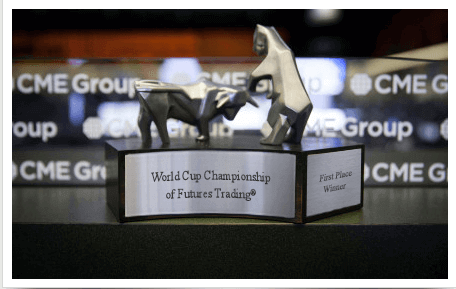

In this article, I would like to introduce you to the World Cup Trading Championships (WCTC). This is the official world championship in trading. There are tons of stock market games and competitions every year, but the WCTC is the gold standard in trading competitions. Here you trade with your own real money account. No simulation, no fictitious accounts!

Inhaltsverzeichnis

Who organizes the World Cup Trading Championships?

The World Cup Trading Championships (WCTC) is the provider of the world championship in trading and has been organizing it since 1983. There are two areas: forex and futures. The WCTC is hosted annually by the Robbins Trading Company.

Robbins Trading Company is also the organizer of the AutoTrade Program. This is a way to automatically follow the trades of the world’s best traders. The world’s best traders are subject to the strict requirements of the World Cup Adviser (WCA). One of the following three conditions must be met:

- Participation in the WCTC and placement among the TOP 3

- Participation in the WCA’s Incubator Program and verification of your own track record

- An already existing track record

Then the approved traders trade their own account and World Cup Advisor takes care of the rest, such as marketing, sales, automatic trade execution, etc.

The Brokers of the World Cup Trading Championships

The Robbins Trading Company also works in the field of online & discount trading and advises customers in the field of online brokerage. It is currently working with the following brokers:

One of these brokers must also be selected when participating in the WCTC.

Participation Conditions and Rules

Anyone can take part in the World Cup Trading Championships:

At the Futures World Cup, the minimum account size is $10,000.

In the Forex World Cup, however, it is $5,000.

If the futures account falls below $1,500, all positions will be closed and this account can no longer be used to participate in the competition.

All positions will also be closed if the account balance falls by more than 50 percent on one trading day. In this case, you will have to wait until the next day to continue trading.

The competition period runs from January 1st through December 31st.

Participation can also take place at any time during the year.

At least ten round-turn trades must be completed.

The fees are the same for all participants. $5 per half turn in futures and for the respective bid-ask spread in forex.

At the end of the period, the three winners with the highest net return will be determined.

Account balance

+ Withdrawals

+/- Open trading positions (if not closed in time for the market close on December 31st)

– Fees for closing the positions still open on December 31st (if any)

= Closing balance

Closing balance

– Sum of all deposited funds

/ Sum of all funds paid out

= Net return

The Performance of the World Trading Champions and Larry Williams

The performance varies greatly. Larry Williams achieved the highest percentage result in 1987 with a performance of an incredible 11,376 percent. In 2001, however, 53 percent was enough to win first place.

For 2017, which has now ended, the performance looked like this:

2017 World Cup Championship of Futures Trading®

| RANK | NAME | NET RETURN |

| 1 | Stefano Serafini (Italy) | 217.2% |

| 2 | Takumaru Sakakibara (Japan) | 199.9% |

| 3 | Maxim Schulz (Germany) | 111.7% |

| 4 | Don Fung (Hong Kong) | 81.7% |

| 5 | Z. Ozgun Tuzuner (Turkey) | 41.3% |

It is nice to see that Maxim Schulz, a German trader, even made it into the TOP 5. His performance is impressive. His individual trades are all published live and are 100 percent transparent.

It is always interesting that many of the traders who have been ranked among the worlds best traders are either students of Larry Williams or have participated in his course. The best example was probably his daughter, Michelle Williams, who won the WCTC in 1997 with a performance of an unbelievable 1,000%.

If you take a closer look at Maxim Schulz’s website, you will quickly see that he too is using the trading approach taught by Larry Williams or that he was inspired by it.

2017 World Cup Championship of Forex Trading®

| RANK | NAME | NET RETURN |

| 1 | Nikolas Pareschi (Brazil) | 100.3% |

| 2 | Weichou Chen (Taiwan) | 40.7% |

| 3 | Oliver Bjoerklund (Sweden) | 23.9% |

| 4 | Markus Sonderegger (Switzerland) | 23.5% |

| 5 | Huachen Sun (US) | 23.0% |

If you look at the performance of the futures and forex traders here, you can see a clear difference.

Second place in forex trading would not even make it into the top 5 in futures trading.

The performance of forex traders is significantly worse than that of futures traders. If you look at the history of the past few years, this is always the case.

This is not because the futures traders are the better traders, but because the forex market is much more difficult to trade than the futures market.

The Traders Trade with Extremely High Risk

At first glance, the World Cup Trading Championships may seem very fair and transparent. But if you examine the results more closely, you will notice one thing:

Quite often, the performance of traders fluctuates a lot. This means that many traders who participate here, trade with a high level of risk, as is known from classic stock market games, etc. Of course, everyone wants to achieve the best possible performance, but is it realistic?

Normally, you should risk 0.5 percent to a maximum of 1 percent of your trading account per trade. In the World Cup Trading Championships, however, many traders often use up to 35 percent or more per trade. This means that even average traders, if they are very lucky, can suddenly belong to the “best” traders in the world.

This can also easily be seen in the AutoTrade program and the performance of the current traders. Many have a drawdown of 50 percent or more. That means that, here too, the selected risk is significantly greater than normal.

In addition, it is possible to log in several times and open an account again, even if the first account has already failed. Alternatively, it is even possible to open several accounts right away using the same registration.

Many really successful traders would rather not participate in a World Trading Championship because they would not actually benefit from it. For many, it is simply used as good marketing or for an ego boost. However, really successful traders usually no longer have such a large ego and therefore have no need for recognition. They receive recognition from the market every day on account of their performance.

Still, the World Cup Trading Championships is a good thing. After all, you have to risk your own money here and real trades take place. Here you have the chance to compete against other traders worldwide and the same conditions apply to everyone. Since trading itself is really nothing more than a competition, a world championship in trading is also justified.

Suggestions for Improvement

In my opinion, the trading world championship should be supplemented by a few criteria, so that it is even more realistic and transparent.

There should be a rule that you are only allowed to risk a max. 2.5 percent of your trading capital (which is quite enough).

The performance of all participants should be visible. Many would probably like to know how often the top 3 traders might have tried before and how what their performance looked like then. The same goes for afterwards. There are some well-known examples (I won’t name any names) that made it into the TOP 3 once, but have never again since. They have, though, taken part in the WCTC every year since then. This can be seen by the fact that they once appeared among the TOP 3 at the WCTC and then suddenly disappeared, although the performance displayed there has not yet been surpassed.

In short, these people simply gambled it away and it was no longer enough for the TOP 3.

The registration should only take place once per year per person and not several times and not with the same account.

All trades of all the participants should also be visible, as well as the risk and money management of the trades.

In addition, the broker should be freely selectable, because the transaction costs at WCTC are extremely high.

Concluding Assessment of the World Cup Trading Championships

Despite the points of criticism addressed here, the WCTC is a great thing.

After all, it’s not the official world trading championship for nothing. It is also one of the very few competitions where you really have to trade your own money. The WCTC has also revealed many first-class traders and many of them are still profitable. To be the winner of the WCTC is definitely a great achievement. Here, you have risked your own money, successfully mastered the difficulties of the markets and have prevailed against the rest of the world.

Every world champion, and thus also the first place winner in the WCTC, deserves the greatest recognition and respect.

Read more: