Broker comparison – who is the best? In this article, we are introducing ViTrade.

Inhaltsverzeichnis

About ViTrade

This article’s review is dedicated to the online broker ViTrade. According to the information provided, the company is part of the FinTech Group AG, which also includes the discount broker flatex. And according to their legal notice, ViTrade is thus also a brand of the flatex Bank AG, which is responsible for the FinTech group’s banking services. This means that client accounts and portfolios at ViTrade are managed by way of the flatex Bank AG.

The latter is a German bank based in Frankfurt am Main that was issue with a „full banking licence“ in 2005.

The online broker offers a variety of tradable assets and trading services, which will be presented and illustrated in greater detail below.

Regulation and deposit protection at ViTrade

But before we turn to the details of ViTrade’s product range, let us take a brief look at the online broker’s regulation and deposit protection first. With the portfolios being managed by the flatex Bank AG, as already mentioned above, the regulation of this financial institution is also what needs to be reviewed here as a consequence.

As its head office is in Germany, the regulation of the flatex Bank AG is seen to by the German Federal Financial Supervisory Authority (BaFin). This means that the company’s dependability can be guaranteed by the BaFin’s strict requirements. In addition to BaFin, the online broker is also regulated by the supervisory authorities ECB and ESMA (European Securities and Markets Authority).

The regulation issue always also includes the question of how client deposits are protected. With this broker, that is the responsibility of the Compensation Scheme of German Private Banks (EdB). This means that its clients‘ funds are fully insured up to a maximum of € 100,000 per client.

ViTrade clients will therefore not be left in the lurch with their deposits if the company goes broke.

Awards won by the online broker so far

When you are looking for a suitable online broker, it can never hurt to also find out about the provider’s past awards, if any. In this respect, the ViTrade website lists a number of prizes that the online broker has been able to win so far.

It has to be noted, though, that these awards are not the latest by any means, but somewhat date back to the past, with the newest being from the year 2013:

- “Broker of the Year 2013” – 2nd place in the Daytrade Broker category of Broker-Test.de

In the two years preceding this, the online broker had even been able to take 1st place in the same test.

Apart from that, the website also features a number of press releases by the provider, which are not that up-to-date either, alas (with the latest dating from 2016).

Which tradable instruments are available at ViTrade?

A key aspect for assessing any online broker is always the range of tradable instruments available to choose from at a provider. ViTrade principally offers its client securities trading on the one side, and CFD trading on the other.

Securities trading

Where the securities trading is concerned, investors can use ViTrade to trade at selected stock exchanges, as well as OTC by way of corresponding issuers.

In the stock exchange trading, ViTrade enables its clients to trade shares, certificates, bonds, ETFs, ETCs, futures and Warrants at all German stock exchanges, as well as the XETRA and EUREX.

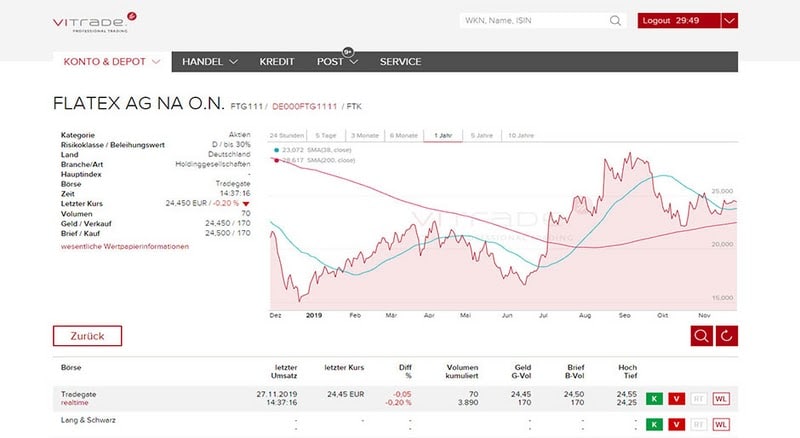

But many traders also like to go for the off-market issuer trading. In this context, tradable assets such as shares, certificates, warrants, bonds and ETFs are available from 24 different trading partners, which also include the Deutsche Bank or Lang & Schwarz. The conditions at the trading partner Lang & Schwarz are as follows:

- Minimum fee € 9.00*

- Commission rate 0.09 % of the market value

- Maximum € 25.00*

* Includes all same-day partial executions. Plus a fixed handling fee of € 2.08 for securities held with Clearstream, and another € 6.00 liquidity providing fee for every purchase or sale of SFDs.

Securities trading with Lang & Schwarz at ViTrade

If you decide to go for the OTC trading, you will principally be able to benefit from a number of aspects.

These for example include the longer trading hours available here, in contrast to the limited opening times for stock exchange trading. And the trading itself is also often cheaper, given the broker’s fee and transaction fee in stock exchange trading. The OTC trading itself works very quickly and conveniently in general.

A list of all the trading partners, including their trading hours from Monday to Friday, is available from the ViTrade website.

In addition to the above, ViTrade cooperates with various premium partners enabling it to offer its clients better trading conditions.

These premium partners include Vontobel, Morgan Stanley, J.P. Morgan, Société Générale and UBS, who number amongst the largest and most important providers for warrants and certificates in the financial market. The product range available via these partners is very extensive indeed, with the online broker enabling trades from an order volume of € 1,000 for a mere € 3.90 per order (in direct OTC trading).

And then there is also the trading at international stock exchanges. Investors and traders can trade securities at 19 of them, with ViTrade offering buy & hold as well as cross-border trading to them.

Last but not least, ViTrade will also let you trade Futures (at Eurex) and funds.

CFD trading

Besides securities, investors can also trade a broad range of CFDs at ViTrade. In this leveraged trading of financial products, traders can even make great profits with little capital outlay. That the risks are also correspondingly higher should go without saying.

ViTrade offers over 600 underlying assets for CFD trading (CFDs on indices, stocks, commodities, futures and currencies). As a market maker for CFD trading, ViTrade cooperates with the Société Générale.

The browser-based CFD platform at ViTrade allows you to trade a whopping 1,200 tradable assets for free. Day traders can thus trade CFDs quickly and efficiently by way of the corresponding platform.

Trading platforms to choose from at ViTrade

Having detailed the various tradable instruments available to investors for trading at ViTrade in the previous section, this one is dedicated to the trading platforms. The online broker offers a variety of software programs for this, enabling the provider’s clients to implement their trading strategies.

ViTrade WebFiliale

To start with, the online broker offers a proprietary trading platform called ViTrade WebFiliale, which is designed for securities trading. This software enables you to manage and control all the functions and tools revolving around your portfolio.

One advantage of this platform is its responsive design, which automatically adjusts to the device you use. Besides the customary order types, this trading platform also offers all the required trading options, as well as a number of useful tools. The picture below shows a screenshot of the software’s user interface:

In addition to an Order book providing the respective trader with information on pending and/or archived orders at all times, the platform also features several integrated watchlists. Clients are able to create up to five of these watchlists in their account.

The online broker sums up the software’s advantages as follows:

- Fast and safe trading

- Responsive design

- Versatile watchlists with various stock exchanges

- Order estimate

- Guaranteed security through TouchID and FaceID

- Transparent portfolio management

HTX

The HTX platform at ViTrade was specifically developed for the requirements of day traders and heavy traders, and offers direct access to the stock exchange. This platform’s user interface can be configured to suit the trader’s individual requirements. Tools such as professional chart analyses, for example, enable fast responses to the markets.

In addition to this, the platform also offers an overview of „intraday and overnight short selling options“ for individual securities. Traders can also rely on various professional order types here.

The free HTX mobile app meanwhile enables clients to trade from anywhere at any time using their iPhone or iPad. This mobile version also impresses with a variety of configuration options, with the trading based on a SSL-protected connection.

Another unique advantage of the HTX trading platform are its many features designed to help investors succeed with their trades.

- Real-time push market overview

- Real-time portfolio valuation

- One-click trading

- Times and sales

- OTC trading with over 20 trading partners

- Individual price ticker

- RTD & API interfaces

- Order from the chart

- Realtime push price delivery

- Event-based order types including OCO, OCA, group, if-done, on-event

- Generous trading lines

- Historic data

- News ticker

- Assignable function keys

- XETRA volatility interruption with automatically filled order screen

HTX trading platform features

Please see below for a brief summary of the HTX software’s advantages:

- Highly professional trading platform

- High-quality support from trained trading experts

- Versatile range of tradable instruments

- Trading from as little as € 5.90 per order

- Intelligent order types to choose from

Guidants

Guidants is an interactive analysis and investment platform that provides a variety of helpful tools such as real-time prices, charting software, demo portfolio, real-time news, and more besides. In addition to which the software was developed by the creators of the well-known GodmodeTrader. What is particularly special about Guidants are the options for close networking with trading experts and other traders.

The user interface can be customized to your individual requirements and equipped with so-called widgets providing the trading process with additional support.

Here follows a short list of Guidants‘ positive aspects again:

- Market data in real time (free price indicators, charting, and news)

- Intelligent tools (price alarms, indicators, etc.)

- Optimal networking with experts and other traders

- Direct connection to the ViTrade portfolio

- Mobile access

- Broad range of Guidants training options

CFD trading platform

ViTrade also offers its client a specific platform for their CFD trading. This browser-based platform can be used to trade the more than 1,200 CFDs already mentioned above. Its user interface has an intuitive design and offers a good overview of all the important functions.

In addition to which it also offers a range of further features:

- Pop-out function

- One-click trading

- Free real-time push prices

- Professional chart tool

- Indicators

- Free app for mobile trading

- Analysis tools

- Chart gallery

- News ticker

- Real-time push prices

Trading conditions with this online broker

One of the most important points for finding a suitable online broker are the trading conditions available there, naturally. The first thing to be mentioned here is that ViTrade’s trading platforms are free to use if a minimum of 70 trades are executed per month. If this is not the case, it will cost you € 49.00, plus the fees for the delivery of real-time prices.

The price structures at ViTrade start from as little as € 5.95 per trade for securities trading.

Germany Collective deposit of securities Clearstream

- XETRA® minimum fee € 5.95

- Minimum fee € 9.00

- for trading floors

- Commission rate 0.09 % of market value 0.12 % of market value

- Maximum € 40.00

- ViTrade price structures

Whereas the minimum fee with the free version HTX Light and the WebTrader comes to € 9.95, with the commission rate amounting to 0.15 percent of the respective market value.

The conditions for CFD trading are somewhat different. Index, commodity, precious metal, currency and interest future CFD trades cost no additional order fees, meaning that you will only need to pay a spread. Please see the table below for more information on the order fees for trading the various CFDs.

| CFDs on | Order fee |

| Indices, commodities, precious metals, currencies, interest futures | No order fee |

| Stocks | 0.05 %, € 5.00 minimum |

| DAX futures | 0.01 %, € 5.00 minimum |

| Other index futures | 0.02 %, € 5.00 minimum |

| Volatility indices | 0.02 %, € 5.00 minimum |

The spreads will vary depending on the traded asset, naturally, which is why the following can only briefly illustrate them for the most important indices, commodities, currencies and interest futures.

| Trading Instrument | Spread |

| DAX 30 | 2 |

| EUROSTOXX 50 | 1,5 |

| DOW JONES INDUSTRIAL AVERAGE 30 | 3,5 |

| NASDAQ 100 | 2 |

| VEU50 | 0,1 |

| Gold US | 0,5 |

| Crude Oil Light US | 0,06 |

| EUR/USD Spot | 1 Pip |

| EUR BOBL | 0,02 |

Last but not least, we should also take a look at the Financing costs for holding long or short positions (overnight). These usually come to 3.5 % plus the respective currency rate.

Demo account at ViTrade

All investors and traders wishing to try out the online broker’s services and offers without running any financial risk at first are recommended the ViTrade demo account. A demo account will on the one hand help them familiarize themselves with the functions of the HTX software, whose HTX Light demo version can be used for a period of 4 weeks.

And on the other hand, the provider also supplies a demo version for CFD trading, which can be trialled for a 14-day period for free. This enables investors to trade under real market conditions with a virtual capital of € 50,000.

This option is particularly recommended for novices interested in finding out more about the opportunities and risks of CFD trading. The 2-week period is a little too short for this, alas.

The customer service of ViTrade

Another aspect that should not be neglected is the customer service at ViTrade. The online broker offers its clients various options for contacting its support. The customer support for prospective clients is available 9 a.m. – 6 p.m. from Monday to Friday, and that for clients from 9 a.m. to 10 p.m. from Monday to Friday. There is also a corresponding contact number for clients from abroad.

On top of this, there is also the option of raising issues by way of their ready-to-use contact form.

Training and upskilling options at ViTrade

A few words should also be said about the upskilling options available at ViTrade. The online broker first of all offers an Academy featuring various options for expanding your skills. And then there are also webinars, which are held by successful professional traders and designed to support ViTrade clients in their trading.

Alternatively, you can also go for their individual trainings. This involves a direct conversation with a ViTrade employee, who will then delve into the corresponding problem or issue. The provider kindly supplies this service free of charge.

Online reviews of ViTrade so far

In closing, just a short overview of ViTrade’s reviews available online. Its extensive range of tradable assets and possibility of day trading make it interesting for many investors. And its trading platforms are also found to be of a modern design and easy to operate, enabling you to create an ideal atmosphere for successful trading.

In addition to which the regulated broker is seen to offer its clients a whole range of free training options. The trading conditions are found to be acceptable, and the customer service reliable and competent. All of which makes ViTrade a highly feasible alternative for all interested investors currently looking for a suitable online broker.

Read more: