Broker comparison – who is the best? In this article, we are introducing IG.

Inhaltsverzeichnis

IG – History

The enterprise registered under the name of IG Group Holdings Plc. was established in England in 1974. The company was originally intended to speculate on gold, at a time when it was still called „IG Index„. Not until eight years later would the company expand its portfolio, enabling so-called „financial spreading betting“ on the 30 largest domestic companies listed in the British share index. This allowed investors to bet on the future development of specific share prices. In 1998, IG was then finally incarnated as an online platform.

Listed in the FTSE 250 share index as a publicly traded company since 2005, the IG Group continued its global expansion year by year, and has offices in all major European countries by now. The IG Group is currently the largest provider in the CFD sector in sales terms. In 2012, the company finally subsumed all the global enterprises (IG Markets and IG Index) under the common name of IG.

Offices of the IG Group

The IG Group has also been able to significantly add to the number of its offices over the years. Branches can already be found in the following cities today:

- Singapore

- Dubai

- Tokyo

- London

- Melbourne

- Dublin

- Chicago

- Paris

- Milan

- Johannesburg

- Geneva

- Madrid

- Luxembourg

- Düsseldorf

- Stockholm

The German subsidiary of the IG Group goes under the name of IG Markets Ltd. and is based in Düsseldorf. But the company also organizes various roadshows and trading events in major German cities several times a year, and is usually present at investor fairs as well.

How is IG regulated?

Investment companies are principally required to keep client funds and their own equity separate. Which is why the client funds deposited with IG are kept separately in segregated escrow accounts of regulated banks, where they are clearly identifiable as the clients‘ property. The background simply being that client funds and investments, e.g. shares, cannot be used for the company’s purposes this way, and that clients funds are fully protected in the worst-case scenario of an insolvency. In addition to which the funds are not kept in just one bank, but spread across several institutes. Important: The deposit guarantee for client funds will only cover amounts up to GBP 50,000.

IG is regulated by the British Financial Conduct Authority (FCA). This authority is known for its strict guidelines and requirements for client funds and capital investments.

Further regulation is provided by the German Financial Supervisory Authority (BaFin). This authority regularly monitors compliance with all the requirements to protect client funds.

Which markets can be traded?

The IG Group offers a host of markets for trading. The selection of 16,000 available markets is continuously being expanded. Inter alia, they also include the following markets for trading:

- Indexes

- Forex

- Stock CFDs

- Commodities

- Cryptocurrencies

- ETFs

- Bonds

- Sectors

- Options

Fees at IG

IG keeps its fee structure transparent and will not claim any hidden costs. Only the spread will principally be payable for everything but shares. The fees for spreads start from 1 point for leading index markets and 0.8 pips for major forex currency pairs. Stock CFDs can be traded online for a commission of 0.05 % per transaction.

Looking at the standard commissions, these start from as little as 0.1 % per executed transaction in all other markets, with the use of the platform itself free of charge. With a minimum of four transactions per month, free “ProRealTime Charts” will become available to boot. If transactions should not transpire in the required numbers, a € 30 fee becomes due at the end of the month.

What are the margin requirements?

The margin requirements at IG are amongst the lowest in the CFD industry. Smaller trade sizes usually benefit from a high market liquidity. Which is precisely why IC offers its clients the opportunity to profit from very low margins.

Let us now take a look at the margin conditions the company is able to provide, starting with the case of a retail investor. This analysis is focussed on the most popular markets in each case. Special margin rates and fees can always be looked up on the IG Group website.

Margin rates for retail investors

IG offers different conditions for retail investors and professional traders. Let us start with the margin rate for retail investors.

- Shares

The margin contribution required from private clients amounts to 20 % with most shares.

- Forex

The margin required for major currency pairs in forex trading is 3.33 %, except for the AUD/USD currency pair with 5 %.

- Indexes

With indexes, the margin per contract usually amounts to 5 % for retail investors.

- Commodities

While the margin for gold is set to 5 %, 10 % will become due for most other commodities.

- Cryptocurrencies

The margin rate for tradeable cryptocurrencies like bitcoin etc. amounts to 50 % for retail investors.

Margin rates for professional traders

And now we take a look at the same list for professional traders.

- Shares

Traders categorized as professional will generally only need to provide a margin contribution of 4.5 % for shares.

- Forex

The margin requirements in forex trading are subject to specific fluctuations depending on the currency pair. The margin rates amount to 0.45 % for the EUR/USD, AUD/USD and EUR/JPY currency pairs, 0.90 % for GBP/USD, and 1.35 % for USD/CHF.

- Indexes

The margin per index contract for professional investors usually comes to 0.45 %.

- Commodities

While the margin for gold is set to 0.63 %, approximately one percent more is asked for most other commodities.

- Cryptocurrencies

There are also differentiations between the tradable cryptocurrencies. While the margin rate for the popular digital currencies bitcoin and Ethereum amounts to 13.5 %, it is set to 22.5 % for the other cryptocurrencies.

Categorization as a professional trader

The next step now raises the question how one can be categorized as a professional trader. IG has formulated a number of questions to qualify investors for this. They are listed below, as found on the UK website:

Have you traded leverage derivatives in significant sizes over the last four quarters?.

Do you have a financial instrument portfolio (including cash deposits) exceeding €500k?

Have you worked in the financial sector, in a professional position requiring knowledge of derivatives trading, for at least a year?.

If you are able to answer yes to two or more of these questions, you may be able to qualify as a professional client.

Slippage

While slippage effects will have a negative impact on clients with stops, investors can benefit from them with limits. IG therefore offers an asymmetric slippage performance, so that clients will benefit on the bottom line, rather than suffer, on average. The company has published its slippage data from the last quarter for this. The table below shows the slippage performance for some popular currencies and indexes.

| Markets | Stops – no slippage | Negative slippage | Positive slippage |

| AUD/USD | 96% | 4% | 22% |

| EUR/USD | 91% | 9% | 25% |

| EUR/USD | 83% | 17% | 44% |

| Germany 30 | 78% | 22% | 58% |

| FTSE 100 | 93% | 7% | 55% |

| US 500 | 74% | 26% | 92% |

Types of trade available at IG (CFDs, options trading & barriers)

IG principally offers three different types of trade for interested traders to engage in: barriers, CFDs and vanilla options.

Barrier options

Barriers or barrier options enable traders to control the leverage and risk without needing to sell the trading object on their own. Barrier options are leveraged options that will close automatically when the underlying market price reaches the investor’s respective “knock-out” level. The so-called knock-out level thus describes the barrier at which the option is automatically closed.

Their main difference from vanilla options is that barrier options can only be bought to open a position. To trade profitably with rising as well as falling prices, you can go for their „IG Call“ and „IG Put“ options.

CFDs

The CFD trading on offer is also of a transparent and flexible design. Options and CFDs are two of the leveraged products available at IG. The range of different markets is diverse and can be traded 24 hours a day. Investors can open long or short positions.

CFDs are available in various markets, including the following:

- Forex: Long or short, with spreads starting from 0.6 points for currency pairs such as EUR/USD, for example.

- Indexes: The most popular indexes, 24/7

- Shares: Over 12,000 international stock markets

- Commodities: A large selection of metals, energies, and soft commodities, with spot gold spreads starting from 0.3 points

- Cryptocurrencies: There is no need for a virtual wallet of your own to trade with the most popular digital currencies like bitcoin, Ethereum, Litecoin and ripple

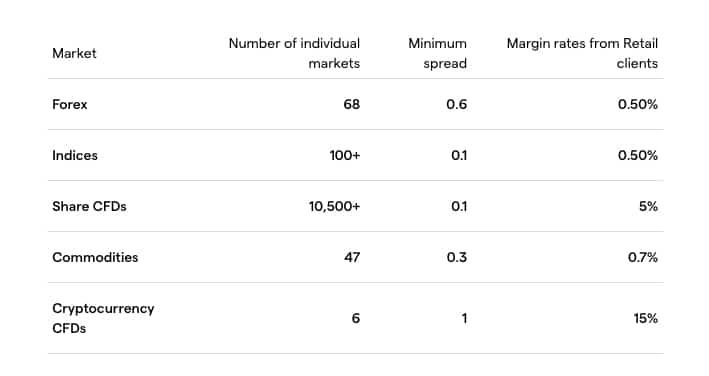

The illustration below provides a brief overview of the CFD trading costs.

Opening a CFD account at IG is not that complicated and takes just three steps.

- Fill in the online form (this is mostly about your previous trading experience)

- Verification: can be conveniently done from home by video call

- Deposit and trading: Now you can directly make a deposit and start trading, or try out the demo account first.

There are also a number of further advantages to be mentioned here that CFD trading with IG will bring, for example including that traders can minimize their risk by using one of the many available Stop and Limit orders. The research service provided to IG clients irrespective of their previous knowledge is also useful.

Vanilla options

Vanilla options are financial products in the form of a contract entitling investors (but not requiring them) to buy or sell an underlying asset at a specific time and fixed price (exercise price). The purchase of vanilla options is subject to a premium that remains the trader’s only risk. This premium is based on various factors such as the market volatility and current price, for example. Just like barrier options, vanilla options also permit you to bet on both rising (call) and falling markets (put).

Mobile app

IG also offers its clients the opportunity to trade flexibly with their smartphone or tablet using a mobile app. This app is available from the respective shop for both Android and Apple devices. They offer their users several benefits. First and foremost, downloading them is free of charge. The mobile app meanwhile offers all the functions required for trading – new trades can be opened, and open options managed, at any time.

In addition to this, the app is optimally customized for all smartphones and tablets, with regular updates enabling users to improve their trading results in the long term. Neither does the security leave anything to be desired: the trading takes place with a safe 256-bit SSl encryption. In addition to which thousands of different markets can be traded, including stocks, forex, commodities, and indexes.

How is money paid in and out?

IG offers various methods for making deposits or withdrawals. If you want to credit your account with funds for trading, you can choose from the following methods for making a deposit:

- Bank transfer (can take up to three working days to arrive)

- Credit card (Visa- or Mastercard – immediate deposit if successful)

- PayPal (immediate, but only selectable after final account activation)

- Mobile app (Android/Apple – immediate deposit upon successful payment)

All these methods of making a deposit are free of charge. There is a general need to ensure that your own name and IG account number are stated in the ‚Reason for transfer‘ field when making a deposit.

Withdrawals by standard transfer are also free of charge. The money should then be credited to your account within 24 hours as a rule. If the funds are to be credited to a card, this can take 2 – 5 days.

Which platforms can I choose from at IG?

IG offers a number of different solutions when it comes to choosing a trading platform. Besides the classic web-based platform, there is also the option of a mobile app for the smartphone or tablet. Over and beyond which one can also use specialized platforms like MetaTrader 4, ProRealTime or L2 Dealer, for example.

It should be mentioned at this point that all the platforms have been customized to the respective devices structurally and design-wise. On top of which MetaTrader 4 comes equipped with 18 free add-ons and indicators, including Autochartist.

The IG demo account

The IG demo account offers interested investors an opportunity to try out CFD and options trading without risk. Although resembling the live account in many aspects, the demo account features a number of differences, too. Orders executed in the demo account will not be subject to any slippage or interest rate adjustments to start with. In addition to which trades cannot be rejected, in contrast to the live account. And last but not least, the IG chart packages are free of charge for investors with demo accounts.

The demo account allows trading with a virtual capital of 10,000 euros. But it will also give you access to the training opportunities in the IG Academy already, and let you try out your first strategies without further risk.

Opening a demo account is easy as pie. Besides a number of personal data, you only need to enter a username and corresponding e-mail address to get started right away.

Risk management at IG

That options and CFDS come with many risks is no great secret. Which is why IG offers its clients specific risk management tools. The website provides support for this by addressing a number of questions concerning CFDs and risks, and giving background information. It mentions various risks that could possibly emerge in the trading process, and then provides explanations for their potential causes, suggesting solutions as to what the clients in question can do in the respective situation, and how to safeguard themselves better in the future.

IG service

Also worth mentioning here is the support and service IG provides to its clients. The customer service is principally available 24/7 if anything is unclear. German-language support is available from 8:15 a.m. – 10:15 p.m. on weekdays and 10 a.m. – 6 p.m. on weekends, with English-language support provided outside these times.

There is also a six-week introductory programme for novices, which will help beginners lower their risk at the start of their respective trades. In addition to which the minimum trade sizes are reduced for a period of two weeks.

Another benefit of the service is that the support offers a platform tour where the website’s functions are highlighted and explained to investors in individual chats. Not to forget the option of conversing with service staff in the live chat.

IG website

In conclusion, something should also be said about the transparency and design of the IG website. The website has a user-friendly structure and enables its visitors to gain a fast overview of the services and conditions of offer.

It also includes many videos in various places, aimed at describing specific subject areas (e.g. barrier or vanilla options) in greater detail, and explaining them briefly and understandably. In addition to which the design is rather restrained, so that website visitors are not drowned in a flood of text.

Conclusions

The online broker IG offers a broad range of tradable products with fair trading conditions to choose from. Besides offices in many other countries, there is also a German branch in Düsseldorf.

IG is variously and strictly regulated by the FCA and BaFin, amongst others. Client funds and capital deposits are segregated from the company’s assets as a matter of principle, helping to protect them.

The support is available around the clock, and there is also a beginner-friendly introduction programme to go with the generally helpful service. The demo account offers extensive training options as well, including access to the so-called IG Academy.

Read more: