application for a CYSEC licence. The company received its official CYSEC licence soon after and established its head office in Cyprus. From which point onwards the online broker was authorized to offer its Skilling services in all EU/EEA countries.

Mid-2019 then saw the market launch of Skilling in Germany, Sweden, Norway and Great Britain, followed by the remaining EU and EEA states soon after. The company has been expanded further since 2020, and is now offering its services outside the EU as well.

Skilling.com – background info

At the time of this review, the Skilling Group consists of a multinational team of over 40 staff working in the company’s three offices. Besides Cyprus, these offices are located in Malta and Spain.

According to the Skilling website, the vision pursued by the online broker is:

„To unlock the potential of the world’s financial markets for everyone.

Everyone with an interest in financial markets should be able to access and harness their full potential.“

To this end, the broker aimed to develop a unique trading platform that is just as suitable for Trading novices as it is for advanced traders, and enables everyone to connect with the global financial markets.

Regulation of and deposit protection at Skilling

Looking for a suitable online broker, you should always pay particular attention to the subject of regulation first.

As an online broker headquartered in Cyprus, the company is licenced by the corresponding Cypriot financial supervisory authority (CYSEC) under the CIF licence number 357/18, and also regulated by it.

Apart from this, Skilling Ltd. is also authorized to operate a branch in Great Britain by the British financial supervisory authority FCA under the reference number 810951.

Since 2020, Skilling (Seychelles) Ltd. is additionally licenced and regulated by that country’s Financial Services Authority (FSA) under the licence number SD042.

As prescribed by Cypriot law, CYSEC moreover requires the company to be a member of the Investors Compensation Fund (ICF). This serves to insure client funds up to a maximum of € 20,000 per trader.

In addition to which Skilling also ensures that deposited client funds are kept in segregated accounts, and thus separate from the company’s own capital.

Skilling – company address and contact

As already mentioned above, the company behind Skilling.com operates branches in three different countries:

Skilling Cyprus

Address: Athalassas Avenue 62, 2nd floor, Strovolos, CY-2012, Nicosia – tel.: +357 22 276710, email: support@skilling.com

Skilling Spain

Address: Avda. Ricardo Soriano 19, 3A, 29601 Marbella, Malaga, Spain

Skilling Malta

Address: The Hedge Business Centre, 5th floor, Triq Ir-Rampa Ta‘ San Giljan Balluta Bay, St. Julians, STJ 1062 Malta

Reputability of the online broker – is Skilling safe?

The safety aspect probably has the largest role to play in selecting a broker, which is why we will take a closer look at the integrity of Skilling here. In this respect, the online broker’s clients benefit from its regulation by CYSEC and membership in the ICF with financial coverage up to an amount of €20,000, while a negative balance is impossible, which definitely speaks for the provider. The annually published financial reports and segregation of client funds indicate a high level of safety at Skilling Ltd as well.

The Trading Platform provided by skilling has a high protection level too, which is ensured by SSL. Private user data will thus be encrypted and protected from hacker attacks.

Skilling.com can therefore be assumed to be a trustworthy provider in the market.

Which assets can be traded at Skilling?

Having discussed the safety of this online broker, this section deals with the trading range Skilling offers its clients.

As already briefly mentioned earlier, you are able to choose from over 800 assets on Skilling’s trading platform at this point in time. Trading is meanwhile possible with currencies, shares, indices, commodities and cryptocurrencies.

Currencies

The Forex Trading range at Skilling includes more than 70 currency pairs, with clients able to trade the popular majors (EUR/USD, GBP/USD, USD/JPY, etc.) as well as a number of Minors and exotic currency pairs.

Shares

The selection of shares at Skilling is also broadly diversified and, besides the stocks of well-known companies (such as Apple, Facebook, Tesla, etc.), also includes over 700 further shares in global enterprises available for trading at comparably fair conditions.

Indices

Where the indices are concerned, investors can trade CFDs on classics like the S&P 500 or Germany 30 along with many others.

Commodities

Skilling will also let you trade commodity CFDs. Traders can choose from popular precious metals such as gold and silver for this, or also bet on the oil price, going either Long or Short.

Cryptos

Not least of all, Skilling can also be used to trade CFDs on Cryptocurrencies, which are steadily gaining in popularity amongst many traders. Trades can also be long or short here. Currently available for trading are CFDs for the cryptocurrencies Bitcoin, Ethereum, Dash, Litecoin, IOTA, Monero, Neo, Ripple and EOS.

Which account types can clients choose from at Skilling?

Having opted for Skilling, you can choose from three different account models.

- Standard

- Premium

- MT4

The Standard account model at Skilling

If you are new to trading, the Standard account model is recommended for you. The low minimum deposit of just €100.00 makes this the ideal account model for all trading novices. The Standard account is a 0-commission account with spreads starting from 0.7 pips. While the maximum leverage for private clients is set at 1:30, professional clients can up it to a maximum of 1:200 – which applies to all 3 account types.

The Premium account model

For more advanced traders, Skilling offers the so-called Premium account model. The main difference from the aforementioned Standard account model here principally resides in the spreads, which start from as little as 0.1 pips, with the commissions to be paid based on the trading volume.

The minimum deposit required for the Premium account is set significantly higher at €5,000. The reason they give for this is the provision of markedly lower spreads.

MT4

The third option offered by Skilling is their MT4 (MetaTrader 4) account model. The eponymous trading platform is one of the most popular Trading programs around the world. MetaTrader 4 is especially popular in forex trading, with the software also available in both web and desktop version at Skilling, or as an App for Android and iOS too.

You can thus either use it to trade directly in your internet browser or by way of a downloaded MT4 desktop version.

Direct comparison of the Skilling trading accounts

The table below is designed for a direct comparison of the individual account models‘ various contents and features.

| Standard | Premium | MT4 | |

| Trading platform | Skilling Trader Skilling cTrader Skilling MetaTrader 4 | Skilling Trader Skilling cTrader | MT4 |

| Commissions from | 0-Commission Account | 35$/Million | 0-Commission Account |

| Spreads from (pips) | 0.7 | 0.1 | 0.7 |

| Minimum deposit | 100 € | 5,000 € | 100 € |

| Leverage for private clients | 1:30 | 1:30 | 1:30 |

| Leverage for professional clients | 1:200 | 1:200 | 1:200 |

| Micro-lot trading (0.01) | Yes | Yes | Yes |

| Currency pairs | 73 | 73 | 73 |

| Cryptocurrencies | 10 | 10 | 6 |

| Indices | 17 | 17 | 16 |

| Commodities | 5 | 5 | 5 |

| Shares | more than 700 | more than 700 | more than 200 |

| Stop-out level | 50 % | 50 % | 50 % |

| Scalping | Yes | Yes | Yes |

The trading platforms to choose from at Skilling

Let us now turn to the various trading platforms that Skilling offers its clients. As we have already seen, the trading platforms you can use depend on the account type you select.

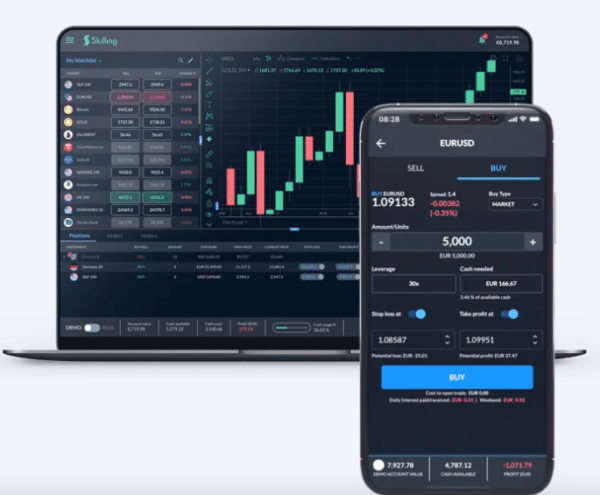

Skilling Trader

Centre stage amongst the online broker’s trading programs is taken by their very own Skilling Trader platform, a proprietary trading platform specifically developed by traders for traders.

According to the online broker, the software was developed with the aim of providing a unique, simple and powerful trading platform that caters to the needs of both novices and more advanced traders.

The benefits of this software can be briefly summed up in the following bullet points:

- Intuitive and user-friendly trading interface

- Seamless integration with Skilling cTrader → trading between the two trading platforms is possible in a single Skilling trading account

- Explanation of the trading basics from the Skilling Trade Assistant

- Technical indicators and drawing tools

- Full desktop and mobile support → trading in your browser, your desktop or mobile app

- Large selection of more than 800 tradable assets

Skilling cTrader

The Skilling cTrader offers a number of advanced functions such as fast order entry, coding customization and various additional indicators, for example. This will also enable sophisticated traders to make better and faster trading decisions.

See below for some of the trading platform’s benefits in a nutshell:

- Powerful software for advanced traders

- Algorithmic trading from the Automate Editor (compatible with C# and .net frameworks)

- Complete charting package with a whole range of different presentation modes and layouts

- Ultrafast execution periods of 0.05 seconds on average

Skilling MetaTrader 4

Last but not least, Skilling also gives you the option of trading with the MetaTrader 4 software. This is probably the best-known platform in forex trading. In comparison to many other platforms, MT4 scores with its versatility and customization options. Apart from which MetaTrader 4 also enables automated trading with expert advisors.

Just a brief look at this trading platform’s advantages:

- Established trading software with an extensive selection of indicators, charting tools and customization options

- Algorithmic trading with expert advisors for automated forex and CFD trading

- Versatile customizing options

- Full desktop and mobile support

- Over 200 tradable assets

Whether you should ultimately go for MetaTrader 4 or cTrader primarily depends on your trading style:

| Benefits of MT4 | Benefits of cTrader |

| Multi-facetted customization options – indicators can even be fully customized without knowing any programming languages | Intuitive user interface that makes it difficult for some traders to change to other trading platforms |

| Automated trading by way of expert advisors | Market depth with three different options for market depth assessment (whereas MT4 only provides one) |

Which platform you go for in the end also depends on your individual requirements as a Trader. If you prefer a transparent, intuitive interface, or market depth, you’d probably be best advised with the Skilling cTrader. But if you want to benefit from the many customizable trading functions of MetaTrader 4, this variant will probably be best for you.

What fees do I need to expect at Skilling?

The basic fees in terms of payable Spreads and commissions have already been briefly outlined under the aspect of the various account models:

- Standard account and MT4 account: spreads starting from 0.7 pips

- Premium account: spreads starting from 0.1 pips

Fees in the form of commissions are only payable for currency pairs and spot metals in the Premium account at Skilling:

| Financial instrument | Commission per million |

| EUR/USD | $35 |

| GBP/USD | $40 |

| Rest FX | $50 |

| Gold | $60 |

| Silver | $120 |

The formula for calculating their commission looks like this:

Commission = trading volume in base currency * (US$ conversion rate * x US$ per traded million) * exchange rate of the account

Swap fees at Skilling

Trading with this online broker can also expose you to so-called Swap fees. These fees can be either negative or positive and are automatically calculated at the end of the trading day (10 p.m. GMT).

The calculation of the swap fees for the various asset classes is transparently and comprehensively documented on the Skilling website.

Swap calculation for forex and spot metals:

Swap = (pip value * swap rate * number of nights)/10

- Pip value: 10 for all forex pairs except for JPY, HUF and THB pairs, whose Pip value is 1,000, and RUB & CZK pairs, whose pip value is 100.

- Number of nights: the total number of nights an open position is held for.

The result is divided by 10 because swap fees are stated in cents.

Swap calculation for indices:

Swap long = (units * price) * (surcharge + LIBOR) / 365

Swap short = (units * price) * (surcharge – LIBOR) / 365

- Units: total number of units bought/sold in the trade

- Price: index price

- LIBOR: the one-month LIBOR rate of the quoted currency

- Surcharge: 3.5 % for buying and 3 % for selling

Swap calculation for stock CFDs:

Swap long = (units * price) * (surcharge + LIBOR) / 365

Swap short = (units * price) * (surcharge – LIBOR) / 365

- Units: total number of units bought/sold in the trade

- Price: share price

- LIBOR: the one-month LIBOR rate of the quoted currency

- Surcharge: 4 % for buying and 3 % for selling

The swaps for cryptocurrency trading are calculated on the basis of a price percentage.

Is there an inactivity fee at Skilling?

Like many other online brokers, Skilling also charges a so-called inactivity fee. This becomes due if a live account has not been logged into for 12 months. In this case the payable inactivity fee amounts to 10 euros.

Opening an account at Skilling

Opening an account at Skilling is uncomplicated and quickly done.

Step 1: First you need to identify yourself to the online broker with some personal data, which is usually done in a matter of minutes.

Step 2: This is followed by your verification by uploading an ID card or passport. As an alternative, you can also register using your BankID.

Step 3: Upon your successful verification, you can pay money in and start trading straight away.

What are the options available for making deposits and withdrawals at Skilling?

In this respect, let us stake a look at the options offered by Skilling for clients making deposits and withdrawals:

| Trustly (including bank transfer) | 0-3 working days |

| Credit/debit card | within 1 hour |

| Neteller | within 1 hour |

| Skrill | within 1 hour |

| Sofort | within 1 hour |

Deposits and withdrawals at Skilling are both principally free of charge. But you need to take into account for withdrawals that only the first one is free in any month, with fees charged for any additional ones.

Is there a minimum deposit at Skilling?

Yes, with the minimum deposit depending on the selected account model:

- Standard and MT4 account: € 100.00

- Premium account: € 5,000.00

Do they have a demo account at Skilling?

Novices to trading are recommended the demo account of Skilling.com. This enables them to try out all the trading platform’s functions without needing to run any financial risks at first. Interested investors can thus familiarize themselves with the platform’s user interface and learn the basics of trading.

A virtual credit balance of € 10,000 enables own trading strategies to be trialled risk-free under real-life conditions.

Do they have a mobile app at Skilling too?

Yes, the online broker also offers a mobile app that can be downloaded for Android as well as iOS.

The functions of the mobile app are the same as with the desktop version.

The ratings of the mobile app in the Android market are rather mixed, alas. While some users laud the app’s versatile functions and user-friendliness, there are also a number of negative reviews that find it too complex in parts.

Website usability

While the usability of the Skilling website is quite intuitive and transparent, there is still some room for improvement in the actual trading. Many users find the design a bit too cluttered in places so that they get lost in distracting details. But after learning the ropes for a while, one also gets used to this.

Skilling and day trading

The online broker Skilling is a suitable alternative for day traders and scalpers, too. Most recommended for them is trading on the Skilling cTrader platform, which is distinguished by an expanded risk management as well as various order functions. In addition to which traders can also rely on a large selection of indicators here, and trade with leverages of up to 1:30.

The customer service at Skilling

In closing, a brief look at Skilling’s customer service. The support is principally available Monday to Friday from 8 a.m. to 10 p.m. There are various potential options for contacting them.

- Telephone support: Mon – Fri from 8 a.m. to 5 p.m.

- Live chat: Mon – Fri from 8 a.m. to 10 p.m.

- Email support: email requests will usually get a response within 24 hours

Conclusions

In comparison with established online brokers in the market, Skilling is still a relatively young company that can be assumed to develop further over the coming years.

But Skilling is still a meaningful option for many traders for all that even now. The online broker can score with its transparency and broad range of tradable assets.

So although there are certainly still a number of shortcomings, the online broker is rated rather positive by many investors on the bottom line.

Read similar articles: