Broker comparison – who is the best? In this article, we are introducing Trade.com.

Inhaltsverzeichnis

Trade.com – background information

This article is about the multi-asset online broker Trade.com, a brand operated by Trade Capital Markets (TCM) and Livemarkets Limited. The provider offers interested investors and traders a sizeable selection of tradable instruments as detailed below. The online broker claims to be looking after more than 100,000 active investors already at the time of this review.

While the Trade.com is headquartered in Nicosia (Cyprus), it also maintains a number of other branches in Europe:

- Germany

- Czech Republic

- Great Britain

- Gibraltar

- Spain

- Slovenia

- Slovakia

The online broker’s regulation and deposit protection

Before delving deeper into Trade.com’s various proposals and services, a brief glance at its regulation and deposit protection. As a Cypriot company, the parent group Trade Capital Markets is regulated by the Cypriot financial supervisory authority CySEC. Livemarkets Limited as the second responsible company is meanwhile regulated by the British FCA.

In addition to the above, client deposits are also insured up to an amount of € 20,000 by a corresponding security fund.

In view of which one can say that the online broker is a reliable provider subject to the strict guidelines of the aforementioned financial supervisory authorities.

These assets can be traded at Trade.com

The selection of tradable instruments at Trade.com includes a range of over 2.100 assets for forex, stock, index, commodity and ETF trading. This can be done both long and short.

Shares

The first to be mentioned in this context is the trading of stock CFDs. Trade.com’s clients can choose from over 250 companies that are tradable as CFDs with leverages of up to 1:5. More information on individual stock CFD’s trading conditions is always available from the Trade.com website.

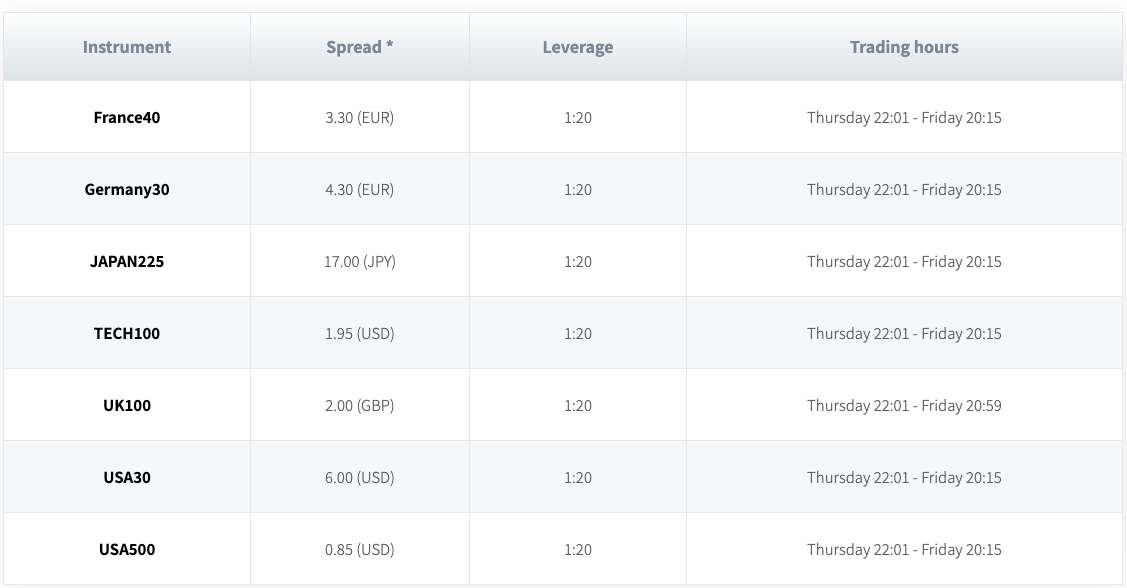

Indices

For clients more interested in index trading, there is also a matching offer: A sum total of 26 global key indices for the principal economic regions can be traded at the online broker 24/5. While main indices can be traded with leverages of up to 1:20, the maximum leverage for the others is 1:10.

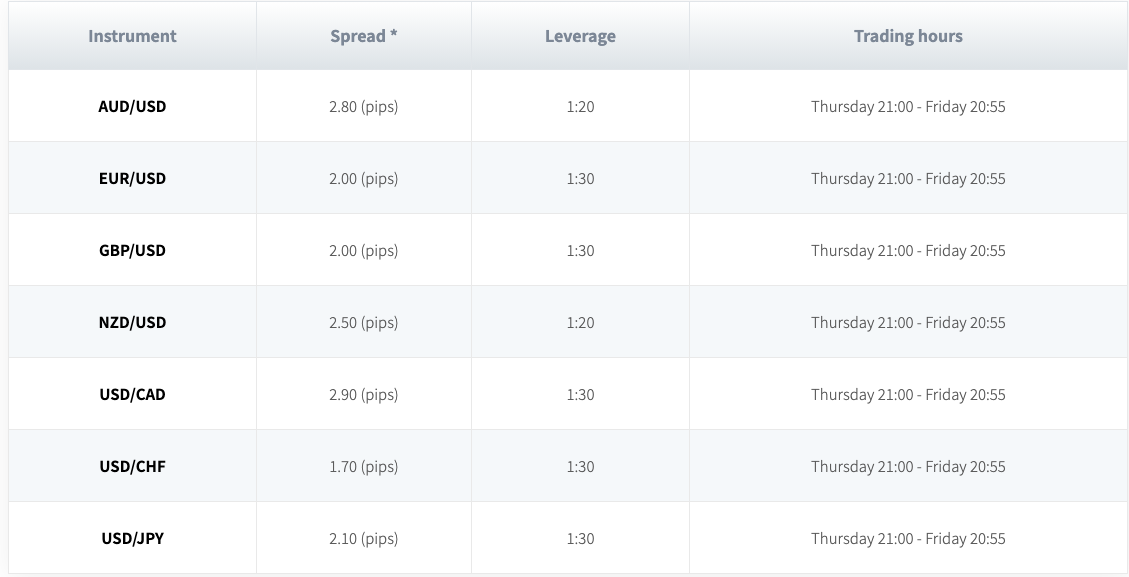

Forex

A daily trade volume of over US$ 5 trillion makes the Forex market the world’s most liquid. Clients can use Trade.com to trade over 55 currency pairs. Forex majors can be traded with leverages of up to 1:30. The spreads of the individual trade instruments, which are mostly competitive, are always available from the Trade.com website. The spreads for the EUR/USD currency pair start from 3 pips, for example.

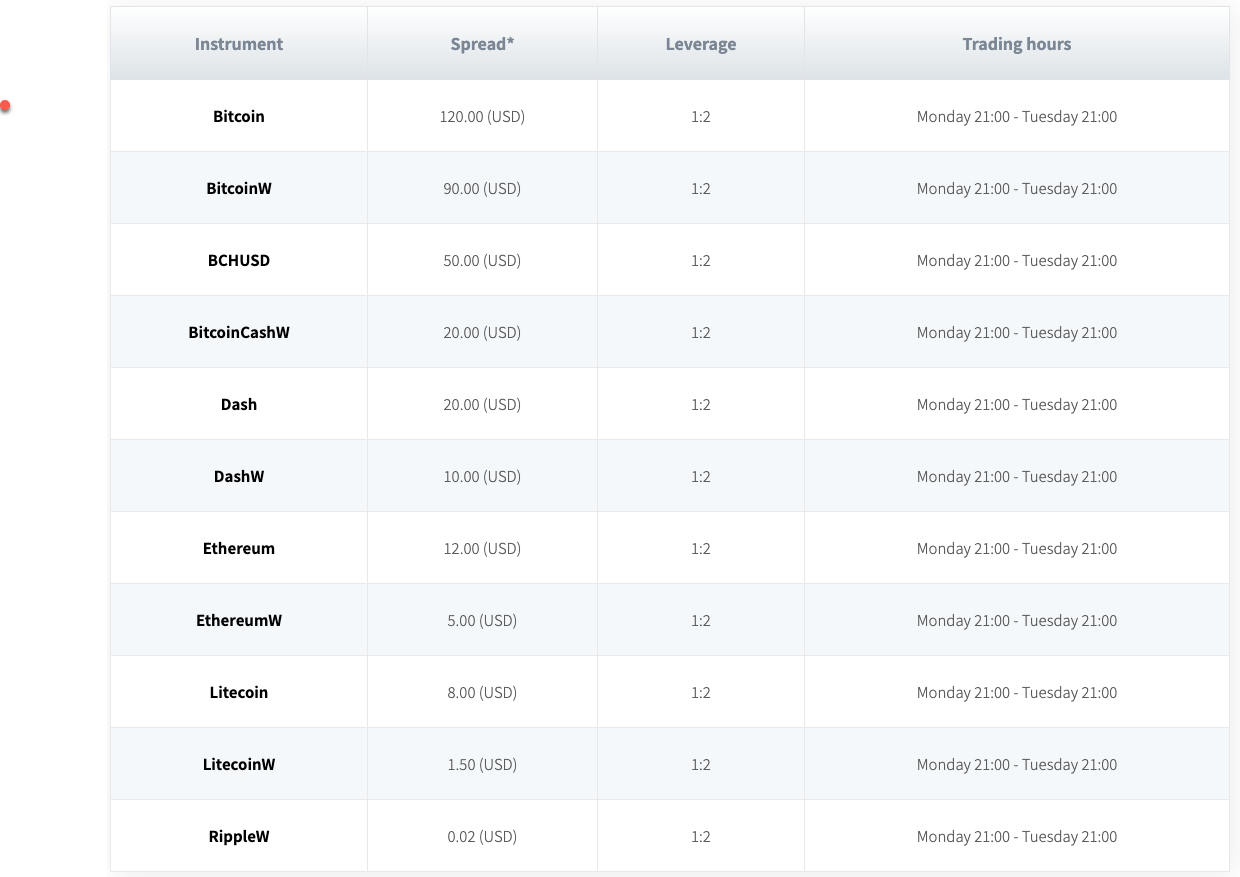

Cryptos

Trade.com can also serve you to trade CFDs on cryptocurrencies, including bitcoin, Bitcoin Cash, Ethereum, Litecoin, Dash, Ripple and others. Cryptocurrencies are characterized by high volatility. Trades can be leveraged up to 1:2.

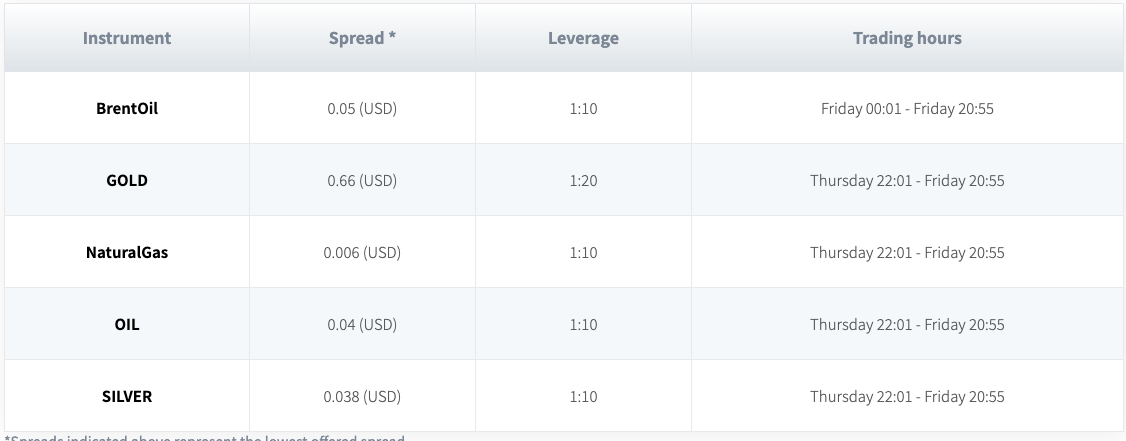

Commodities

Trade.com also lets its clients trade commodity CFDs, enabling them to diversify their portfolio with attractive premiums and versatile trading strategies.

They can choose from the following commodities:

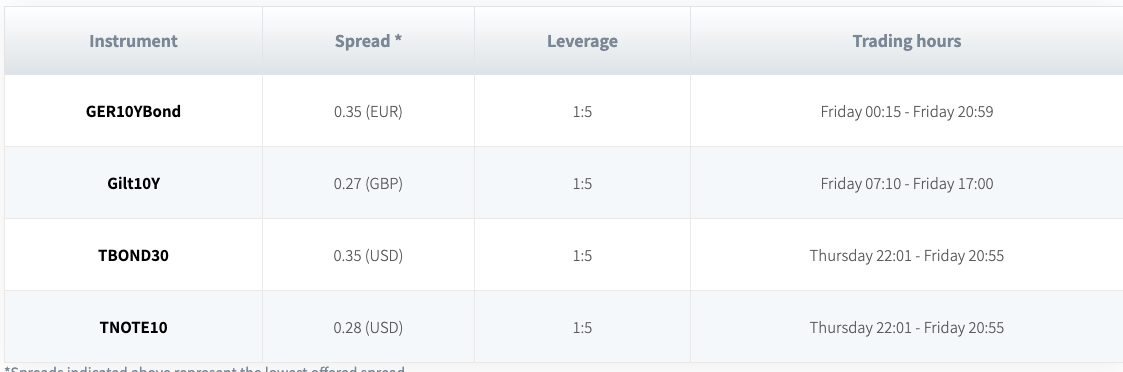

Bonds

Also available for trading at the online broker are Sterling, yen, euro & dollar bonds, with the maximum leverage set to 1:5.

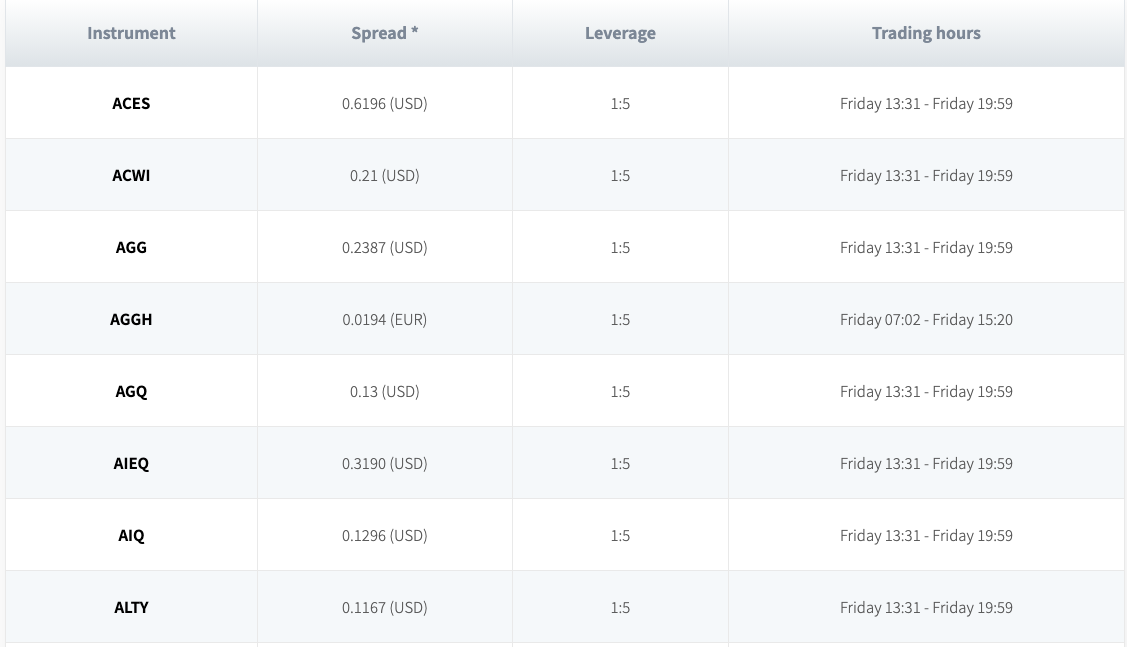

ETFs

The last on this list is EFT trading at Trade.com, with over 30 EFTs available to the online broker’s clients on their PC, tablet or mobile for trading at fair conditions. The maximum leverage here is also 1:5.

Payment options available at Trade.com

Once you have decided to open an account at Trade.com, your next step is to capitalize it. The online broker gives you various payment options for this, as detailed below.

- Credit/debit cards

- Sofort

- EPS

- Giropay

- Multibanco

- iDEAL

- Safetypay

- Bank transfer

- Skrill

- Neteller

The online broker charges no fees for deposits or withdrawals in this as they are fully covered by the provider.

The trading conditions at Trade.com

In contrast to many other online brokers, there are no commissions to pay at Trade.com. The fees mainly come in the form of spreads instead. The amount of the respective spread depends on the account type selected at Trade.com. Which is why the account types shall be examined in some greater detail below.

There are also a number of further cost factors to be considered beside the spreads, however. They include Overnight financing costs as well as conversion fees and an inactivity fee, which becomes due after 90 days without trading activities.

Account types to choose from at Trade.com

As the trading conditions largely depend on the selected account type, see above, this section takes a closer look at the various models. The online broker principally offers five different account models:

- Micro – minimum deposit US$ 100.00

- Silver – minimum deposit US$ 1,000.00

- Gold – minimum deposit US$ 10,000.00

- Platinum – minimum deposit US$ 50,000.00

- Exclusive – minimum deposit US$ 100,000.00

The table below illustrates the differences between the spreads payable with the various account types (in pips).

| MICRO | SILVER | GOLD | PLATINUM | EXCLUSIVE | |

| Gold | 0.7 | 0.6 | 0.56 | 0.5 | 0.4 |

| EUR/USD | 3 | 1.9 | 1.5 | 1.2 | 1 |

| USD/JPY | 3 | 1.9 | 1.5 | 1.2 | 1 |

| GBP/USD | 3 | 1.9 | 1.5 | 1.2 | 1 |

| DJ 30 | 6 | 5 | 4.5 | 4 | 3 |

| DAX 30 | 2 | 1.8 | 1.6 | 1.5 | 1.4 |

| NASDAQ 100 | 2 | 1.8 | 1.6 | 1.5 | 1.4 |

| CRUDE OIL | 0.05 | 0.04 | 0.03 | 0.03 | 0.02 |

For more detailed insights into the spreads for the various trade instruments, Trade.com additionally also provides a list that transparently shows the spreads for all the assets.

In addition to the different spreads, the account types are also distinguished by various functions and extra services.

Opting for a Platinum or Exclusive account, for example, means that you will benefit from a premium customer service. Other resources such as Trading Central or daily analyses are also only available with the higher account classes.

Which trading platforms are available at Trade.com?

To help its clients trade more effectively, the online broker gives them two different trading platforms to choose from, one being WebTrader, and the other MetaTrader 4.

Cosmos WebTrader

The first alternative offered by the online broker is Cosmos WebTrader, which can be used to trade all the 2,100 available trade instruments. This is a proprietary Trading software giving Trade.com’s clients access to a whole range of useful functions and control elements.

Besides its intuitive user interface, the trading platform can also score with other benefits:

- Mobile trading using iOS or Android devices

- Simple navigation

- Modern charts and indicators

- News ticker

MetaTrader 4

The second software on offer at the online broker is MetaTrader 4, one of the world’s most popular trading platforms. You can download MT4 directly from the Trade.com website. Users of this software can trade over 300 available assets (forex, contracts for difference, commodities, bonds, indices and shares). The platforms other advantages can roughly be broken down as follows:

- Mobile trading also possible

- Automated trading

- Integrated Tick charts and notification of trading positions

- Customizations for pursuing specific trading strategies

For traders using a Mac for their trading activities, Trade.com offers a compatible download function for also using MetaTrader on an Apple computer. The online broker provides detailed instructions for installing and using MT4 on its website.

Tools at Trade.com

Having taken a closer look at the trading conditions and various platforms at Trade.com, we shall now turn to the tools provided by the online broker for free.

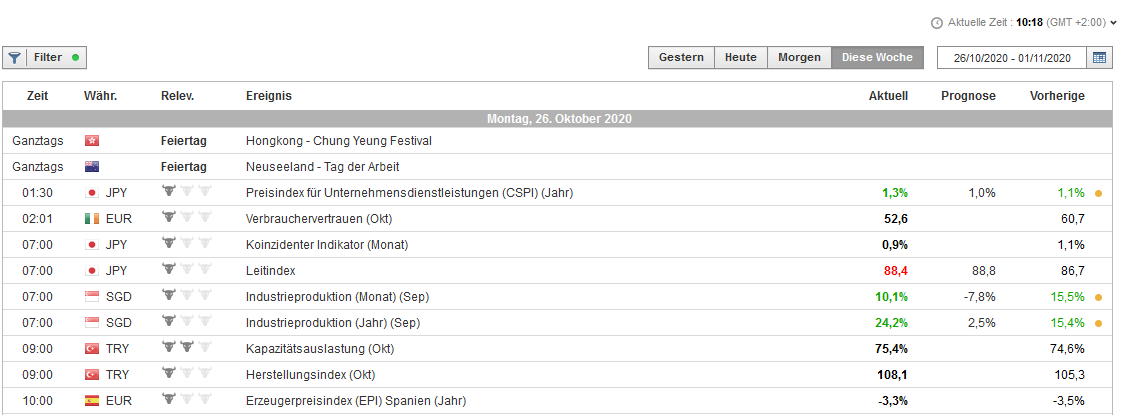

Economic calendar

Like many other providers, Trade.com also has an Economic calendar available on its website. The results can be filtered by the criteria of country, time, category and importance.

Trading Central

Trading Central is a renowned investment research provider for financial market experts that comes as a plug-in for MetaTrader 4. Trade.com clients can use this information and access Technical analyses of trends, prices and market developments at all times.

Trading Central’s various trading strategies meanwhile embrace shares, indices, forex, commodities and fixed-income markets; the methodology is based on indicators with charts and caters to various trading styles – from Day trading via Swing trading through to long-term investments.

TradingView charts

Thanks to the active cooperation of Trade.com, the online broker’s clients can access the TradingView software directly in their browser for free. TradingView is recommended for Novices to trading as well as more advanced investors and experienced traders.

Besides powerful charts and a Stock Screener, TradingView can also boast of a large and active community. See below for the tool’s advantages in bullet points:

- More than 100 Indicators

- Multi-asset comparison in the same chart

- Creation of effective Signals (buying and selling points)

- Trading alarms

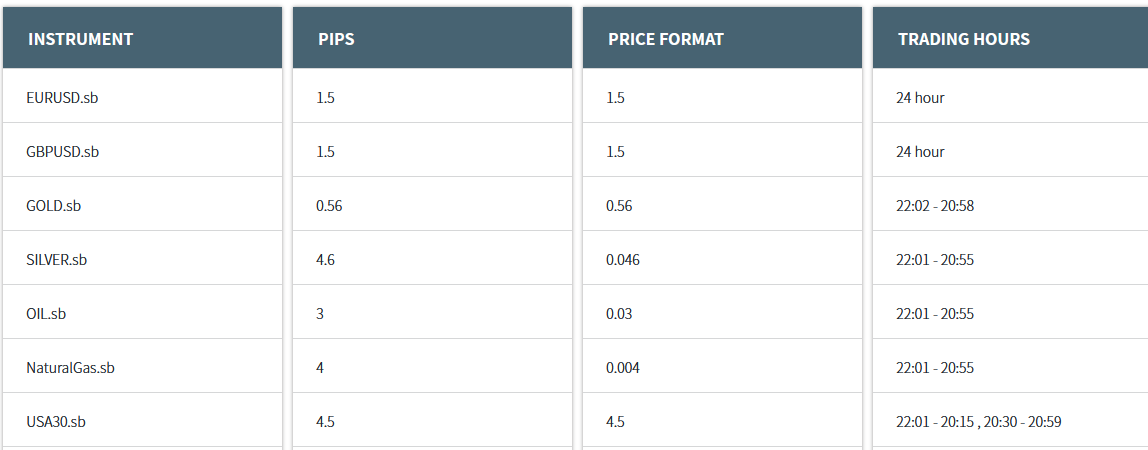

Spread betting at Trade.com

As an alternative to CFD trading, the online broker also offers the option of spread betting.

Spread betting is a form of trading that is based on derivatives. In this kind of trade, investors never own the asset they trade with, but speculate on their price developments instead.

The spreads and trading hours for the individual instruments are shown on the Trade.com website.

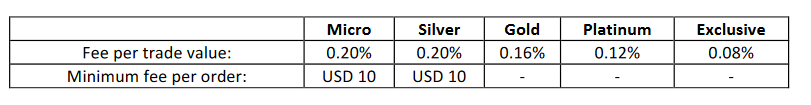

In addition to this, you also need to take commissions into account, which can vary from one account type to the next.

The customer service at Trade.com

Another aspect never to be neglected in selecting a suitable online broker is their customer service. If you have questions or run into problems, Trade.com offers its users various ways of getting in touch.

First and foremost you can always e-mail the Broker Support Team, which is available to deal with traders‘ concerns from 10 p.m. on Sunday to 10 p.m. on Friday.

Another option is to contact the support team on WhatsApp. You will generally receive a helpful and competent answer in a short time this way.

And you can also use the chat function to ask your questions directly on the Trade.com website. This will also usually lead to a quick answer in staffed times.

The last option for contacting the service team is their request form. All you need to do is enter your name & e-mail address and describe the respective problem.

Online ratings of Trade.com so far

In conclusion, a brief examination of Trade.com’s online ratings so far. Many users appreciate the large selection of trade instruments (over 2,100 assets), which enables clients to diversify their portfolios. Trade.com additionally scores with its trading platforms – with MetaTrader 4 recommended for trading novices as well as professionals, for example. And the customer service is also popular with most of the traders on the bottom line.

But what some traders also cast a critical eye on are the partly above average spreads for some assets. A 3 pip spread for the EUR/USD major is set relatively high in comparison with many other providers, for example. But one should also note at this point that the spreads become more competitive again in the higher-class account models.

All-in-all, Trade.com can thus be described as a reliable and regulated online broker with a large range of trading services that also enjoys great popularity amongst many traders. There are reasons why this provider should have over 100,000 active users already.

Read similar articles: