A pivot point is a mathematically calculated point on a chart that often serves as support or resistance. It represents a potential turning point in the market or can be used as an indicator of market movements.

Inhaltsverzeichnis

Pivot point basics

With the help of pivot points, you can easily and consistently calculate support and resistance levels.

There are various types of pivot points, and all have one thing in common:

They are calculated on the basis of the highs and lows of the previous trading day (“daily pivots”). This makes them a popular instrument because they contain the most important information from the previous day.

The most important aspects are:

- Price fluctuation

- High

- Low

- Close

With the help of the pivot point, you can calculate additional support and resistance levels that reflect market volatility.

The five most popular types of pivot points are:

- Standard

- Fibonacci

- Camarilla

- Woodie

- DeMark

Standard pivot points

The best-known pivot point is known as the standard or classic pivot.

It’s calculated using the following formula:

Pivot = (H + L + C ) / 3

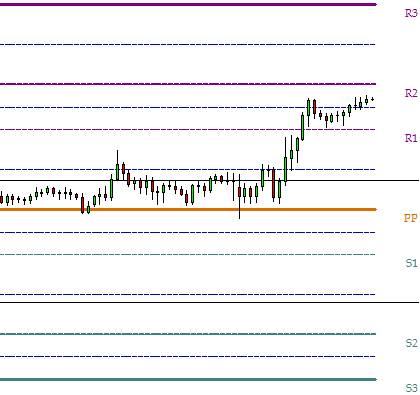

In other words, it is simply the average of the high, low and close of the previous day. It provides a foundation for calculating additional support and resistance levels. Generally speaking, the market is considered bullish when prices rise above the pivot point, and bearish when they fall below it.

Support and resistance levels are calculated as follows:

R3 = H + 2 (Pivot – L)

R2 = Pivot + (H – L)

R1 = (2 x Pivot) – L

S1 = (2 x Pivot) – H

S2 = Pivot – (H – L)

S3 = L – 2(H – Pivot)

These points are often used as stop loss and take profit levels. One possible approach is to look for a short scalp when prices reach R3, and a long scalp when prices fall to S3.

Fibonacci pivot points

The Fibonacci pivot is calculated the same way as the standard pivot. The result is then multiplied by the well-known Fibonacci levels. Many traders work with 38.2%, 61.8% and 100% retracements. Because of their popularity, it makes sense to use them as multipliers to calculate pivot point levels.

R3 = PP + ((High – Low) x 1)

R2 = PP + ((High – Low) x .618)

R1 = PP + ((High – Low) x .382)

PP = (H + L + C) / 3

S1 = PP – ((High – Low) x .382)

S2 = PP – ((High – Low) x .618)

S3 = PP – ((High – Low) x 1)

Camarilla pivot points

Camarilla pivot points were developed in 1989 by the bond trader Nick Scott.

They place greater emphasis on the closing price than standard pivot points. They involve calculating eight major levels (four resistance and four support levels) with the help of a multiplier. The underlying idea is that prices have a tendency to fall back to and test the previous close.

The idea is similar to standard pivots. When R3 is reached, you should look for a short entry. When S1 is reached, you should consider long trades.

However, if R4 or S4 is breached, it should be taken as the sign of a strong intraday trend, and you should trade only in that direction.

R4 = C + ((H – L) x 1.5000)

R3 = C + ((H – L) x 1.2500)

R2 = C + ((H – L) x 1.1666)

R1 = C + ((H – L) x 1.0833)

PP = (H + L + C) / 3

S1 = C – ((H – L) x 1.0833)

S2 = C – ((H – L) x 1.1666)

S3 = C – ((H – L) x 1.2500)

S4 = C – ((H – L) x 1.5000)

An interesting aspect of Camarilla pivot points is that you can replace the multipliers with your own values and calculate interesting levels depending on the market or currency pair.

Woodie’s pivot points

In terms of how they are calculated, Woodie’s pivot points are similar to Camarilla pivots. They also focus on the closing price, which is multiplied by a factor of two.

R2 = PP + High – Low

R1 = (2 X PP) – Low

PP = (H + L + 2C) / 4

S1 = (2 X PP) – High

S2 = PP – High + Low

DeMark’s pivot points

DeMark’s pivot points are calculated as follows:

If the close < open, then X = (H + (L * 2) + C)

If the close > open, then X = ((H * 2) + L + C)

If close = open, then X = (H + L + (C * 2))

You calculate R1, S1 and PP as follows:

R1 = X / 2 – L

PP = X / 4

S1 = X / 2 – H

FAQs about pivot points

1.) What do R and S stand for?

R stands for resistance and S stands for support.

2.) True or False? Pivot points are sufficient on their own to consistently perform well in the market or conduct market analysis.

False.

3.) How can range traders profit from pivot points?

When the price reaches upper resistance, they can enter a short trade. When the price falls to lower support, they can trade long.

4.) What type of traders can benefit the most from pivot traders?

5.) If a range trader has entered a long trade at S1, what is the first recommendable take-profit level?

PP, or the pivot point itself, because the sequence is as follows: S3 > S2 > S1 > PP > R1 > R2 > R3.

6.) What closing data do traders usually use for the high, low, open and close in pivot point calculations?

The closing price in New York.

Because the forex market is open twenty-four hours, most traders use the closing price at 4:00 pm EST on the previous day in New York.

Conclusion on the use of pivot points

For most of the trading day, prices move between R1 and S1. Pivot points can be used not only by range traders, but also by breakout and trend traders.

Range traders typically go long near S1 or short near R1.

Breakout traders often place a stop buy above R1 and a stop sell below S1.

Trend traders often use pivot points to identify a bullish or bearish trend and place their take profit near R3 or S3.

Due to their simple use and standardized calculation, pivot points are an attractive trading tool. If you know which pivot points have a high probability of success in a given market or with a given approach, you can use them to identify important price levels without having to look for additional support and resistance in a chart.

However, like all other trading tools and indicators, pivot points are not the holy grail and have little significance on their own.

Read more