Is the reward/risk ratio total nonsense or the holy grail of traders? In this article, we’ll take a closer look and show that both views can be true.

Inhaltsverzeichnis

What’s the reward/risk ratio?

As the name suggests, the reward/risk ratio (R/R ratio) is a measure of the relationship between reward and risk. Also known as the risk/reward ratio, it’s one of the basic principles of risk and money management, which, as every trader knows, provides a foundation for long-term success in the market. As hedge fund manager Larry Hite once said, “Frankly, I don’t see the markets; I see risks, rewards, and money.”

- Potential risk: the difference between your entry price and stop loss

- Potential reward: the difference between your entry price and take-profit point.

If you calculate the quotient between the potential reward (profit) and the potential risk (loss), you get the reward/risk ratio.

For example, if the potential profit is 20 pips and the stop loss is 10 pips, the reward/risk ratio is 2:1, meaning the potential profit is twice the potential loss. So, in the event of a profitable trade, you’ll get back two euros for every euro you place at risk.

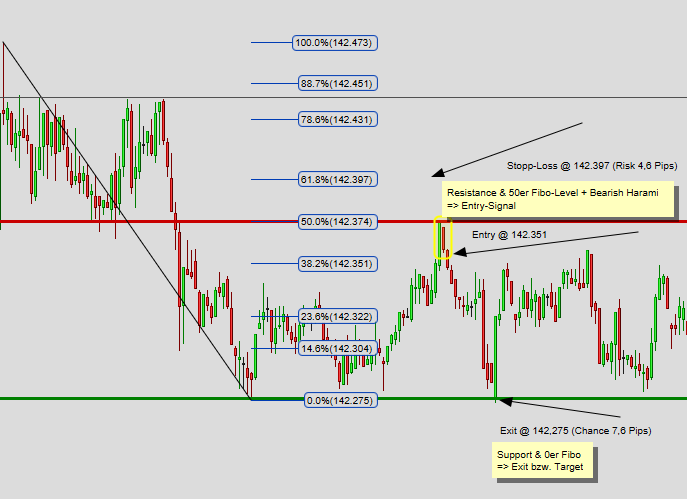

An example of a reward/risk ratio using GBPJPY

Let’s look at a trade in the GBP/JPY currency pair as an example.

We want to go short in GBP/JPY. The entry signal is a bearish reversal pattern, the bearish harami. It forms at the 50 % Fibonacci retracement level. We enter the trade after the bearish harami forms – e.g. at the 38.2% Fibonacci level. We place our stop above resistance some distance from the entry point – e.g. at the 61.8% Fibonacci level. The price target is the next support, in this case the 0% Fibonacci level.

- Potential reward: target (142.275) – entry (142.351) = 7.6 pips

- Potential risk: stop loss (142.397) – entry (142.351) = 4.6 pips

- Reward/risk ratio = potential reward (7.6) / potential risk (4.6) = 1.65

This trade thus offers a reward/risk ratio of 7.6/4.6 or 1.65/1

Why the reward/risk ratio alone doesn’t work

However, traders often make things too easy for themselves. Many books recommend not entering any trades with a reward/risk ratio of less than 2:1 or even less than 3:1. Any book that contains this recommendation can be safely thrown out the window. It shows why the author wrote a book about trading instead of trading successfully himself: he probably didn’t understand trading and had to earn a living in other ways. The reward/risk ratio on its own is totally meaningless.

It’s also meaningless to consistently enter trades that you think have a reward/risk ratio of 10:1. The idea that profits will theoretically always be 10 times risk sounds nice, but how realistic is it? How many of you have ever entered a trade with a reward/risk ratio of 10:1? And if you have, how often?

There are no good or bad reward/risk ratios

That there are good or bad reward/risk ratios is a myth. Whether a reward/risk ratio is useful or not can only be answered with the help of the hit rate.

Traders also make a mistake when they plan a trade and simply extend their target and/or reduce their stop loss in order to get a supposedly better reward/risk ratio. Theoretically, they might get a better one, but how often will that be successful in practice? It’s also a mistake to think you can easily make up for a losing trade by increasing the target of your next trade. Trading is not pure mathematics – that would be too easy. It’s a game of probabilities. This also applies to the reward/risk ratio. You have to know the probabilities of your trading system.

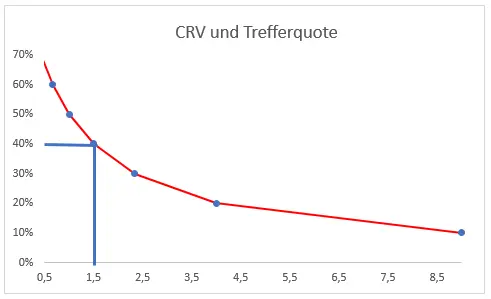

The reward/risk ratio in combination with the hit rate

Once you gain more experience with your trading strategy, you’ll get a better feel for what’s a realistic reward/risk ratio. Then you can easily calculate the required hit rate and expected reward/risk ratio. The formula for calculating the minimum hit rate (that is, breaking even on a trade) is as follows:

- Minimum hit rate: 1 / (1 + R/R ratio)

If you know your hit rate, you can then use the following formula to calculate the reward/risk ratio that you need to at least break even:

- Required R/R ratio: (1 / hit ratio) – 1

As you can see from the chart, with a R/R ratio of 1.5, a hit rate of 40 percent is all you need to break even.

The simplest example is of course a R/R ratio of 1. Here you need a hit rate of greater than 50 percent to be profitable or 50 percent to break even.

Let’s assume that our system generates 100 trades a month and we have an R/R ratio of 1. The hit rate is 50 percent and we risk €500 on each trade.

Then the total profit each month would be €0, as you can see from the following formula (number of trades x hit rate x risk per trade x R/R ratio):

Winning trades – losing trades

(100 x 0.5 x 500 x 1) – (100 x 0.5 x 500 x 1) = €0

With the same hit rate, but an R/R ratio of 1.5:1, a trader would generate a total profit of €12,500 with the same risk and the same number of trades:

Winning trades – losing trades

(100 x 0.5 x 500 x 1.5) – (100 x 0.5 x 500 x 1) = €12,500

What’s the difference between the reward/risk ratio and the R-multiple?

They’re both quite similar. Normally, the difference between the entry and the stop loss is 1R.

That’s the maximum amount you want to risk per trade.

In the above example, that amount was €500. If you earn €1,000 on one trade, the trade generated 2R (€1,000/€500). You can also apply this principle to pips or points.

If the initial risk was 10 pips and you earned 18 pips, the trade generated 1.8R (18 pips/10 pips).

R-multiples thus always refer to the initial risk.

The reward/risk ratio is therefore a measure of potential performance, while the R-multiple describes current performance. However, since both essentially have the same goal, you can work solely with the R-multiple, because it can also be considered when planning trades.

That’s why I work solely with the R-multiple. However, the most important thing is to plan your trades in advance and always know what risk you’re taking in each trade and how you’re defining it. One of the most important trading principles is that every time you open a position, you should know in advance when you’re going to close it – regardless of whether things go in your favor or against you. So you need to run through all the scenarios in your head and know exactly what actions you’re going to take at every point in the trade.

A tool for determining the reward/risk ratio

I use the reward/risk tool in TradingView to calculate my R/R ratio automatically.

It has an ingenious feature that allows you to display the metric.

You can also enter your current trading capital and what percentage is risked per trade.

I find the tool, and TradingView as a whole, ingenious.

You can easily determine the reward/risk ratio for a long trade using the Long Position tool, and for a short trade with the Short Position tool.

Here you see an example in a daily chart.

- The trade is entered at 1.21121, when the trend line is touched at support. This was preceded by a positive candlestick formation (a doji and a green confirmation candle).

- The stop is placed at the last retracement low of 1.19919.

- The target is the next resistance level in the daily range at 1.23720.

The trading capital is €10,000 and the risk is 1 percent per trade.

Based on these parameters, TradingView displays €9,900 at the stop – the trading capital that would be left if the stop loss were hit.

On the other hand, the trading capital will increase to €10,216 if the target is reached.

The reward/risk ratio is also calculated automatically. In this case it is 2.16 (reward: 0.02599, risk: 0.01202; R/R ratio = 0.02599/0.01202 = 2.16).

The profit would be €216 (€100 risk x 2.16).

Conclusion

Even though the reward/risk ratio alone is meaningless, it’s one of the basic components of trading. After all, you should plan every trade before you enter it, and the reward/risk ratio is part of this planning – based on the idea that the only thing you can always control in trading is risk.

Together with the hit rate and a good money management strategy, the reward/risk ratio will ensure you a good chance of trading profitably over the long run. That’s why it’s important to learn more about it. As George Soros correctly pointed out, “It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.”

Read more: