Lately I’ve seen a growing number of people claiming in trading forums that the Martingale strategy is an ideal system that can guarantee you success in the long run. It’s the holy grail of trading strategies, so to speak. But what exactly is this strategy and is it really recommendable?

Inhaltsverzeichnis

What is the Martingale strategy?

The Martingale strategy originated in the eighteenth century and is a gambling system in which you increase your bet after every loss. To be precise, the bet is doubled. Any of the strategies in this category can be called a “Martingale.”

In other words, you bet on the occurrence of a certain event. If it doesn’t occur, you double your bet that it will happen. You continue until the desired event occurs.

An example based on roulette

Let’s take roulette, a game of chance, as an example. One of the wagers you can make is that the ball will land on a certain color (red or black). In other words, you’re betting on the occurrence of a certain event. Let’s assume that the last winning color was red. So now you bet on the opposite color, black.

You start with one euro, but the ball lands on the color red. You now double your bet of one euro, placing two euros on black. You keep doubling the bet until your color wins.

| No. | Result | Stake (total loss/gain) |

| 1 | Red | 1 € (-1 €) |

| 2 | Red | 2 € (-3 €) |

| 3 | Red | 4 € (-7 €) |

| 4 | Red | 8 € (-15 €) |

| 5 | Red | 16 € (-31 €) |

| 6 | Red | 32 € (-63 €) |

| 7 | Red | 64 € (-127 €) |

| 8 | Red | 128€ (-255 €) |

| 9 | Red | 256 € (-511 €) |

| 10 | Black | 512 € (+1 €) |

As you can see by this table, the strategy appears to work in practice and seems easy to use. But this is just an illusion.

Why doesn’t the Martingale strategy work in roulette?

The pockets on the roulette wheel are not only red and black, but also green (the zero). If the ball lands on zero, you lose half your bet.

In addition, there is a fixed maximum bet in roulette, called the table limit.

A few mathematical facts

There are 37 numbers in roulette – 1 to 36 and a single green zero. In other words, there are 18 black numbers and 18 red ones.

The chance of winning is thus 18/37, or 48.6 percent. That translates to a 51.4 percent probability of loss.

In other words, the chance that you’ll win your bet the next time the wheel is spun is always 48.6 percent. At the same time, the probability of losing your bet and thus having to double it is 51.4 percent.

The probability of betting on red and losing seven games in a row is (19/37)7 or 0.94 percent.

Despite these relatively low odds, you’ll never win enough in the long run to make up for this losing streak. The reason is that, because your profit is always equal to the initial bet of one euro, you would have to win 127 times to make up for the loss.

You should keep in mind that the chances of winning don’t increase as your losses continue. The ball has no memory and always lands randomly in a certain pocket. As a result, it’s wrong to assume that the odds of winning increase with your losses.

For mathematical reasons, then, it makes no sense to use this strategy in roulette.

Use of the Martingale strategy in forex trading

At this point people might object that all this might be true in a casino, but there’s no “zero” in forex trading, only long or short. Nor is there a maximum bet, as in a casino. So it must be possible to successfully apply the strategy to forex trading, right?

It’s important to note, though, that the strategy doesn’t increase the odds of winning. The long-term profit is still the same. All the strategy does is postpone losses over time. Under the right conditions, losses can be postponed to a point in time when it looks as if you have a better profit opportunity.

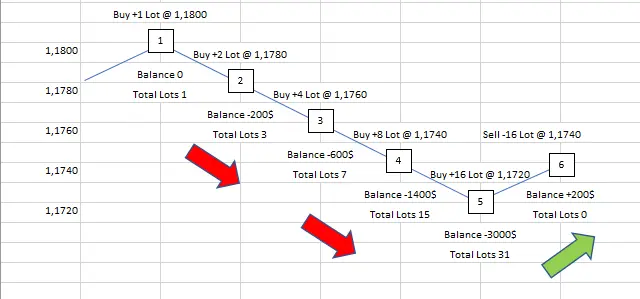

In trading, the Martingale strategy is essentially a cost-averaging system that reduces (or, if you’re short, increases) your entry price each time you increase your position size. The strategy requires you to double your position size until you score a winning trade.

| Trade | Order | Lots | Entry | Average price | Loss in pips | Break-Even | Profit/loss in $* |

| 1 | Buy | 1 | 1,18 | 1,18 | 0 | 0 | 0 |

| 2 | Buy | 2 | 1,1780 | 1,1790 | -20 | 10 | -200$ |

| 3 | Buy | 4 | 1,1760 | 1,1775 | -40 | 15 | -600$ |

| 4 | Buy | 8 | 1,1740 | 1,17575 | -60 | 17,50 | -1400$ |

| 5 | Buy | 16 | 1,1720 | 1,17388 (1,173875) | -80 | 18,75 | -3000$ |

| 6 | Sell | 16 | 1,1740 | 1,17388 | -61,2 | -1,25 | +200$ |

In the example above, we buy one lot (100K) of the EUR/USD currency pair at a price of 1.18. Our profit target and stop loss are 20 pips. This means the strategy has 1R, which is typical for a Martingale system. For this reason alone, the strategy isn’t recommendable, as the risk/reward ratio is always only 1R. If, in addition, we assume that our hit rate is 50 percent (corresponding to the prognosis in Eugene Fama’s famous 1965 article “Random Walks in Stock Market Prices”), we’ll be playing a zero-sum game in the long run. There’s also a high probability that at some point, our entire trading account will be wiped out.

Let’s assume that EUR/USD goes against us and reaches our theoretical stop loss. However, instead of closing the position, which is what a good risk and money management system would have us do, we buy more. This time we purchase two lots, so our breakeven is not 20 pips, but only 10 pips. “Averaging down” by doubling position size reduces the breakeven at which losses can be recouped. After the fifth trade, our breakeven is 1.17388 (rounded up from 1.173875). This means that if the price returns to this point, we can exit and cover all the losses from the previous trades.

By doubling the position size after each losing trade, we’re now able to reach the profit target of 20 pips when the price falls back to 1.1740. After all, our average price is 1.17388 (or 1.173875) and we’re able to exit at 1.1740. We thus generate a profit of 1.25 pips with 16 lots, which correspond to 20 pips in total.

The Martingale strategy is not recommended for trading

With the Martingale strategy, a winning trade can thus make up for total losses, and the initial profit target can be reached. This is illustrated by the following formula:

2n = ∑ 2n-1 +1

This may sound tempting, but from the perspective of risk and money management, which are essential for long-term success in the market, it’s by no means recommendable. In our example, for a trade of 1R, you risk 15R. That’s a ratio of -15:1, which is absolutely insane!

From a mathematical and theoretical perspective, the Martingale strategy appears to be feasible because markets are known to move in impulse and correction waves and every trend usually corrects at some point. However, when that happens is uncertain.

In addition, forex markets tend to have very long trends. In order to experience the turning point, you need an infinite amount of capital, as a losing streak of ten or more trades is highly likely. In the above example, after only four losing trades, you already have a position size of 31 lots. That’s the equivalent of $3.1 million. If you had ten losing trades in a row, you’d have 2,047 lots, worth $204,700,000!

Even if you trade the smallest position size – one nano lot worth $100 – that would still be $204,700. Because you use leverage in forex, you theoretically don’t need to have all this capital in your account to trade the entire position, but these large sums are nevertheless the greatest danger of the Martingale strategy, especially in forex trading.

If you use leverage of 1:100 and your account balance is $2,047, you’ll be able to trade 31 nano lots. But if the position continues to rack up losses, which is not unlikely, your loss will grow to 100 times your account balance. This once again illustrates the crazy scale of this “strategy.” Fortunately, many brokers don’t allow losses to exceed the funds deposited in an account, so the bet is limited. For that reason alone, the strategy isn’t feasible (as in roulette). However, even if brokers allowed losses to exceed deposits, the strategy would sooner or later ruin every trader.

If we assume that a trader uses leverage of 1:10 and the funds in his or her account are $15,000, the trader could survive a maximum losing streak of eight trades. Then the invested capital would total $10,230 (1,023 nano lots x 100/10 leverage).

The mathematical facts relevant to trading the Martingale strategy

The more trades you make using this strategy, the more likely you are to have a long losing streak.

The strategy’s statistical profile matches that of the Taleb distribution. In other words, it provides a payoff of small positive returns while carrying a “small” but significant risk of total loss. You have the high probability of a small profit, combined with the low probability of a significant loss. The strategy’s payoff profile thus differs from what a trading strategy should be. Its “expected value” is less than zero.

With this strategy, risk increases exponentially while the profit payoff profile is linear.

In the event of n losses, the trader’s risk increases by 2n-1.

Assuming, as I said, that the hit rate is 50 percent, the expected profit generated by the trades is as follows:

- Profit ≈ (1/2 n) x p

- n: total number of trades

- p: profit per trade

Guided by our above example, a trader can limit his or her losses to eight losing trades. In this case, the largest possible position size would be 256 lots. This maximum amount would be lost only the trader had a losing streak of nine trades.

The probability of this happening is (1/2)9.

This means you have to assume that you’ll reach the maximum loss every 512 trades.

After 512 trades:

- Expected profits: (1/2) x 29 x 1 = 256

- Expected maximum loss: -256

- Expected net profit is thus 0

Conclusion

Although the Martingale strategy may initially sound tempting, you should avoid it at all costs, even when the forex markets are range-bound!

The strategy shows that in discretionary trading, you should never add to losing positions, as this often leads to ruin. What you can do, though, is use an anti-Martingale strategy and add to your position when you’re showing a profit. This is known as pyramiding. However, it’s important not to increase your risk. Also, the strategy of pyramiding is recommended only for very experienced traders.

Read more: