Broker comparison – who is the best? In this article, we are introducing Dorman Trading.

Inhaltsverzeichnis

Who is Dorman Trading?

Dorman Trading is one of the world’s oldest family-run futures brokers, established in 1956 by Bernard Dorman. The founder was a commodities trader at the Chicago Board of Trade (CBOT). Two generations of the Dorman family are still actively involved in the day-to-day running and management of the company.

Dorman Trading is registered with the National Futures Association and the Commodity Futures Trading Commission.

Which markets are tradable?

Dorman Trading will let you trade futures only as the broker specializes in futures trading.

Dorman Trading gives traders access to the markets of the CME Group (including CME, CBOT, NYMEX, COMEX) and the Eurex exchanges.

The following futures can be traded:

- Currencies

- Energy

- Interest rates

- Stock indices

- Metals

- Commodities

Which platforms are there?

Besides the proprietary platform Doman Direct, there is also a whole range of other trading platforms.

At this point in time, you can choose from the following platforms:

What is Dorman Direct?

Dorman Direct is their proprietary platform, also known as T4.

Inter alia, the platform offers you the following features:

- T4 Sniper – creation of user-defined spreads

- Options Pro – expanded options functions such as Heatmap, for example

- Order Templates – order template creation and automation of entries and exits

- Spread Matrix – overview of the calendar spreads, butterflies and condor strategies

- Own App: the company’s own app will also keep you continuously up-to-date on the go

Can Dorman Trading also be used with NinjaTrader?

Dorman Trading does not offer NinjaTrader as a trading platform directly. But NinjaTrader is available with NinjaBrokerage. NinjaBrokerage is an introducing broker of Dorman Trading, amongst others, permitting Dorman Trading and the NinjaTrader platform to be combined.

Which customer groups does Dorman Trading cater to?

Dorman Trading divides its clients into the following groups:

- Professional

- CTA/Funds

- Algo Traders

- Individual

- Institutional

- Introducing Broker

The service is the same for all customer groups. All traders benefit from the many years of experience and fast execution speeds.

There are differences in the commissions, however, with particularly high-volume traders getting special discounts.

Algo traders, for example, benefit from the trading servers located directly in the CME data centre in Aurora. Dorman is additionally also compatible with many Platforms specifically developed for algo traders.

What is systems trading?

Dorman Trading offers various automated trading systems, with over 1,750 of them to choose from at this point in time.

They generate automatic buying and selling signals that can be automatically implemented in real time.

These systems are offered with the following partners:

- Striker Securities

- iSystems

- Collective2

You can view the respective systems with their key parameters such as profit factors, drawdowns, traded markets, capital requirements, ROI, etc. at the partner in question. This way, every trader can choose the system that suits them best. The systems offer the advantage that everything is completely automated, enabling traders to earn money passively. And with the trades still executed via Dorman Trading, you will always have a reliable broker by your side.

Is there a training section?

Yes, Dorman Trading also has an educational section where the key terms of futures trading are explained, and regular market reports provided.

What other trading tools are there?

In the „Quotes and Charts“ section, you can view various markets and filter them by changes and volumes.

In addition, you can also view the respective contract specifications also showing the name, exchange, trading hours, trading month, contract size and point value next to the symbol.

The market calendar provides an overview of upcoming dates of relevance for futures traders.

Is there a Wikipedia entry for Dorman Trading?

No, there is no Wikipedia entry, but an entry on Marketswiki.com.

What do the experiences with Dorman Trading look like?

The experiences with Dorman Trading are very good.

Particularly appreciated are the favourable conditions, many years of experience in the market, and the great range of available trading platforms. In addition to which the account opening process is uncomplicated and of a transparent design.

What is their customer support like?

The customer support is competent and easily reached by live mail or on the telephone. They are able to provide competent answers to your questions.

How do I open a real money account?

Opening an account is fast and uncomplicated.

Simply click the „Open Account“ button and then enter your personal data.

The whole thing won’t even taken ten minutes.

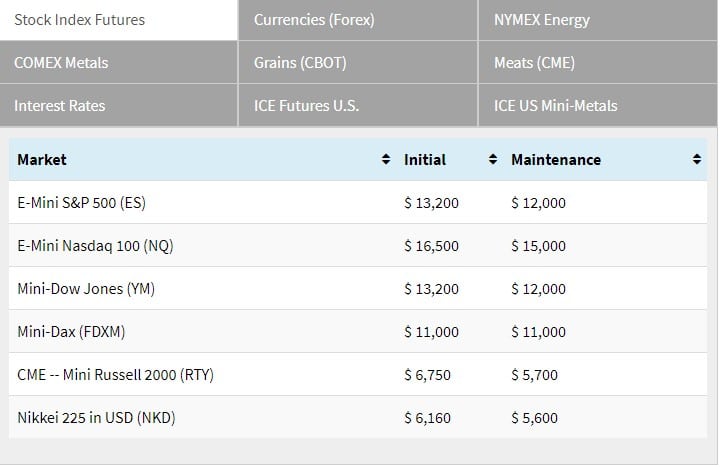

How high are the margins?

The margins are higher than with other US brokers.

The initial margin runs to:

Apart from these, you can also go for the ICE US Mini-Metals, where the margin is considerably lower than with the large contracts. The current margin of the Mini Gold future is US$ 1,650, in contrast to the regular gold future, whose margin requirements are US$ 10,000. The Mini Silver future is also tradable.

Upshot of this report about Dorman Trading

Dorman Trading is one of the world’s oldest brokers.

Its financial stability and the fact that it is run by the family make it one of the most dependable brokers altogether.

Anyone wishing to use the NinjaTrader platform and still rely on Dorman as a broker can open an account at NinjaBrokerage and select Dorman Trading as their broker.

This makes Dorman ideal for futures traders, but it also offers outstanding technology for algo traders.

There is a large selection of trading platforms and the fees are competitive as well.

As the margins are a little higher than with the competition, and the training area is not that large, Dorman is primarily used by more professional traders.

The customer service is easy to reach and competent.

And the trading systems provided in cooperation with other providers are also interesting.

Further reading: