Broker comparison – who is the best? In this article, we are introducing GBE Brokers.

GBE Brokers is a forex and CFD broker that is based in Cyprus. But GBE Brokers also operates a branch in Hamburg. It not only offers services for retail traders, but also liquidity services for institutional enterprises.

Inhaltsverzeichnis

Which products can be traded at GBE Brokers?

GBE Brokers permits over 250 different products to be traded. This means that all the popular asset classes are available for trading:

- Forex

- Cryptocurrencies

- Metals

- Indexes

- Bonds

- Commodities & energy products

- Stocks

In forex, exotic currency pairs are also available for trading besides the familiar major and minor pairs.

The available metals include gold, silver, copper, palladium, and platinum

All-in-all, GBE Brokers offers 20 indexes and index futures for trading. The tradable indexes include classic stock indexes such as the German share index DAX and Dow Jones, but also more exotic ones like the Singapore Blue Chip Future, for example.

The tradable bonds include the Bund Future, Gilt Future and 10yr T-Notes Futures.

All the popular markets are also available for trading commodity and energy products, including crude, WTI crude oil, cocoa, sugar, coffee, or cotton, for example.

Can I trade cryptocurrencies at GBE Brokers?

Besides the best-known cryptocurrency bitcoin, which is available in four different currencies, Ethereum, Litecoin, Dash and Ripple can also be traded.

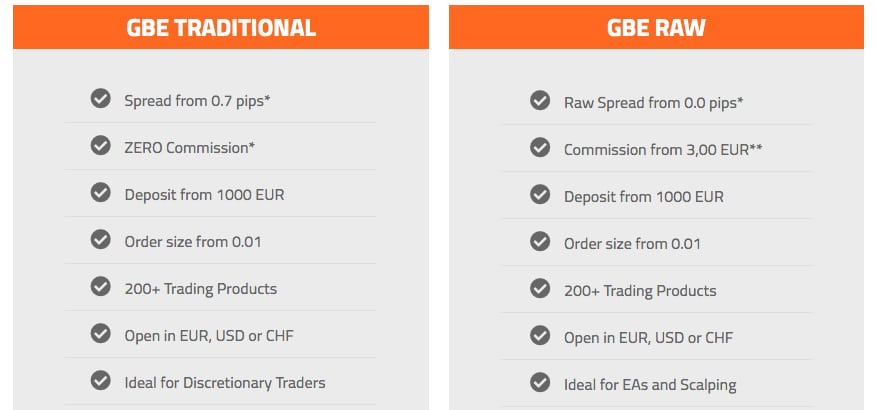

Which account types are there?

There are two account types at GBE Brokers:

- GBE Traditional

- GBE Raw

The Traditional GBE account type is recommended for anyone preferring spread-based trading with no additional commissions.

If you are looking for fixed market transaction costs for your own trading strategy, however, you will need to opt for the GBE Raw account type. This account type is therefore ideal for EAs and scalping.

You can always change accounts free of charge.

Where can I find the GBE Brokers demo account?

A demo account can be opened directly on the start page of the website, all very easy and uncomplicated.

Can I download MetaTrader 4 and 5?

MetaTrader 4 and 5 is available at GBE Brokers, and can be downloaded for Windows, MAC, iOS, and Android. MT4 VPS is also available.

VPS (virtual private server) hosting enables forex traders to execute automated algorithmic strategies, including expert advisors, 24/5 on a virtual machine in a data centre (server).

The key advantage of this is that you will not need to keep your own PC running around the clock at home, and will not depend on your own internet and power connection for the VPS to keep going – as this is guaranteed by the VPS provider.

From a minimum turnover of 100 lots per month, GBE Brokers offers its clients a free VPS in the Equinix LD4 computer centre in London.

What is the MT4 Booster Pack?

The MT4 Booster Pack will give you access to various MT4 platform tools. All you need to do to get it is register for a GBE Brokers live account and fund it with a minimum of € 2,000.

The MT4 Booster Pack offers a complete set of professional trading tools for the GBE platform.

The features of the MT4 Booster Pack include:

- Alarm Manager

- Correlation Trader

- Correlation Matrix

- Excel RTD

- Market Manager

- Trade Terminal

- Sentiment Trader

- Sentiment Map

- Tick Chart Trader

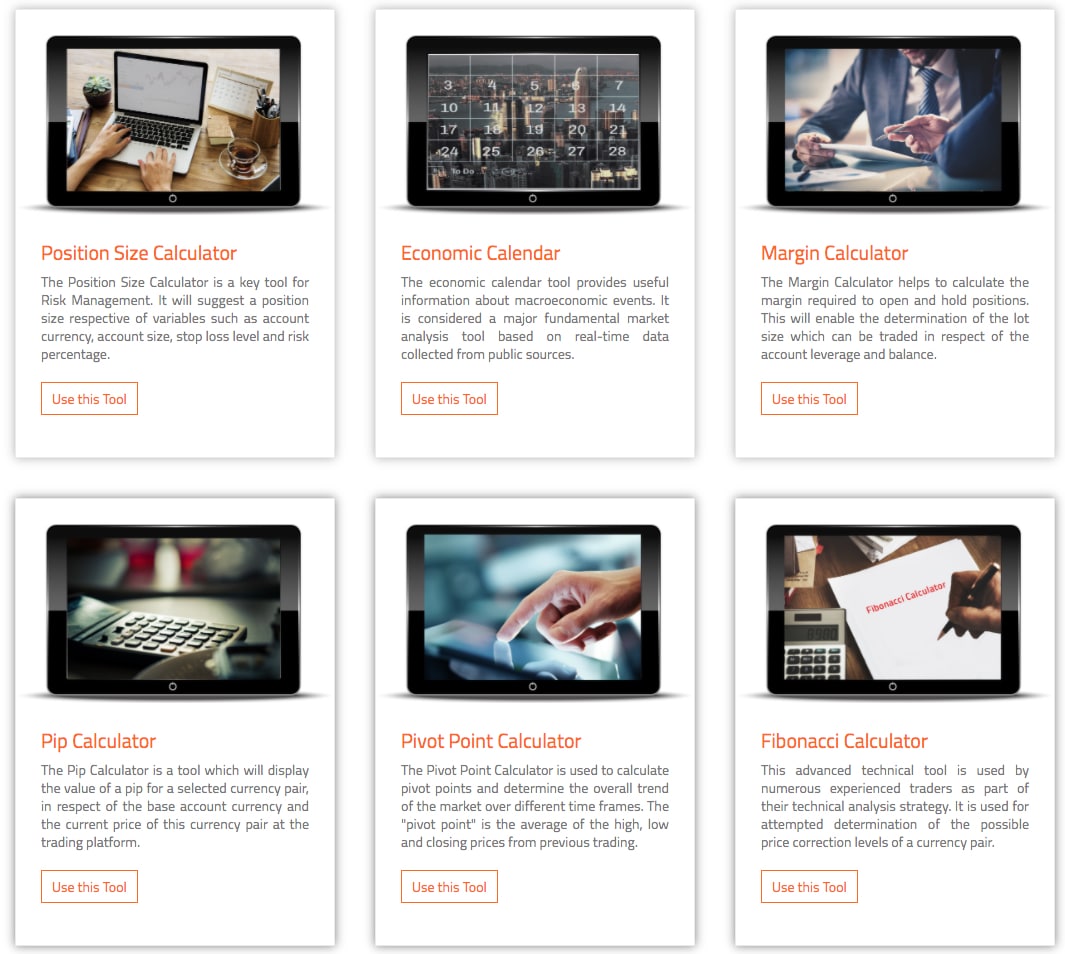

Which other tools are available at GBE Brokers apart from the MT4 Booster Pack?

There are more free tools available than just the MT4 Booster Pack. They currently include:

- Position Size Calculator

- Economic Calendar

- Margin Calculator

- Pip Calculator

- Pivot Point Calculator

- Fibonacci Calculator

To be honest one should also note, however, that these other free tools are also available online from many other places and thus do not really add to the value. In addition to which the Position Size Calculator cannot calculate position sizes for CFDs.

Does GBE Brokers also offer the option of trading by way of an API?

In addition to the MT4 platform, GBE Brokers also offers the option of trading by way of a FIX (financial information exchange) API (application programming interface).

With the FIX API, the latency for order processing is even significantly shorter than with the MT4 platform, with execution delays of a few milliseconds. This is particularly important for news-based trading where fast order processing and execution are of the essence and a few milliseconds can make all the difference for the profitability of a trade.

The FIX API can be used for trading spot FX, CFDs, algorithmic trading, HFT and is a tailor-made solution for high-end finance managers and other retail brokers.

How do I register with GBE Brokers?

Accounts are quick and easy to open. Opening an account will also give you access to MyGBE, the GBE Brokers portal where you can plan and monitor your trading activities.

This is where you can access the Trading platforms and simply select the MT4 platform you need. Money is also paid in and out by way of the MyGBE portal.

In addition to which the portal can be used to submit documents and contact the support.

The GBE Brokers app

GBE Brokers also has an app for iOS and Android. Their smartphone app will give you access to MetaTrader and thus all the functions of MT4.

Inter alia, the features offered by the app include:

- Real-time prices for all tradable products

- All available order methods

- Screening of your open positions

- Interactive real-time charts with zoom and scrolling functions

- Seven time charts in three presentation modes

How can I contact GBE?

GBE Brokers can be contacted by phone, e-mail, live chat and through your own MyGBE portal. The support is easy to reach and requests are also answered quickly.

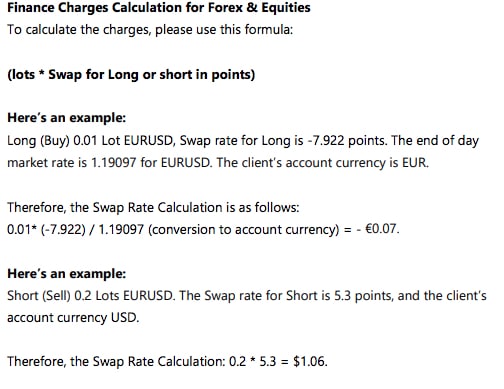

How high is the swap with GBE Brokers?

Spreads/commissions are only charged once at the start. The Swap is invoiced on a daily basis, however, as soon as a customer decides to hold a position overnight (from 11:59 p.m. server time).

Holding positions for several days will have an effect on the costs of trades. Swap rates are not fixed and vary from day to day.

Sample overview of the costs, incl. swap rate, for EUR/USD trades with the Traditional account type.

What are the criteria for being categorized as a professional trader?

To meet the criteria for being categorized as a professional trader, you will need to satisfy two of the three requirements below:

- Copies of bank statements, share certificates, account statements from brokers or other documents confirming deposits or investments with a total value of more than 500,000 euros.

- Adequate experience as a trader and having engaged in a significant volume of forex, CFD or spread betting transactions in every calendar quarter.

Having worked in the financial sector, in a professional position requiring knowledge of leveraged products like CFDs, for at least a year.

How is GBE Brokers regulated?

As a CySEC-regulated broker working in compliance with the Markets in Financial Instruments Directive (MIFID), GBE Brokers is obliged to ensure that you will enjoy the highest level of customer fund security at all times.

GBE Brokers is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) – one of the world’s best-known financial supervisory authorities (registration no. 240/14).

In addition to this, the German branch of GBE Brokers in Hamburg is registered with the German Financial Supervisory Authority (BaFin registration no. 148129).

GBE Brokers is furthermore registered with the FCA. As a company that is regulated in a country of the European economic Area (EEA), GBE Brokers offers financial products and services in the United Kingdom (UK) under its registration with the Financial Conduct Authority (FCA) – the British financial supervisory authority (reference no. 717554). Registration status: EEA authorized.

And finally, GBE Brokers works in compliance with the Markets in Financial Instruments Directive (MIFID) of the European Union, which offers investors the highest level of protection and optimizes the efficiency and transparency of market functions.

As an additional security level, GBE Brokers is a member of the Investor Compensation Fund (ICF) which, in the unlikely case of a broker defaulting, insures justified customer claims up to € 20,000.

How do I make deposits and withdrawals?

GBE Brokers offers a range of dependable, trustworthy payment methods. Deposits and withdrawals can be made using leading payment gateways, credit cards and traditional bank transfers.

Deposits are kept in a secure, segregated account at a prime banking institution. Customer funds are kept strictly separate from the company’s own assets and the two are never mixed.

Bank transfers are made in cooperation with Raiffeisen Bank Austria, Astro Bank Cyprus, and Sutor Bank Germany. Deposits will arrive in 1 – 4 banking days. Withdrawals are free of charge, too, as long as they are made in euro and within the SEPA zone. For all other withdrawal requests, GBE Brokers charge 0.15% of the withdrawn amount with a minimum of 15 EUR / 20 USD / 20 CHF (ist das die Mindestgebühr oder Mindestauszahlung? Wäre entsprechend zu ändern, ist so doppeldeutig).

Withdrawals by credit card and Neteller/Skrill will usually be made the same day, but fees will become due for deposits as well as withdrawals with them. The fee for deposits by credit card is 1.49%, and by Neteller/Skrill 3.6% or 2.9%, respectively. The fee for withdrawals by credit card is € 2, and 1% for both Neteller/Skrill.

What is the minimum deposit?

The minimum deposit is € 1,000.

What are the margin requirements?

The margins for main forex currencies start from as little as 3.33%. The margin for minor and exotic currency pairs is 5%.

The margin for metals and bonds is also 5%. The margin for indexes is 5% and that for index futures 10%.

A 10% margin becomes due for commodities and energies.

The highest margin is required for shares, where it comes to 20%.

Is GBE Brokers an ECN/STP broker?

According to GBE Brokers, they are an ECN/STP broker.

Is there any positive slippage?

It is in the interest of GBE Brokers to at last reduce executions with negative slippage.

Final words

GBE Brokers is a good broker and meets the key criteria any forex and CFD broker should.

The support is also competent and always easy to reach.

With MetaTrader and some additional tools available, the trading is also fast and relatively uncomplicated.

The executions and pricing both seem to be fair.

There are also no requotes with GBE Brokers.

Another plus worth mentioning is that there is no bonus for new customers, as experience has shown that they will not benefit from this in the long-term.

GBE Brokers is a trustworthy and recommendable forex and CFD broker, as far as we can tell.

Read more: