If you’ve ever seen The Wolf of Wallstreet starring Leonardo DiCaprio or any other popular stock market movie, you’ve probably heard the terms “penny stock” and “pink sheets.” But they’re used so broadly that few people know what they really mean. In addition, definitions differ: a penny stock in Germany isn’t necessarily the same as a penny stock in the United States. In this article we’ll take a closer look at the world of penny stocks and provide you with some basic information.

Inhaltsverzeichnis

What are penny stocks?

The term “penny stock” consists of the words “penny” and “stock” – one-hundredth of a dollar (or any other unit of currency) and share. This gives us our initial definition: it’s a stock that, depending on the currency, trades for just a few cents or pennies.

Usually, the underlying companies are on the verge of bankruptcy or have already gone bust. The shares are no longer worth much and often trade for pennies. Often the bankruptcy itself has been heralded by certain signals that have offered good investment opportunities for short sellers.

In Germany, a penny stock is any share worth less than one euro. This low stock price is generally an indication that the company is in financial distress. Some stocks may start out in penny territory for other reasons – a large number of outstanding shares or foreign currency conditions. Two examples of penny stocks are Nel Asa of recent notoriety and Aston Martin. In the case of Nel Asa, the latest upmove has led to prices much higher than one euro, whereas Aston Martin is still trading in the penny range.

Trading penny stocks

You can trade penny stocks through most brokers, including Comdirect, OnVista, and Flatex. There are no special rules because it doesn’t matter to a broker whether you buy Amazon for 3,000 dollars a share or a penny stock for 50 cents. Commissions and other fees are the same. In other words, penny stocks are not a separate asset class, but defined solely by their extremely low price.

However, if you want to trade the stock of an faltering company, you should be aware that it’s a high-risk investment. Trading penny stocks can result in a total loss of capital, as it’s not uncommon for an already bankrupt company to lose the last bit of cash on its balance sheet and be delisted, or to see its stock decline to a market value of 0 euros. This is something you should always keep in mind.

This means that if you’re interested in trading penny stocks, you should only invest small amounts in them. Some people call this “play money” – sums you won’t need even in an emergency. The smaller the amount you invest, the smaller your potential loss (and, conversely, the smaller your potential gain). You should also keep an eye on broker commissions. If you pay a commission of 10 euros per order, it makes no sense to invest 300 euros because the transaction costs are too high. That’s why we recommend an inexpensive broker like Trade Republic for trading penny stocks.

Finding the one penny stock that will rise out of the penny range and earn you a nice profit isn’t easy. You may succeed, but the probability of long-term success is relatively low.

Who can trade penny stocks?

There are no restrictions on trading penny stocks. If you have a brokerage account with access to penny stocks, you can trade them. No special knowledge is required.

But what’s true of other trading activities is also true of penny stocks: you should have a basic understanding of the stock market and market movements. Otherwise, speculation in penny stocks can quickly lead to a loss.

Where can you trade penny stocks?

You don’t need to have an account with any particular broker to trade penny stocks. As mentioned above, you can buy them through all the most popular brokers. You only need a broker that offers the penny stocks you want to trade. In terms of fee structure, though, brokers sometimes differ considerably, and a broker with low fees is a huge advantage. In addition to already mentioned Trade Republic, we recommend LYNX Broker and Interactive Brokers, especially if you want to trade US penny stocks, which are not offered by most brokers in Germany. LYNX, which specializes in US penny stocks, has reasonable commissions. It offers other stocks as well, but probably has the largest selection of penny stocks among all the brokers competing in this field.

In Germany, foreign shares and German penny stocks are listed in the Open Market segment of the Frankfurt stock exchange. Called the Freiverkehr, this segment contains companies that do not fulfill the listing requirements of Germany’s Regulated Market. Open Market stocks are thus subject to looser reporting, accounting, and disclosure requirements.

How do you trade penny stocks?

When trading penny stocks, you don’t need to proceed differently than with other stocks. You simply select a promising stock, determine how many shares you want to buy, and place an order with your broker. Once the order is executed, the desired number of shares will be credited to your account.

As always, when trying to identify a promising stock, you need to consider different scenarios and ask yourself whether the penny stock you’re interested in will move in the desired direction and what will trigger the move. To help answer these questions, you should look at company reports and key company figures. Unfortunately, many popular German stock screeners such as Aktienfinder and Alle Aktien Qualitätsscore don’t cover penny stocks and aren’t helpful in this regard.

Penny stocks and their potential

Investors interested in penny stocks often overestimate their potential. Aston Martin is a penny stock that is currently all the rage, and many see it as a great way to make a decent long-term profit. After all, like most penny stocks, it has fallen from a much higher price level and has not been in penny territory for years or even months. Such stocks attract people hoping for quick money. But investors should ask themselves why shares have fallen so far from their all-time highs and whether there’s a realistic chance that they return anywhere near those levels.

Many investors make the mistaken, mathematically challenged assumption that it’s much easier for a stock to double if its current price is just 10 cents. After all, they reason, an advance to 20 cents is small and within easy reach. Other stocks fluctuate by this tiny amount within seconds. But in order to double from 10 to 20 cents, the stock price must increase by 100 percent. Many inexperienced investors believe this is more realistic than a stock climbing from 50 to 100 euros, yet a 100 percent price increase is required in both cases.

Conversely, a steep decline is no guarantee that a stock will recover quickly. Various studies have shown that weak stocks tend to underperform and are therefore poor investments.

A stock’s trading volume is also crucial for a price trend. With penny stocks, volume is very low and there’s often a large difference between the bid and the ask.

On the other hand, because penny stocks frequently experience extreme price swings, money can be made through clever trades.

Differences between penny stocks

As discussed above, there’s a simple definition for a penny stock: any share trading for less than one dollar (or one euro). However, that definition is not always reliable, and a standard definition is in fact impossible to formulate. The term “penny stock” often suggests a nearly worthless company, but a number of countries show that even that definition is not always correct.

If you take a look at Vodafone stock, for instance, you might get the impression that it’s well on its way to become a penny stock. On several occasions, the stock’s flirted with the magical one-euro mark. Yet the company is solidly positioned and not on the verge of bankruptcy. The reason for the low share price is the huge number of shares on the market. This drives the price down, despite the fact that Vodafone is still very valuable and far removed from actual penny stock status.

On the exchanges in Australia or Hong Kong, you can also find companies that look like penny stocks, but can hardly be described as penny stocks in the true sense of the word. Australia-based Alumina, the world’s leading bauxite and aluminum producer, is currently at penny levels, but there’s no reason to assume it’s experiencing financial difficulties.

Penny stocks in the United States

The situation is completely different and unique in the United States, where penny stocks are defined by other criteria. Unlike Germany with its one-euro threshold, all US stocks trading for less than five dollars are considered penny stocks. That’s not some magical or made-up mark, but simply the price set by the Securities and Exchange Commission (SEC). Only stocks trading above this level may be listed on the important NYSE or Nasdaq exchanges.

This is why companies whose shares trade for less than five dollars are found on the over-the-counter (OTC) market, which is similar to Germany’s Freiverkehr. These shares are listed and tradable as so-called pink sheet securities.

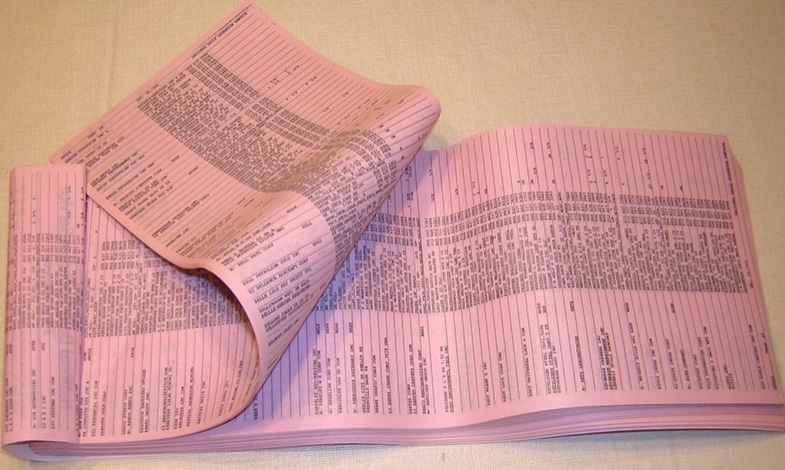

Pink sheets

The term “pink sheets” refers to the fact that quotes and information about these stocks used to be printed on pink sheets of paper. “Pink Sheets” is also the name of an unofficial trading platform operated by the private bank Pink Sheets LLC, which is only found in the US. Companies don’t need to meet stringent criteria for their stocks to trade on the pink sheets. As a result, similar to Germany’s Open Market, these companies are subject to looser legal requirements and don’t need to register their shares with the SEC.

This poses a particular challenge for investors, as the lack of disclosure requirements makes it difficult to get reliable information about the companies. Most of the information about pink sheet securities is unverified and should be taken with a grain of salt. Price quotes for these listings aren’t subject to any real rules either, which is why they’re considered highly speculative investments. The speculative nature of these stocks has often provided a basis for fraud, as shown in the movie The Wolf of Wall Street, mentioned at the start of this article. The film focuses on the life and stock market activities of the broker Jordan Belfort (Leonardo DiCaprio), who for many years lived a life of luxury from penny stock and pink sheet scams. However, this type of fraud is punishable by law, and Belfort was eventually convicted in court. Today he is no longer active in the stock market, but works as a motivational coach.

Price and shares outstanding

The price of a stock may also be influenced by the number of shares issued by a company. In several of the countries mentioned above, including England and Australia, issuing practices are linked to a different investment culture and securities law than in Germany. Like Vodafone, Alumina has an extremely large number of outstanding shares, which has contributed to its low share price.

In these countries, companies can increase their capital by issuing new shares for just a few cents each, which naturally leads to a dilution of share capital. In Germany, by contrast, a minimum price of one euro is required for such transactions. For this reason, German penny stocks are really only those of companies that can no longer refinance operations by increasing capital (unless they first consolidate their shares through a reverse split). They should thus be treated with even greater caution, as the specter of bankruptcy is very real. It’s best to avoid true German penny stocks altogether because they really only belong to junk companies. A recovery of their share price is unlikely.

Once-in-a-lifetime opportunity or bankruptcy risk?

Penny stocks generally present attractive opportunities for risk-tolerant investors. If you pull off a good trade, you can expect a profit of several hundred percent. To return to the example of Aston Martin, its stock price rose around 300 percent from its low as a penny stock to its most recent high. But as Aston Martin shows, at some point you need to book profits: the stock has since declined is currently up “only” 70 percent. As result of its reentry into Formula 1 racing, its new management, and a redesigned racing car, many investors are hoping for a return to past price levels of two to four euros, but that’s probably wishful thinking.

Aston Martin can be seen as a stand-in for many other companies and the hopes associated with their penny stocks. There’s always a chance for huge profits, but you need to analyze and select companies whose potential is real and not based on pie-in-the-sky thinking.

At the same time, the bankruptcy risk is much higher because many penny stocks are mere shell companies – the listed vestiges of insolvent corporations. They will never experience a turnaround or pay out profits again. They may continue trading for years after bankruptcy, particularly in the OTC market, but in such cases, there are no chances for success. The only advantage for investors is the opportunity to realize losses for tax purposes. For banks, it’s the possibility of earning money through order commissions. No other advantages exist.

Dead cat bounce

A “dead cat bounce” is a metaphor used to describe a certain type of price pattern in the stock market. The macabre image is often evoked in conjunction with penny stocks. The original saying is: “Even a dead cat will bounce if it is dropped from a great height.” Applied to penny stocks, this means that there can be a strong upward price movement when masses of traders enter a stock after a sharp fall. These movements have become even more pronounced in the age of social media and social trading. Stock market influencers may announce that they’ve purchased a stock, causing others to follow suit. Or increased trading volume will spark tremendous demand for what is actually a “dead” stock. However, this dead cat bounce is never sustainable. Experienced traders can certainly make money off it, but inexperienced investors who chase short-term trends tend to sustain losses.

How reliable are penny stock recommendations?

The stock market trades on expectations of the future and is always a little bit ahead of the real economy. That, at any rate, is an old stock market adage. While it certainly contains a kernel of truth, experience shows that penny stocks tend to rise when the broader market is in a strong uptrend. This is not because penny stocks are forward indicators of the real economy, but because investors act irrationally. Instead of buying healthy companies based on sound analyses, they buy into the latest trends, which are then hyped in Internet forums. The sectors in which you should actually be investing get overheated, and chances are good that a short-term correction or worse is around the corner.

This sort of hype was recently apparent in marijuana stocks. When the market then learns that there is little or nothing behind the hype in a penny stock, it can drop as quickly as it has risen. Anyone who hasn’t timed their purchases well won’t be able to sell for a profit. That’s why stock market forums and Facebook groups aren’t good places to get penny stock recommendations. It takes a lot of skill to filter out the one or two good recommendations from the many bad ones in these groups.

Speculating with shell companies

As explained above, some companies use insolvent listed corporations as “shells” to go public, thus saving themselves the time and money of an IPO (initial public offering). This process is sometimes called a back-door listing. The company first acquires the majority of shares in the insolvent corporation and then takes various measures that can indeed lead to a rise from the ashes.

These methods often prompt investors to open speculative positions in shell corporations, as they assume that their resurrection will result in rising share prices. Risk-tolerant investors can trade this type of penny stock with good chances of success. Of course, the risk of loss continues to exist because the actual stock corporation is worthless, but investors who understand the nature of these trades will not find a better profit opportunity in the penny stock segment.

When the bubble in a penny stock bursts

You can see that it’s difficult to perform a sound analysis of penny stocks. Information is hard to come by, and much of the information that does exist needs be treated with caution. Trends or strong upward price movements often play a greater role in determining price behavior than do serious analyses. As a result, bubbles often form in penny stocks, and when they burst, anyone who hasn’t booked profits or taken steps to limit losses may suffer a total loss.

Penny stock scams

The Wolf of Wall Street contains a prominent example of fraud with penny stocks. The bubble in penny stocks can burst for different reasons, including illegal activities, and cause losses for retail investors. Scammers deliberately spread fake information about companies in order to earn huge profits from rising stock prices. Entire networks work to boost the price of a penny stock and convince large numbers of investors to buy them.

Because the scams are not based on companies of any substance, they ultimately only make the fraudulent networks rich. The scammers’ strategies include publishing buy recommendations and articles about stocks on fake Internet sites and planting news in Internet forums. In this way, they foist valueless penny stocks on inexperienced traders. In 2013, the SEC uncovered one of these fraudulent networks in the United States that had earned scammers around 140 million dollars. Retail investors suffered huge losses.

Alternatives to penny stocks

Penny stocks are risky investments that most investors would do well to avoid. Not only is the risk/reward ratio often poor, but there are plenty of alternatives that offer far better profit opportunities.

Small cap stocks

Small cap stocks are one alternative. Like penny stocks, the underlying companies have low market capitalizations, but unlike penny stocks, they still run viable businesses. They aren’t bankrupt corporations, but well-functioning companies.

If you manage to get in at a low price, you can book huge gains. One example is the German cloud-computing company Cancom. For years, Cancom was more of a penny stock than a serious company, but then its cloud computing division began expanding and demand for its technology and services took off. Cancom’s stock price climbed from 0.62 euros in 2008 to almost 50 euros today. That’s the kind of success story that every investor wants to be part of.

Small caps like these are often found in the IT or biotech sectors. The future importance of these sectors is an additional reason to buy stocks in them. In addition, German small caps are usually listed in the Regulated Market, not the Freiverkehr.

Turnaround stocks

A second alternative is turnaround stocks. Here investors may be betting on new impetus or a turnaround because of their positive expectations of the company. The stock price may have declined because business figures were weak. When the first signs of improvement are visible, it could be a good time to buy the stock. There are plenty of prominent examples of turnaround stocks, including Apple and Puma.

Of course, investors may be wrong, but these turnaround candidates at least have real businesses and prospects for improvement. That minimizes risk.

Risks with penny stocks

As we’ve seen, the risks associated with trading penny stocks are relatively high. You should therefore ask yourself whether buying a penny stock is really a good investment idea and how willing you are to take such risks. If the answer is yes, you might be able to sell for a profit, but you should always consider the risk/reward ratio and accept the possibility of a total loss.

That’s why you should only invest play money in penny stocks, not large sums.

Minimizing risks

It’s also possible to minimize risks in other ways. To begin with, you should get as much information as possible and thoroughly analyze a company. You shouldn’t chase every trend based on tips in stock market forums or constantly get lured into the idea of a new boom. In addition, it’s advisable to take profits from time to time instead of letting them run forever. Although you should work with a stop loss, you should keep in mind that penny stocks are subject to wide price swings and you can quickly get stopped out.

Penny stocks: conclusion

Penny stocks are certainly one way to profit from interesting trading opportunities, but they’re only recommendable for seasoned traders and short sellers, not for retail investors. Because of their experience, these professionals can respond more effectively to the opportunities and better assess the risks. Retail investors should consider other investment opportunities. Small cap and turnaround stocks are a good alternative.

However, if you have some money you want to play with and can accept a total loss, you can purchase a promising penny stick and see what happens. But this is really only advisable with play money that you can afford to lose.

Read more: