Software comparison – Which is the best? In this article we introduce TradeStation.

In this article I would like to introduce you to the TradeStation software. I used this platform myself for a long time and was very satisfied with it. Now, TradeStation is even better and has more functions than before.

Inhaltsverzeichnis

What is TradeStation?

TradeStation is both a state-of-the-art trading platform and an online broker for trading financial products.

How did TradeStation get started?

TradeStation is a wholly owned subsidiary of the Monex Group, Inc., one of the largest Japanese online financial services companies.

The company known today as TradeStation was founded by Cuban-born brothers William “Bill” and Rafael “Ralph” Cruz.

Bill and Ralph founded their own trading software company, known then as Omega Research, in order to offer software tools to private individuals that they could use to trade at a professional level, just like institutional traders, without a technical or programming background.

In 1987 Omega Research released the first desktop software product that allowed users to develop their own trading strategies and test them using historical market data.

In 1991 Omega Research released the first real-time version of this product, which is now known as TradeStation.

In 1997 the company went public and was listed on the Nasdaq National Market.

In 1999 RadarScreen was launched, which enables traders to scan hundreds of symbols.

In 2000 TradeStation 6 was introduced. The securities dealer, Onlinetrading.com, which was later renamed TradeStation Securities Inc., was also acquired.

In 2001 the company was renamed the TradeStation Group. The trading symbol on the Nasdaq was changed from OMGA to TRAD.

In 2006 TradeStation Europe Limited (now TradeStation International Ltd) received approval from the UK Financial Conduct Authority (FCA) as an Introducing Broker.

In 2011 TradeStation was taken over by the Japanese Monex Group.

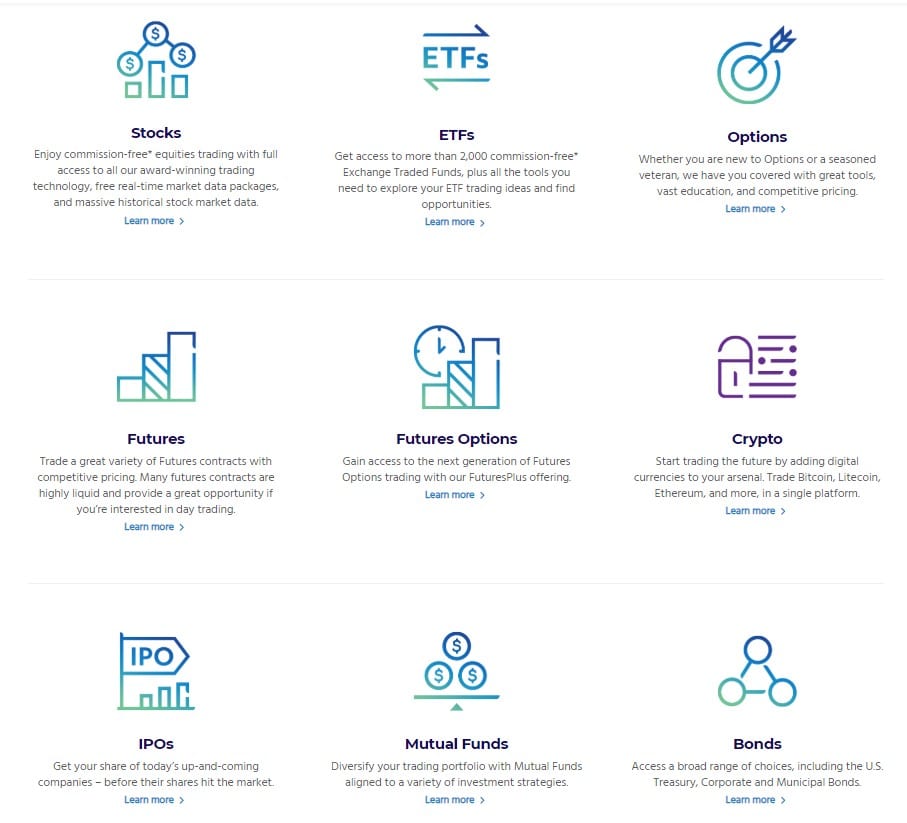

Which markets can be traded with TradeStation

The following markets can be traded in TradeStation:

- Shares

- ETFs

- IPOs

- Options

- Futures

- Futures Options

- Cryptocurrencies

- Mutual Funds

- Bonds

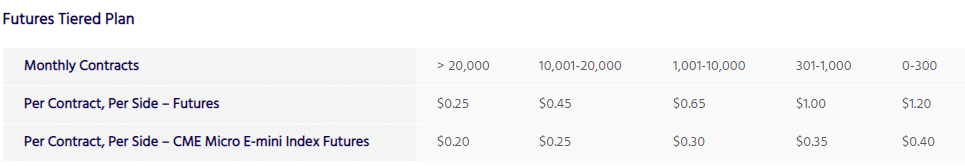

How high are the fees?

TradeStation’s fees are competitive.

Shares can be traded from $0.01. For futures, the commission starts at $0.50 per contract. Futures options are tradable from $1.50 per contract.

Mutual funds and bonds have fees of $14.95 per trade.

TradeStation as a trading platform

TradeStation really offers a wide variety of functions. From creating your own trading systems to chart analysis to portfolio trade and much more.

Chart analysis

The chart analysis at TradeStation leaves nothing to be desired. All the functions you need for professional chart analysis are included here.

This is why TradeStation is rightly one of the leading trading platforms for chart analysis.

The following chart types are included:

Chart types in TradeStation

- Candlesticks

- Time Price Opportunity (TPO)

- Volume Delta

- Volume Profile

- OHLC

- Point and Figure

- Renko

- Kagi

- BetterRenko

- 3 Line break

- Heiken-Ashi

- Cumulative Delta

- Hollow Candlesticks

- Candlesticks with border

- HLC

- Invisible Bars

- Dots

- Line on Close

- Symbol Chart

- Histogram chart

- FlexRenko

- Reversal Bar

- Imbalance Delta

There is also a huge selection of drawing tools. The following are a selection of the drawing tools available.

Drawing tools in TradeStation

The same goes for indicators. In addition to the indicators already included, you can also program your own indicators. Here is a list of indicators that are already integrated in TradeStation.

- Andrews‘ Pitchfork

- Fibonacci Speed/Resistance Arc

- Fibonacci Speed/Resistance Fan

- Fibonacci Retracement

- Fibonacci Trend-Based Time Lines

- Fibonacci Time Zones

- Gann Fan

- Gann Square

- Trend line

- Extended Line

- Ray Line

- Text

- Retracement Calculator

- Ellipse

- Rectangle

- Extended Parallel Lines

- Ray Parallel Lines

- Parallel Lines

- Horizontal Parallel Lines

- Horizontal Line

- Regression Channel – Segment High-Low

- Regression Channel – Standard Deviation

- Regression Channel – Raff Regression

- Regression Channel – Standard Error

- Arc

The same is true for indicators. In addition to the indicators already included, you can also program your own indicators. Here is a list of indicators that are already integrated in TradeStation.

Indicators in TradeStation

- Accum Distribution

- AccumSwingIndex

- ADX

- ADXR

- Average Price

- Average True Range

- Bollinger Bands

- CCI Average

- Chaikin Oscillator

- Comm Channel Index

- Comm Sel Index

- Custom 1 Line

- Custom 2 Line

- Custom 3 Line

- Custom 4 Line

- Day Close

- Detrended Price Osc

- DMI

- Ease of Movement

- Extreme Profit Accum

- Gapless Bar Chart

- High

- HPI

- Keltner Channel

- Low

- MACD

- Mass Index

- Momentum

- Money Flow

- Mov Avg 1 line

- Mov Avg 2 Line

- Mov Avg 3 Line

- Mov Avg Weighted

- On Balance Volume

- Open, Open Interest

- Parabolic

- Pcnt Chng 1 Data-Cum

- Price Channel

- Price Oscillator

- Rate of change, Stochastic – Fast

- Stochastic Classic

- Swing Index

- TRIX

- TypicalPrice

- Ulcer Index

- Ultimate Oscillator

- Volatility

- Volume

- Volume Oscillator

- Volume ROC

- Weighted Close

- Williams Acc-Dis

It is also possible to filter for specific signals or to display them in the chart.

Signals in TradeStation

- 1-2-3 Reversal

- 1st Hour Breakout

- Atlant IfThenElse

- Atlanta Points

- Atlanta System

- Atlanta System ADX, Bail1 for Daily

- Bottom Fishing, Buy Mon Sell Mon

- Confluence, Counter Atlanta

- Derivative Moving Average

- Elliott Wave System,

- Exiting Partially

- First 2 Hour Channel

- Force Index System, Mark

- Mon. or Tues. Buy

- Mov Avg – Supp/Res

- Mov Avg X 2-20

- MovAvg Adaptive Fltr, NMP System

- OBVDI, Oddballvar 1.2

- Price Vol System

- RangeBreakout

- Season Trading

- Sharpe Demo

- Simple Futures MA

- Stochastic S&C

- Support-Resistance

- TFS Signal

- TRIX System S&C

- TSF System

- Thrust Retracement

- TrendLine BreakOut

- Weekly S&P System

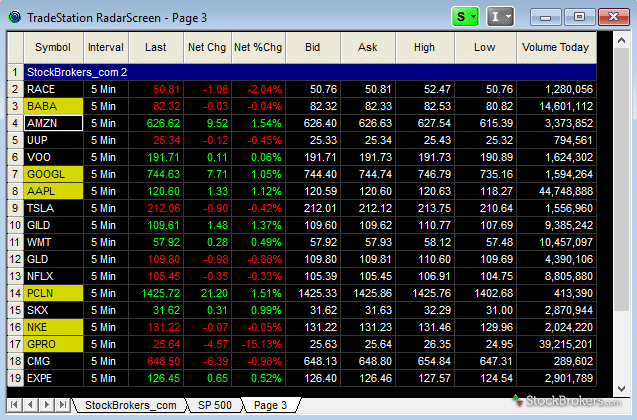

RadarScreen

You can scan instruments around the globe according to specific criteria with the help of RadarScreen.

RadarScreen continuously monitors and evaluates up to 1,000 symbols in real time based on more than 180 fully customizable technical and basic indicators, as well as a virtually unlimited number of custom criteria.

There are a number of options for scanning and all the indicators are also included. The scans can be filtered in detail.

For example, you can show all stocks that have exceeded the moving average of 20 in the last three trading days or are currently trading above it.

Market data playback

If you would like to have the past few days replayed live in order to be able to take another look at the market, then market data playback is the function you want.

The data can be played back at various speeds and thus has something to offer for every trader.

This tool is especially well suited for discretionary traders who use certain price patterns and other methods that are harder to program or those who simply want to improve.

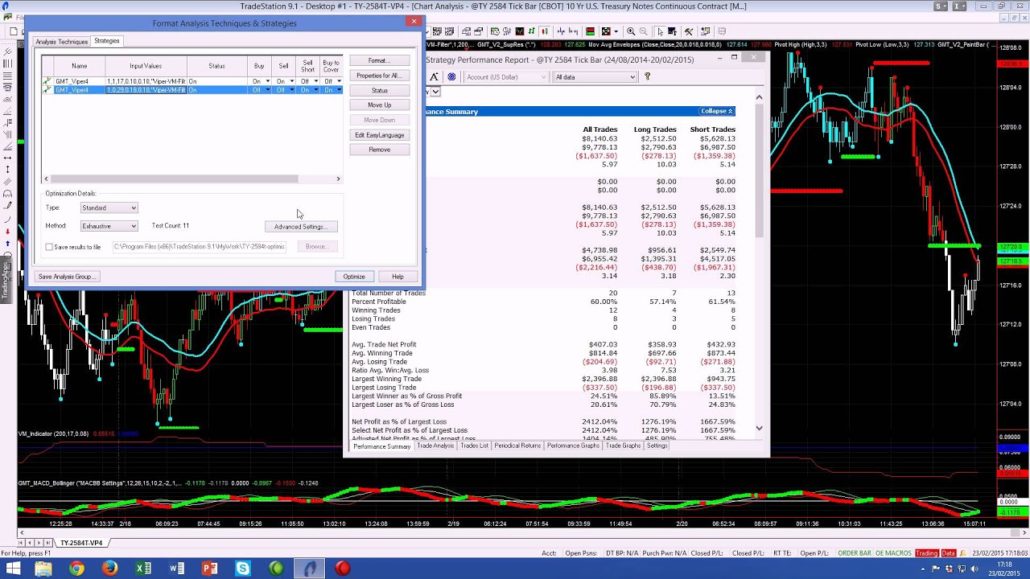

Strategy backtesting

TradeStation is especially popular because the software also offers numerous options for automated trading. This also includes strategy backtesting.

Here you can test your own trading ideas and strategies using decades of historical market data.

Strategy backtesting allows for this type of testing and generates a comprehensive report that contains all the parameters and results.

The strategy can also be displayed in the chart, so you can quickly and easily see the entries and exits. If the trade is profitable, the entry and exit are connected with a green line. For unprofitable trades, the line is red.

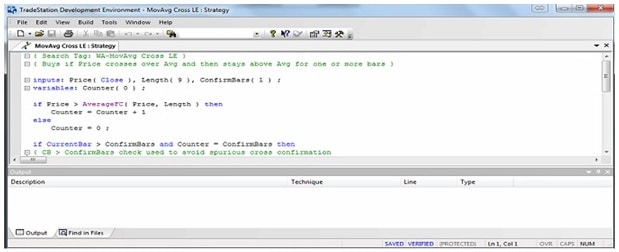

Strategy development

Developing your own strategies is possible in TradeStation with EasyLanguage. This programming language, developed especially for TradeStation, allows traders without programming knowledge to create strategies.

The simple structure of the scripts means you can easily start here at any time. Existing strategies and signals can be changed or combined. Of course, you can also program your own strategies, even very complex ones.

Analysis of trading systems

Using TradeStation, detailed analyzes of trading systems can be created.

You can access a large number of metrics and analysis options. Be it strategy performance, run-up and drawdown or a periodic analysis. Various metrics and ratios can also be displayed.

You can create an overview of all trades in detail as well as a complete overview. Thus, you have the option to evaluate every trading strategy and trading system quickly and professionally.

The statistical analysis can be useful for making important decisions. There are a variety of different graphs to assist you. Thus, the analyzes can be quickly adapted to your own needs.

Optimizing the trading strategy

A trading strategy is created by drawing on trading concepts, ideas and observations of historical market behavior and implementing them in a trading system.

Optimization can help you determine the optimal parameters. The goal is to adapt the trading system and the parameters so that the system becomes “more effective.”

The optimization searches for the optimal parameters using predefined criteria. Based on historical data, the optimal combination of parameters is determined, which enables the best possible result of the strategy performance.

TradeStation offers a wide range of optimization options. Thus, there are different optimization types to choose from.

These are as follows:

- Genetic optimization

- Walk-forward testing

- Brute-force optimization

Each optimization option has its advantages and disadvantages. These can be used either individually or in combination.

Every optimization has a detailed optimization report. It contains all the results of the optimization and the individual parameters in detail. The results can be filtered according to specific criteria.

Automated trading

With automated trading, orders and strategies can be carried out completely automatically.

There is also paper trading to check the functionality and error-free implementation of the trading systems.

The orders and strategy positions can be displayed and followed in real time in a separate window.

There is also the option to display all reports on automated trading.

Manual and semi-automated trading

With TradeStation, traders also have the option to trade manually as well as semi-automatically. This means that certain areas in trading can be significantly simplified.

Whether it’s the entry, determining the position size, the exit or the trade and risk management.

This allows every trader to determine whether and to what extent they want to automate.

It is also possible to trade some strategies automatically and others manually or semi-automatically, which can also make a lot of sense.

Portfolio Maestro

Using Portfolio Maestro, entire portfolios can be traded and backtested automatically.

These can also be optimized, just like individual strategies on a specific base value.

In addition, the Portfolio Maestro also enables various strategies and instruments to be traded at the same time.

As with normal backtesting and optimization, the Portfolio Maestro provides extensive and detailed reports on all metrics, etc.

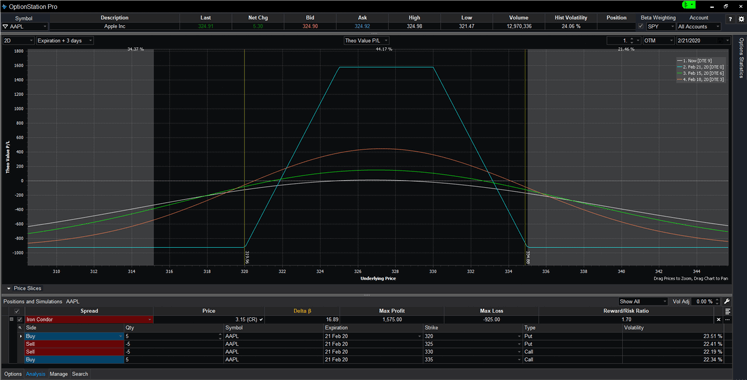

What is the OptionStation Pro?

The OptionStation Pro is a modern, professional tool for trading options.

Various options strategies can be created as well as graphically displayed and analyzed. This also has the advantage that trades can be placed in the market very quickly. Even complex spreads or strategies can be created with just a few clicks. The orders and positions are clearly displayed.

The tool also offers the option to create theoretical positions and it creates various diagrams for them.

The diagrams help in the analysis of important metrics, such as the maximum profits and losses, break-even points or standard deviation curves.

How high is the minimum deposit at TradeStation?

The minimum deposit for margin accounts is $2,000.

If you want to open a futures account, however, you must deposit a minimum of $5,000.

Which data providers does TradeStation support?

TradeStation is also the data provider (TradeStation Network). That means that TradeStation provides the real-time data as well as the historical data itself.

Data for cryptocurrencies is provided by TradeStation Crypto, Inc.

TradeStation data is known for its high quality and long data history. Therefore, the data is also very suitable for backtesting, as well as for optimization, etc.

How much does TradeStation cost?

TradeStation is $99 monthly. All functions such as the RadarScreen, OptionStation Pro, scanner etc. are included in that price.

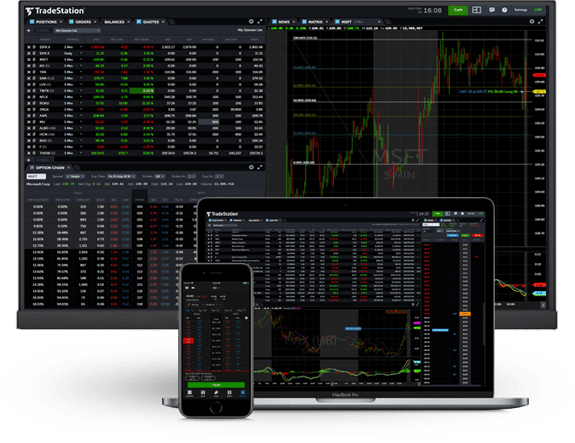

Does TradeStation also offer an app?

Yes, TradeStation also has its own app.

With the TradeStation Mobile App you can follow your positions and the markets in real time while you are on the go.

The most popular features are as follows:

- Real-time quotes from all markets

- Analysis and trading of options and options spreads

- Inside view of market depth

- Receive alarms via the app

- Analyze charts including indicators, etc.

- Order placement and trading on the go

- Position monitoring, as well as orders and account balance

Is TradeStation also available in German?

No, TradeStation is currently only available in English.

Is there a training section?

There is an extensive training section.

With YouCanTrade, TradeStation also offers its own channel. Various free courses and a free master class are offered through this channel.

TradeStation also has its own YouTube channel, which currently has around 37,500 subscribers. The YouTube channel offers a variety of videos and recorded webinars.

The online library contains a vast amount of information on a wide variety of topics, such as trading with options, rules for trading, trading stocks, etc.

Terms are explained in the glossary.

Which awards has TradeStation won?

TradeStaton has won numerous awards.

- Barrons: Best for Frequent Traders, Best for Options Traders (2016-2020)

- StockBrokers.com: Best Platform Technology, # 1 Broker, Platform and Tools, Customer Service (2016-2020)

- Technical Analysis of Stocks & Commodities: Best Trading System, Best Professional Platform, Best Real-Time Data, Best Training (2016-2019)

- Investors Business Daily: Overall Customer Experience, Equity Trading Tools, Mobile Platform, ETF Choices (2016-2020)

Conclusion

TradeStation is an ingenious trading platform and also a very good online broker, as well as a reliable data provider.

Thus, TradeStation offers a complete package with excellent value for the money.

The platform is very easy to use and has all the functions you need for professional trading. Automated trading is also very easy with the help of TradeStation. Thanks to the simple programming language, EasyLanguage, it is also suitable for beginners.

The fees are low and the choice of markets is immense.

The customer support is competent and helpful.

The many awards that TradeStation has received year after year show that there’s good reason for TradeStation’s popularity.

Read more: