Broker comparison – who is the best? In this article, we are introducing RoboMarkets.

The provider RoboMarkets is a so-called multi-asset broker. Interested traders and investors can use this online broker to trade 8 different asset classes comprising over 12,000 actual assets.

Apart from its extensive range of tradable assets, RoboMarkets also gives its clients access to modern and professional trading platforms and technologies. This is intended to create a trading environment that is as ideal as possible for all traders.

RoboMarkets was founded in 2012, and licenced as a European broker one year later. Although the head office of the company behind it, RoboMarkets Ltd., is situated in Cyprus, there is also a branch operating in Germany under the name of RoboMarkets Deutschland GmbH. The German branch has been located in Frankfurt/Main since 2015.

Inhaltsverzeichnis

Is RoboMarkets regulated?

As an online broker that is based in Germany, RoboMarkets is also regulated by the competent German Federal Financial Supervisory Authority (BaFin). This is tasked with monitoring the providers of financial services (such as banks or brokers) and their compliance with various obligations.

With Germany’s BaFin known for its strict regulatory requirements, one can safely assume that RoboMarkets is a dependable provider as well.

The online broker’s head office in Cyprus is meanwhile regulated by CySEC, the Cyprus Securities and Exchange Commission.

How safe is RoboMarkets?

One important question traders quite rightly ask themselves in their search for a suitable online broker concerns the safety of their paid in customer deposits. The answer is provided by RoboMarkets guaranteeing on their website that all client deposits are kept in specifically opened trust accounts. These are managed separately from the company’s own accounts and are therewith also safe in the event of an insolvency.

As the online broker is a member of the Cypriot Investor Compensation Fund (ICF),its clients are assured compensation for up to € 20,000 if it goes insolvent.

Over and beyond this, negative account balances are also prevented by the legal regulations.

Another aspect confirming the high level of security at RoboMarkets is their two-stage authentication, which enables the online broker’s clients to protect their sensitive data such as email addresses, passwords and bank data from unauthorized access.

One can therefore basically assume that the provider ensures an adequate level of security for its clients‘ funds and sensitive data.

Awards won by RoboMarkets so far

Ever since its inception, RoboMarkets has been able to win a number of awards, with some of the latest honours briefly outlined below:

- Professional Trader Awards 2020: Best Mobile Trading Platform

- International Business Magazine Awards 2020: Best Indices Broker

- London Trader Show Awards 2020: Safest European Broker

A full list of all the awards won by RoboMarkets since its establishment is available from the online broker’s website.

In addition to the many awards, the online broker also claims to maintain over 200,000 trading accounts already.

Which assets can be traded at RoboMarkets?

Having provided a brief overview of the online broker, its regulation and safety, this section is intended to take a closer look at the various trade instruments available there. Robomarkets.com principally offers 8 different investment options.

Forex trading at RoboMarkets

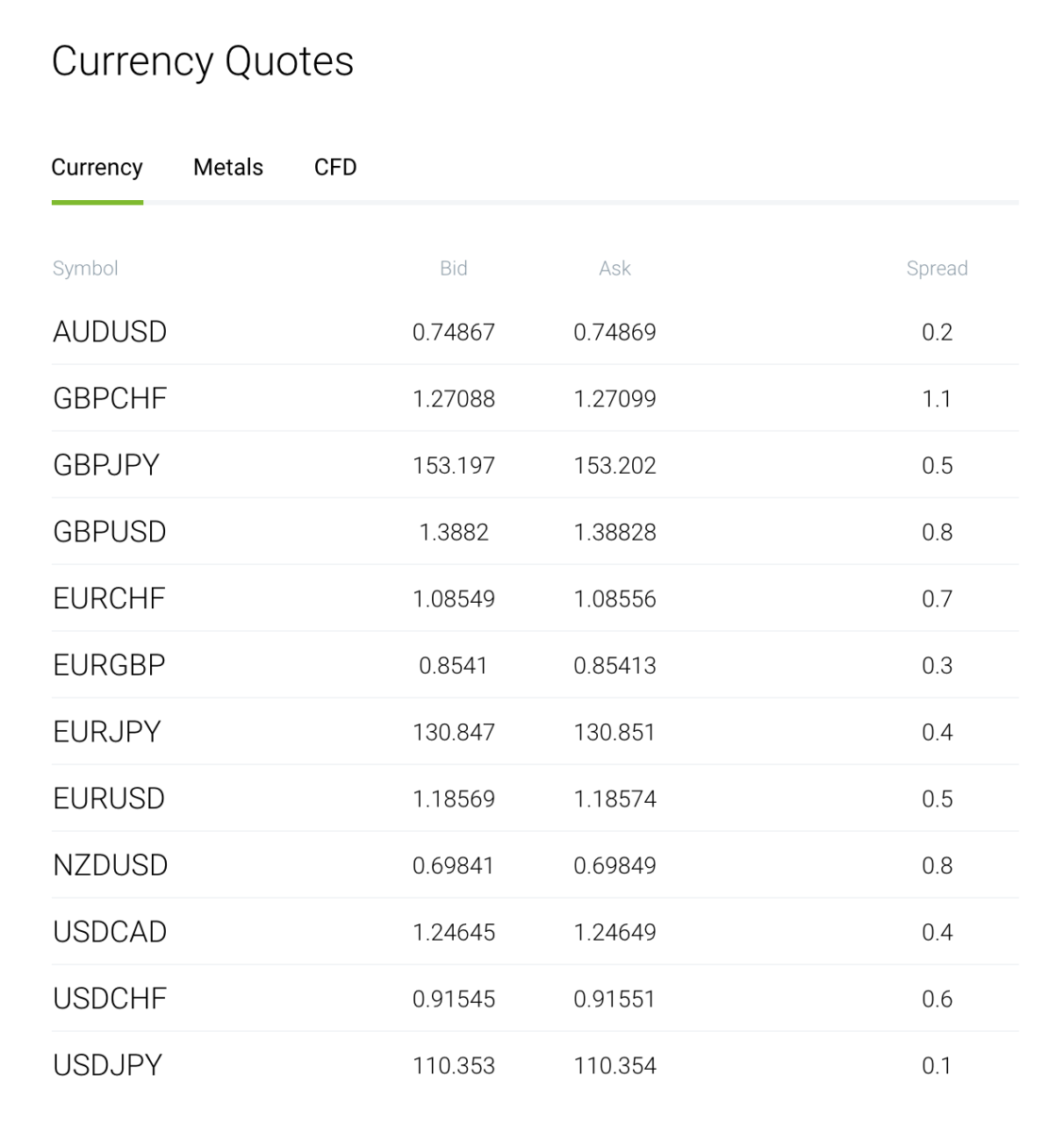

With a daily trading volume of over US$ 6.6 trillion, the Forex market is the world’s most liquid market. RoboMarkets clients can use the online broker to trade 35 different currency pairs, including the majors EUR/USD, EUR/GBP, USD/JPY and GBP/USD. These trades are possible from a spread of 0 pips and an order execution speed of 0.1 seconds.

RoboMarkets also provides interested investors with live quotes for other assets on its website.

Shares at RoboMarkets

RoboMarkets lets you trade over 12,000 shares, including over 8,400 stock CFDs on the one hand and more than 3,000 real shares of US companies on the other. The online broker’s clients can not only apply leverages of up to 1:20 in doing so, but also rely on a free construction kit for trading robots.

Indices at RoboMarkets

Indices are highly liquid trade instruments reflecting changes in the performance of specific groups of shares. RoboMarkets‘ clients can trade more than 10 of these trade instrument with a minimum deposit of only US$ 10.00. Depending on the selected account type, the commissions for a trading volume of US$ 1 million can start from as little as US$ 4.00. The average spread for DE30Cash in ECN and Prime accounts is a mere 0.5 pips, and 0.7 pips with a Pro Standard account.

ETFs at RoboMarkets

Once they have paid in the minimum deposit of € 100.00, clients can choose from over 1,000 ETFs for trading at RoboMarkets from as little as 0 pips to diversify their portfolio. The maximum leverage applicable here is also 1:20.

Agricultural commodities at RoboMarkets

Another type of asset you can invest in at RoboMarkets is a whole range of agricultural commodities (cocoa, coffee, wheat, sugar, cotton, and more). The maximum leverage available for commodities trading is also 1:20.

Energy commodities at RoboMarkets

Energy commodities are most of all recommended for day trading. Besides heating oil, natural gas, ethanol and oil, the online broker will also let you trade many other energy commodities.

Metals at RoboMarkets

Not only Gold is becoming ever more popular amongst many traders, but many other precious metals are increasingly regarded as lucrative investment products, too. RoboMarkets enables its clients to trade commodity ETFs for more than 20 different metals, including silver, aluminium, iridium, copper and nickel, as well as palladium and platinum.

The minimum deposit for metal trading at RoboMarkets amounts to € 100.00, with spreads starting from as little as 0 pips.

Cryptocurrency trading at RoboMarkets

All lovers of digital online currencies will also find a corresponding offer at RoboMarkets, where more than 10 Cryptocurrencies are available for trading 24/7 in the form of CFDs. Opening an account here will enable you to trade many popular cryptos such as bitcoin, Ethereum, Litecoin and others.

Which trading accounts are available at RoboMarkets?

RoboMarkets gives its investors various options to choose from for opening an account:

- Cent (Micro) account

- ECN account

- Robo.Pro

- R Trader

- Demo account

Cent Account

The Cent (Micro) account is primarily designed for learning and testing the trading conditions applicable to real money accounts. This account model will basically let you try out your own trading strategy or those of expert advisors without difficulty and no great financial risk. The unique feature of the Cent accounts is that they are based on 100x denominated currencies (US cents, EU cents, GB pennies, etc.). The trading conditions with these accounts are principally the same as with the standard accounts in all other respects, however.

Users of Cent accounts can trade 36 currency pairs as well as metals and cryptocurrencies. The trading is based on market execution with variable spreads starting from 1.3 pips. The minimum initial deposit required to open a Cent account is € 100.00.

ECN account

The ECN account is the online broker’s recommended account model for advanced and professional traders, distinguished by narrow spreads starting from 0 pips and volume-based transaction commissions. Another benefit of the ECN account are its very low latencies starting from as little as 0.1 seconds, enabling effective trading of a variety of assets such as currencies, cryptocurrencies, metals and commodities.

The minimum deposit here is also € 100.00, with tradable assets including 36 currency pairs, various metals, US stock CFDs, index CFDs and oil CFDs, as well as cryptocurrencies.

RoboMarkets gives you two different types of ECN account to choose from:

- Robo ECN

- Prime

The Prime version is a VIP account, offers the best trading conditions of all RoboMarkets account models, and is recommended for experienced traders. Professional clients can use Prime accounts for leverages of up to 1:300, while the previous minimum deposit of US$ 5,000 has been lifted. The commission for a trading volume of US$ 1 m comes to US$ 10.00.

ECN accounts

Robo.Pro

Robo.Pro is the most popular account model at RoboMarkets, and recommended for investors and traders irrespective of their level of experience. Holders of a Robo.Pro account trade with variable spreads starting from 1.3 pips. The minimum deposit required amounts to € 100.00 as well.

R Trader

R Trader is a modern multi-asset platform that doubles up as an efficient desktop platform. This special account type enables clients to use a variety of expanded chart functions and automated strategies in their trading of over 12,000 assets. This includes the trading of real shares, stock CFDs, forex and ETFs, as well as oil and metal CFDs. The account is particularly recommended for experienced investors in Stock trading, with spreads starting from as little as US$ 0.01.

That leveraged trading is also possible should go without saying, with the amount of leverage depending on the traded asset in question.

Robo.Cent

The Robo.Cent account type lets you use cents (US$ cents, € cents) as the base currency, enabling traders to try out their new trading strategies with small investments. Available for trading are 36 currency pairs, and metals.

Demo accounts

Traders and investors interested in risk-free trading can always also go for a Demo account. This is of the same design as the classic live accounts and thus enables strategies to be tested under real market conditions but without the financial risks. The demo account can be used with all the trading platforms available at RoboMarkets (MetaTrader 4, MetaTrader 5 and R Trader) and is free of charge, but will expire if there is no activity for 90 days.

RoboMarkets offers its clients three different demo accounts, each of which copies the corresponding live version.

Direct comparison of the RoboMarkets account models

Please see the following table for a direct comparison of the individual account types briefly outlined above.

| Robo.Prime | Robo.ECN | R Trader | Robo Cent | Robo.Pro | |

| Tradable assets | 28 currency pairs, metals, US stock, index, oil CFDs, cryptos | 36 currency pairs, metals, US stock, index, oil CFDs, cryptos | Over 12,000 assets: indices, cryptos, real shares, stock & oil CFDs, forex & ETFs, and metals | 36 currency pairs, metals, cryptos | 36 currency pairs, metals, US stock, index, oil CFDs, cryptos |

| Trading platforms | MetaTrader 4, MetaTrader 5, R Trader | MetaTrader 4, MetaTrader 5, R Trader | R Trader | MetaTrader 4, MetaTrader 5, R Trader | MetaTrader 4, MetaTrader 5, R Trader |

| Minimum deposit | € 100.00 | € 100.00 | € 100.00 | € 100.00 | € 100.00 |

| Spread | Variable from 0 pips | Variable from 0 pips | from US$ 0.01 | Variable from 1.3 pips | Variable from 1.3 pips |

Which trading platforms can I choose from at RoboMarkets?

Another key aspect in the search for a suitable online broker are its trading platforms. RoboMarkets principally provides its clients with a choice of three different trading programs:

- MetaTrader 4

- MetaTrader 5

- R Trader

MetaTrader 4

MetaTrader 4 is the classic software program for traders. Its user-friendly interface and many trading and analysis tools make MT4 one of the most frequently used trading platforms to this day. Amongst others, the trading platform is distinguished by the following aspects:

- 3 order execution types

- 9 chart time frames

- 50 integrated Indicators for technical analysis

- Various order types

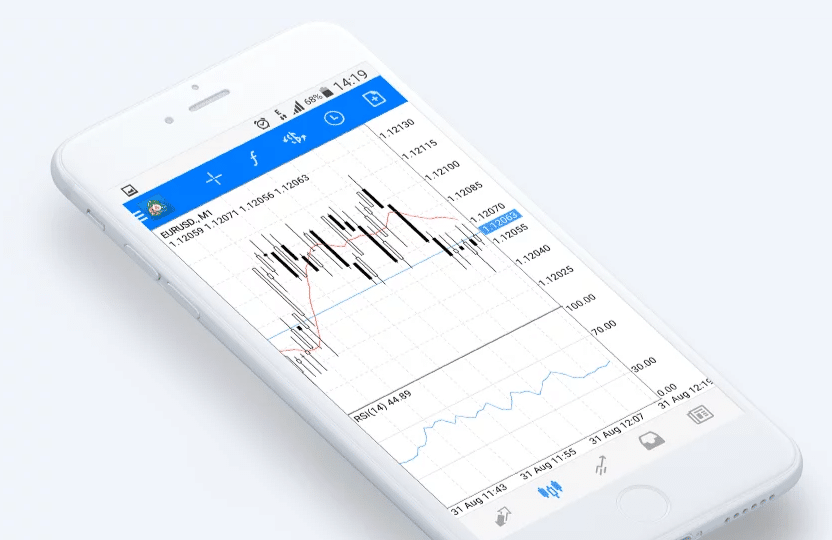

In addition to which there is also a mobile version for iOS and Android devices enabling location- and time-independent trading. The mobile application has exactly the same functions and tools as the desktop version.

MetaTrader 5

MT4’s successor software MetaTrader 5 is also available for use at RoboMarkets. This modern software is recommended for more advanced traders and offers efficient technologies with over 1,500 expert advisors and technical indicators. Users of this platform can choose between netting and hedging systems. Over and beyond this, the software also offers:

- 4 order execution types

- Algorithm-based trading

- Flexible trading system

- 6 types of pending order

- Market depth

MT5 is also in a mobile version for both Apple and Android devices too.

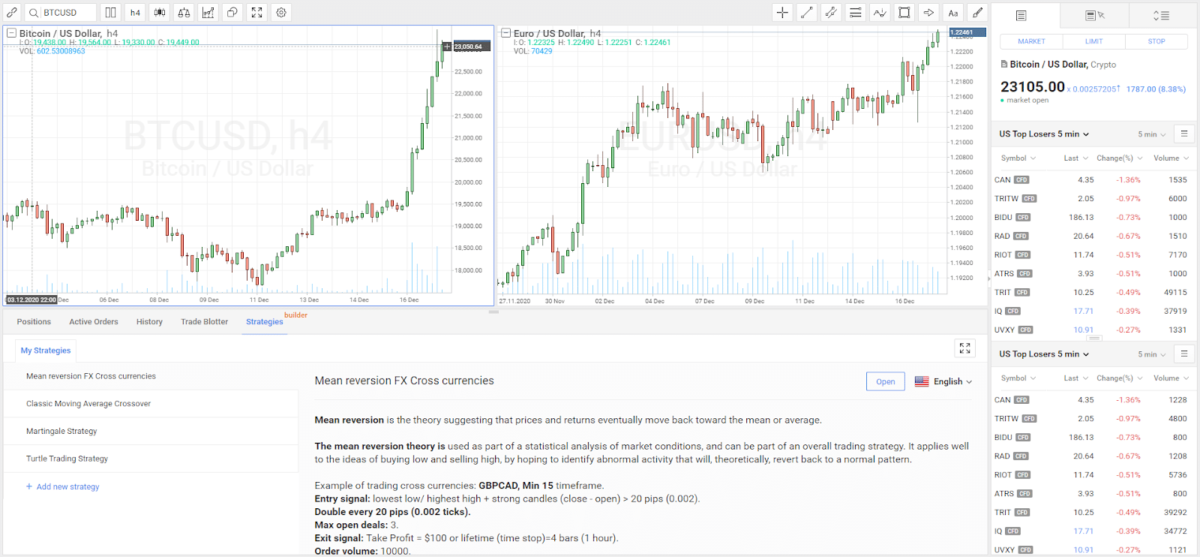

R Trader

If you would like to access over 12,000 trade instruments at RoboMarkets, R Trader is the perfect choice for you. Besides its great range of tradable assets, R Trader can also provide you with expanded chart functions and automated trading strategies. In addition to which this multi-asset platform also offers the following benefits:

- Trading in global markets

- Capital measures (automatic dividend payments)

- Level II market depth

- Construction kit for algorithmic strategiesrobo

- Netting & hedging settlement models

- Watchlists

- One-click trading

- Trading straight from the chart

- Share leverages of up to 1:20

The trading conditions you’ll enjoy with R Trader meanwhile depend on the traded asset. Please see the following table for a brief overview.

| US shares (deposit > US$ 10,000) | US shares | US stock CFDs | European stock CFDs | Cryptocurrencies | Forex | Indices | Metal CFDs | Oil CFDs | |

| Leverage | Up to 1:20 | 1:2 | Up to 1:5 | Up to 1:5 | 1:1 or 1:2 | Up to 1:30 | 1:20 | 1:10 | 1:10 |

| Commission | US$ 0.0045 per share | US$ 0.02 per share | US$ 0.015 per share | 0.07 % | 0.30 % | US$ 15.00 per million | Variable | US$ 15.00 per million | US$ 35.00 per million |

| Commission-free | Yes | Yes | No | No | No | No | No | No | No |

| Spreads | From US$ 0.01 | From US$ 0.01 | From US$ 0.01 | From US$ 0,000 | From 0 (was?) | From 0 (was?) | From 0.5 (was?) | From 0.01 (was?) | From 0.01 (was?) |

| No. of assets | More than 3,000 | More than 3,000 | More than 8,400 | 84 | 9 | 50 | 9 | 2 | 2 |

| Swap-free | Yes | Yes | Yes | Yes | Yes | No | No | No | No |

For users of the R Trader account, the online broker will meanwhile charge no commissions for share trades as long as their leverage is 1:1. This means that RoboMarkets enables stock CFDs and/or real shares to be traded with that leverage free of charge.

What are the options available for making deposits and withdrawals at RoboMarkets?

RoboMarkets provides its clients with a number of different payment options to choose from. Besides classic bank transfers (SOFORT, giropay, Fast Bank Transfer, etc.), there is also the option of making deposits using electronic payment service providers such as PayPal, Skrill or Neteller. But you can naturally also make deposits with your VISA or MasterCard.

While deposits are principally free of charge, withdrawals are subject to various fees depending on the payment method.

Opening an account at RoboMarkets

If you want to open an account at RoboMarkets, you first need to enter the corresponding data and must then complete a brief test designed to determine the clients‘ level of experience.

Once you have completed the test, they will suggest an account model that matches your test results and thus the respective trader’s skills.

Training and education services at RoboMarkets

The online broker provides a whole range of training and education options on its website. Clicking on the Useful Tools tab of the RoboMarkets website will not only provide you with helpful analyses and tools (such as an Economic Calendar), but also extensive training contents.

These for example include video tutorials that all registered members can view at all times.

Over and beyond that, RoboMarkets also offers webinars that you can register for on the online broker’s website. These are provided free of charge and held using the MyOwnConference platform. The seminars will usually take 40-50 minutes.

The customer service at RoboMarkets

Before we come to the end, just a brief look at the quality of the customer service at RoboMarkets. The responsible branch for clients from the German-speaking regions is located in Frankfurt am Main and also provides them with technical support. If you have any questions or run into any problems, you can on the one hand contact them by email or on the telephone. On the other, there is also a live chat enabling you to contact trained specialists 24/7.

Online reviews of RoboMarkets so far

In conclusion, some details about the reviews of RoboMarkets on the internet so far. All-in-all, the online broker’s ratings tend to be positive. RoboMarkets can most of all impress with its extensive range of over 12,000 tradable assets and the fair conditions they offer.

Depending on your trading account, spreads can start from as little as 0 pips. The required minimum deposit of € 100.00 meanwhile enables you to start trading with little capital. In addition to which their free demo account is highly recommended for trying out your strategies.

Read similar articles: