We’ve noticed that many new traders are interested in day-trading the DAX index or DAX futures, but lack important information. In this article, I’d like to explain the basics of DAX futures trading and answer the most common questions we get about our live day-trading of DAX futures.

I’ll be discussing the following topics in the article about day-trading DAX futures:

Inhaltsverzeichnis

Selecting a broker and account size

If you want to day-trade DAX futures, we recommend opening a futures account.

Because futures, or futures contracts, are traded on exchanges and their price is determined by supply and demand, it doesn’t really matter which broker you choose. The most important criteria when choosing a broker are transaction costs, required margin, and the trading platform.

All these vary with the size of your account. Brokers in Europe, for example, charge a higher margin than those in the United States.

If you have trading capital of more than €18,000, you can open an account with Interactive Brokers – certainly an excellent choice.

If you have a smaller account, you’ll only be able to trade DAX futures through a broker in the United States due to margin requirements. AMP Futures or NinjaTrader Brokerage are suitable for smaller accounts.

If you want to trade DAX futures with one of the brokers in the US, it’s advisable in most cases to have a minimum account balance of $5,000. The larger the account, the better, as it reduces the amount of risk per trade.

In general, you should consider the following criteria when choosing a broker:

- Price execution, spread, and slippage

- Transaction costs

- Service/support

- Product range

- Segregation of customer funds from broker funds

- Separation of brokerage services from market-making activities

- No proprietary trading by business units with contact to customers

- If available, brokerage rating from a rating agency

- Financial stability, strong balance sheet

- Discretion

- Login protection

- Clearing

Risk per trade

A single futures contract has a value of €25 per DAX point. We generally work with a stop loss of 7 to 13 points in DAX futures trading.

Please note: we ALWAYS work with a stop loss. No order will be entered without a clearly defined stop.

The average risk per trade is 10 points, or €250 (10 x €25).

So if you’re willing to risk 1 percent of your trading capital on each trade, you should have at least €25,000 in your account.

Trading tools

You don’t need much for the actual trading.

Most importantly, you need a futures account with one of the brokers I’ve mentioned above. It automatically comes with access to the order book/DOM and Time & Sales. In addition to the Level 1 data thus provided, you need Level 2 data from Eurex in order to view the full depth of the order book.

You can find additional information on the order book/DOM, Time & Sales, and Level 1 and 2 data in our article “Order Book Trading – DOM, Level 2, and Time & Sales” (currently available only in German).

Additionally, you need a trading platform for chart analysis.

ProRealTime is an excellent software program that provides accurate data and good charting. I use it myself.

But there are many other software providers that fulfill the requirements of DAX futures day-trading. Another good platform is the Trade Navigator from Genesis Financial Technologies.

Generally speaking, all of these are available at the different brokers. The brokers in the United States offer a very wide variety of trading platforms.

The difference between DAX futures and the DAX cash index

The DAX is the leading German stock market index. It’s made up of the 30 largest German companies based on order book volume and market capitalization. For this reason, it’s also referred to as Germany’s blue-chip index.

The DAX contains companies from various sectors that account for around 80 percent of the total market capitalization of all listed companies in Germany. It can thus be seen as an indicator of the development of the German economy.

In the media, this index is usually referred to simply as the DAX. What is meant, though, is the DAX cash index. Typical trackers such as the L&S DAX, DB DAX, and GER30 are all based on the DAX cash index.

The DAX is calculated on the basis of the Xetra prices of the 30 DAX stocks using a weighting formula established by Deutsche Börse.

In a cash market, orders are executed and settled almost immediately.

The futures market is the opposite of the cash market. There is a large time lag between the purchase and settlement of a contract. This is also true of the DAX futures contract, also called the FDAX, where “F” stands for future. The FDAX is a contract on the underlying DAX 30 that is traded on the Eurex Exchange (the European futures and options market).

To simplify a bit, DAX futures can be understood as a bet on the level of the DAX at a certain date in the future. This is called a forward bet. The market participants who make this bet agree to deliver or to take delivery of a portfolio replicating the DAX index at a specified point in time.

The price of the FDAX is based on supply and demand, but due to arbitrage with the cash market, it’s in synch with the DAX index. Arbitrage prevents major deviations or divergences between the FDAX and DAX.

Normally, the FDAX is higher than the DAX cash index. The difference becomes larger for contract expiration dates further in the future and for money market interest rates that are projected to be higher at the expiration dates. The price of futures can be calculated on the basis of the following equation: price = DAX cash + cost of carry (the hypothetical refinancing costs until the expiration date). On the expiration date, the price of the DAX futures and the DAX cash index converge. For more on this topic, as well as an example of index arbitrage, please see:

“What Is the ‘Fair Value’ of a Futures Contract” (currently available only in German).

CFDs

CFD stands for contract for difference. CFDs are a type of swap and thus belong to the category of derivatives. They can be used for hedging or speculation.

Margin calls for CFDs were abolished in August 2017, but these contracts are still subject to the risk of total loss. In fact, due to the elimination of margin calls, this risk is now even greater because the new rule forces brokers to close open positions when the collateral deposited in a customer’s account (margin) is depleted. Even short-term price fluctuations can cause this to happen.

The additional problem with CFDs is that they’re traded over the counter (OTC). There is no price discovery on an exchange; rather, prices are quoted by various providers (market makers). This means that the pricing of CFDs is normally not as fair or as transparent as the pricing of the underlying asset that is traded on the exchange. Market makers have a certain leeway when pricing the contracts. An additional problem is that brokers can see the stop losses, which creates an additional conflict of interest.

Due to the low margin requirements of many US brokers, even traders with smaller accounts can trade futures directly through them.

Learn: Losses with CFDs: The 10 Most Common Mistakes (2021)

What are futures?

Like CFDs, futures can be used for two purposes: to hedge or make speculative bets. In fact, futures originated as hedges.

A futures contract is sometimes referred to as a forward contract. More specifically, it’s an unconditional forward contract for the purchase and sale of a specific asset (underlying) at a specific future maturity date and at a forward price set when the contract is entered into.

Exchange-traded futures are standardized and specify the following:

- a precisely defined object (underlying)

- a specific quality and quantity (contract size) of the underlying

- the purchase price of the underlying, agreed upon at contract formation

- a fixed future settlement date

- the method of settlement (delivery of the object against payment of the agreed price or cash settlement).

Standardization facilitates transparent trading, low trading costs, and easy market access.

What is margin and leverage?

In order to trade futures, you must deposit the required margin (collateral) in your account.

However, you only need to raise a fraction of the full contract value.

The full contract value of the FDAX at a price level of 12,500 can be calculated as follows:

12,500 x €25 = €312,500

In this case, the full contract value is €312,500.

Margin is only a fraction of the full contract value and is not the same at all brokers. At many US brokers, for example, margin is only $2,500. This corresponds to a leverage of €312,500 / €2,500 or 125 (for simplicity’s sake, one dollar = one euro). This means that with just €2,500, you control a contract worth €312,500. At Interactive Brokers, intraday initial margin is currently €14,631, which results in leverage of €312,500 / €14,631 or 21.

If the value of your account falls below the required margin, you receive a so-called margin call. This means that the broker asks you to deposit more money in your account. If you don’t, the brokerage will close your open positions to protect your capital and ensure it doesn’t have to chase after any money that is lost.

Intraday initial margin refers to the margin required for day-trading. It doesn’t apply to positions held overnight. If you want to hold futures overnight, you have to deposit overnight margin, which is generally much higher because holding positions overnight involves greater risk, such as the possibility of a gap opening the next day. At Interactive Brokers, overnight margin for the FDAX is currently €29,262.

Tick size and tick value

A tick is the smallest possible price movement. For the FDAX, it’s 0.5 points.

The tick value is the minimum price variation for a futures contract. For the FDAX, it’s €12.50.

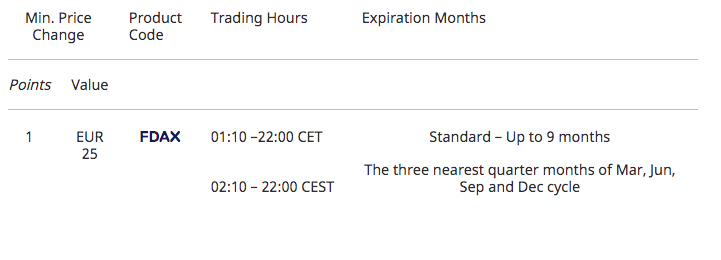

Contract specifications for the FDAX

If you want to see the different specifications for a futures contract, it’s best to look them up at the associated futures exchange. Contract specifications include all the standardized codes and trading information you need for the different futures. For the FDAX, Eurex is the applicable exchange:

The difference mini-DAX futures and DAX futures

There are different contract specifications for mini-DAX futures and DAX futures.

The mini-DAX has a minimum price movement, or tick, of one point, while for DAX futures it’s 0.5 points.

For mini-DAX futures, one tick is worth €5, for DAX futures, €12.50. Given that one tick in DAX futures is 0.5 points, a one-point move is worth €25 (2 x €12.50 = €25).

Because mini-DAX futures and DAX futures differ in terms of their tick values, there will always be minimal price differences between the two.

Mini-DAX futures are well suited for beginning traders and/or smaller accounts.

Because of the smaller tick value, the margin for mini-DAX futures is less than that for DAX futures. Intraday initial margin for mini-DAX futures at Interactive Brokers is currently just €2,919, or one-fifth the margin of DAX futures. This is because the full contract value is also only one-fifth of the value of DAX futures.

Learn: The new Micro E-mini futures: an alternative to CFD trading?

The Eurex exchange and its trading hours

Eurex is one of the largest international derivatives exchanges. It offers some of the most liquid derivatives on euro-denominated equity indexes and fixed income in the world. Its products include DAX futures, mini-DAX futures, and Bund futures.

The product range is rounded off by a variety of derivatives on individual equities, alternative asset classes, and commodities. These can be traded on the exchange or OTC.

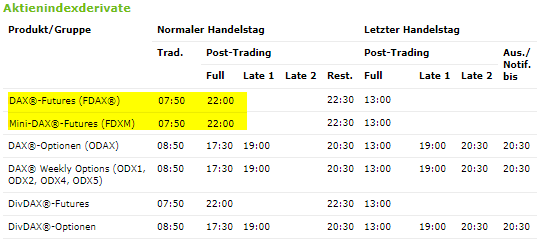

The trading hours for DAX futures and mini-DAX futures are a follows:

Symbols and maturities

Symbols and abbreviations may vary from broker to broker, but the most common ones are:

- DAX future: FDAX

- Mini-DAX future: FDXM

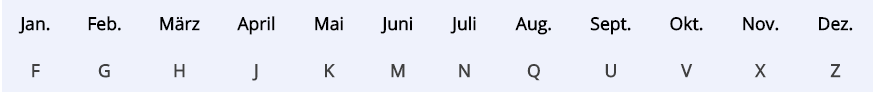

Because futures always have limited durations, these symbols are followed by the code for the respective month and year.

For DAX futures (as well as mini-DAX futures), the trading months are March, June, September, and December.

The two digits at the end designate the year. The code for the DAX futures contract expiring in March 2018 looks like this: FDAX H 18

Order types when day-trading DAX futures

The most common order types are:

Buy market order (buy order with no limit price)

The trader agrees to accept the current price when purchasing DAX futures.

Sell market order (sell order with no limit price)

The trader agrees to accept the current price when selling DAX futures.

Buy limit order

Traders specify a maximum price at which they agree to purchase DAX futures.

Sell limit order

Traders specify the minimum price at which they agree to sell DAX futures.

Stop loss order

A stop loss order is a sell order executed at the next traded price after a limit set by the trader is reached.

Stop buy order

A stop buy order is a buy order executed at the next traded price after a limit set by the trader is reached.

Stop sell order

A stop sell order is a sell order executed at the next traded price after a security reaches or falls below a limit set by the trader.

Stop at break even (BE)

This is not a traditional order type, but an important concept in trade management. It involves moving the stop to the entry or “break even” (BE) price.

Rolling futures and the triple witching hour

Because futures have specific expiration dates, traders must roll their contracts if they want to remain invested in the asset beyond maturity.

Rolling means switching from the current futures contract to one with a longer time to maturity. To do so, you need to close your current position and open a new position in this other contract.

If you stay invested until contract expiration, you theoretically risk having to buy the underlying asset. Because most brokers don’t support physical delivery, the risk is in fact negligible, but you should keep in mind that your position will automatically be closed by your broker, triggering cash settlement. The market can be very illiquid during these periods, leading to poorer execution (slippage).

This has no direct relevance for day-trading, but it’s good to be aware of the limited duration of futures and always trade the contract with the highest trading volume.

Four times a year, there is a triple witching hour in the futures market due to contract expirations. It takes places when three classes of options and futures expire, which is on the third Friday of every quarter. This applies to all the major stock exchanges around the world (with the possible exception of public holidays).

On the Eurex derivatives exchange, futures and options on the DAX expire at 1 pm.

These periods are extremely important for day traders, because increased market volatility and trading volume can be expected on both the expiration day and the days leading up to it.

As the time of final settlement approaches, institutional market participants try to push prices in their direction, which leads to larger price swings, especially in the last hour before expiration.

There’s also a double witching hour the third Friday of every month. However, its impact on markets is usually negligible. It’s also worth noting that DAX futures only expire quarterly.

15. Contango and backwardation

Contango and backwardation are two important concepts related to the rolling of futures.

Futures are rolled to avoid actual delivery of the underlying asset and to allow continuous investment.

If the contracts that are purchased are more expensive than the ones sold, traders incur a roll loss. Another name for this situation is contango.

When the market is in contango, the roll yield is negative, reflecting a rising forward curve.

If, on the other hand, the newly purchased contracts are cheaper than the ones sold, the situation is called backwardation. In this case, the rolling of contracts generates profits (also known as roll gains).

The roll yield is positive, reflecting a declining forward curve.

Spread and slippage

The spread is the difference between the current bid and the current ask.

Because futures are traded on an exchange, every broker displays the same spread. For CFDs, however, the spread varies from broker to broker.

In addition, spreads change depending on the market situation. Increased volatility and nervousness in the market result in a wider spread.

Slippage occurs when an order is executed at a worse price than desired. Increased volatility is one reason.

Settlement and delivery

A futures contract is comparable to a sales contract in which both parties agree to exchange goods and money in a step-by-step process. Settlement is the final stage of this process, in which the exchange actually takes place.

For DAX futures, settlement takes the form of a cash settlement. Payment is due on the first day of trading after the settlement date.

Although this is irrelevant to day trading, you should at least have an understanding of the basic principles.

Day-trading the DAX: conclusion

Professional futures trading involves more than just following a few charts.

Futures are fascinating but also complex products, and traders should always be aware of the principles behind the futures they trade.

The standardization of futures contracts facilitates transparent trading, low costs, and easy market access.

Read more: