In this article we want to introduce the best traders in the world and their trading performance.

Inhaltsverzeichnis

Overview

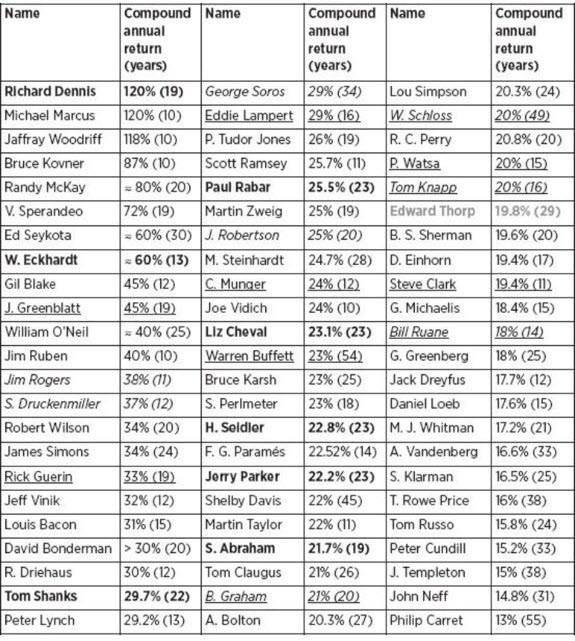

I’d like to start by posting a ranking of the top traders in the world and their performance. Afterward I’ll describe the individuals and their trading approaches in greater detail.

The table below ranks the best traders in the world.

Their names are followed by their compound annual return and the number of years they achieved it (in parentheses).

In addition to well-known traders such as William O’Neil, Jim Rogers, Stanley Druckenmiller, Peter Lynch, Warren Buffett, and Benjamin Graham, there are a number of unknowns on the list.

The best traders are probably the ones least known to many readers.

It’s worth noting that Larry Williams – the trader with the best annual performance in the history of trading (11,376 percent in one year) – is not included in this list. Why? Because he has never come even remotely close to achieving this extreme performance again. It can thus be assumed that it was more of a stroke of luck than a real trading achievement.

An annual return achieved just once is meaningless in trading.

However, if a trader achieves the same or a similar return over many years, it’s significant.

The top five traders in the world achieved their high annual returns at least ten years in a row. That’s a significant period of time.

Now let’s take a closer look at the top five traders.

Richard Dennis: the Turtle Trader

Richard Dennis achieved an incredible annual return of 120 percent for 19 years in a row. That’s truly amazing.

But who is Richard Dennis? I suspect he’s unknown to many readers.

More people are probably familiar with the Turtle Traders – a legendary group of traders founded by Richard Dennis and his friend William Eckhardt.

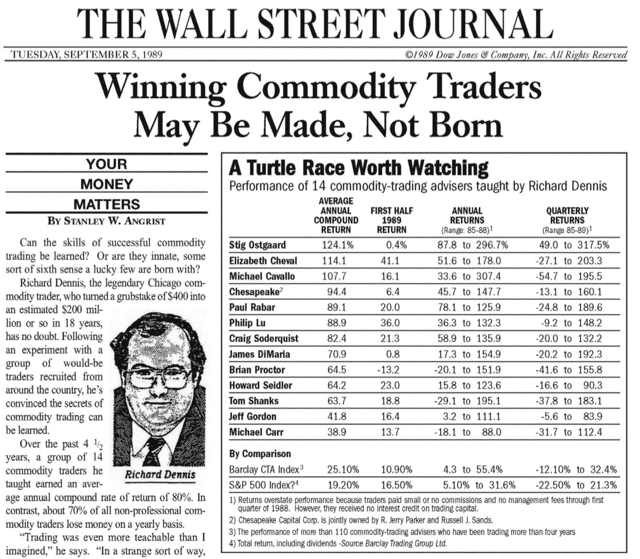

The project was a result of Dennis’s conviction that people could learn trading like any other skill. Eckhardt disagreed. So the two launched an experiment in which they trained 14 young people with no professional trading experience. They taught them a trend-following system for futures trading.

After the simulation phase, the ten best traders among them were allowed to trade with real money. They achieved an average annual return of 80 percent over the next four years. Many still work as traders today. This is the best proof to date that trading can be learned if you’re given the right tools.

The Turtle Trading System is no longer effective, not only because markets have changed, but also because too many people know the system.

The author Michael Covel has published a book on the Turtle strategy called The Complete Turtle Trader.

The strategy is based on two scenarios:

Breakout from a 20-day high

- Go long when the market reaches a new 20-day high.

- A trailing stop remains in place until the position reaches a 10-day low.

- The stop loss is twice the ATR of the past 20 days.

- The stop loss is not deactivated until the trailing stop is above it.

- For a short trade, all the rules are reversed.

Breakout from a 55-day high

- Go long when the market reaches a new 55-day high.

- A trailing stop remains in place until the position reaches a 20-day low.

- The stop loss is twice the ATR of the last 55 days.

- The stop loss is not deactivated until the trailing stop is above it.

- For a short trade, all the rules are reversed.

Richard Dennis developed a 100-percent rule-based system with a 100-percent rule-based exit strategy. This was an enormous advantage at the time. Even today, trend-following strategies are among the most effective trading strategies in the world.

This system made Dennis the best trader and trading coach in history. As it became known to more people, though, the traders who used it lost their edge.

Michael Marcus: the small cap trader

In less than 20 years, Michael Marcus turned a stake of 30,000 dollars into an incredible fortune of 80 million dollars.

He says that his mentor Ed Seykota deserves credit for his success.

Marcus bought plywood futures in 1972. That year, the US government took measures to freeze commodity prices, but futures contracts rose sharply and his stake grew from 7,000 to 12,000 dollars.

In 1973, he began trading derivatives and once again increased his trading capital significantly, from 12,000 to 64,000 dollars.

He joined Commodities Corporation, where he worked as chief currency trader.

He also founded his own company, Canmarc Trading, through which he invests in small cap companies and makes private placement investments in the small cap sector.

This explains his performance. At the start of his career, Marcus managed to increase his capital almost a hundredfold in a very short time. Later he had the opportunity to participate in private placements in the small cap sector through his company and network.

This continues to be a profitable approach today, but the sector is accessible only to very few people. Anyone who has the right network and access to the sector can achieve exceptionally high, sustainable returns.

Unlike Richard Dennis, Marcus didn’t pursue a trading strategy that retail investors can copy.

Jaffray Woodriff: the quant

Jaffray Woodriff is the co-founder and CEO of Quantitative Investment Management (QIM), a three billion dollar hedge fund.

Quantitative Investment Management (QIM) is one of the world’s largest hedge funds in the managed futures space.

Woodriff ranks among the highest-paid hedge fund managers in the world.

Unfortunately, we don’t know much about his trading approach.

His last blog article is dated February 26, 2013.

He’s a bit more active on Twitter, but he doesn’t discuss his trading approach there either.

It is generally known, however, that his hedge fund uses, among other things, a fully automated trend-following strategy to trade futures and stocks.

Of all the traders who work professionally in asset management, Jaffray Woodriff is the only one who ranks among the top three traders in the world.

Unlike the majority of well-known asset managers such as Warren Buffet, he doesn’t take a purely fundamental approach. He’s a trader with an extremely good understanding of the market, which enables him to achieve extremely high returns despite the huge sums under management.

Bruce Kovner: the macro trader

Bruce Kovner borrowed 3,000 dollars against his MasterCard to place a bet on soybean futures. The contracts increased in value to 40,000 dollars, but then gave back much of the gains. Kovner closed the trade with a profit of “just” 23,000 dollars, earning almost eight times his original investment. He learned an important lesson in the process – “the importance of risk management.”

He began his trading career under Michael Marcus (see above), earning his first million and, with it, initial fame. This capital enabled him to launch his own hedge fund, Caxton Associates.

Caxton is a macro fund. Unlike Jaffray Woodriff, Kovner doesn’t use a quantitative approach. He invests in all asset classes, including stocks, bonds, and commodities. Discretionary decisions play a major role, in stark contrast to quant. Another well-known follower of this strategy is George Soros.

The approach involves identifying macroeconomic developments at an early stage and profiting from them. Social, political, and economic developments are monitored and bets are placed on certain scenarios coming true.

As a rule, around 80 percent of the strategy is based on fundamentals, and 20 percent on chart analysis.

It’s an interesting approach that the majority of institutional traders continue to use today, especially in the forex market.

Randy McKay: war veteran and FX trader

After flunking out of college as a psychology student, Randy McKay was drafted by the marines and served in the Vietnam War.

When he returned, his brother Terry, a broker at the Chicago Mercantile Exchange (CME), helped him get a job as a runner on the exchange floor. For two years, McKay worked at the CME in the mornings and attended college in the afternoons. This was nothing more than a side job at the time, as he still wanted to be a psychologist. All that changed in 1972.

That year, the CME launched a subdivision, the International Money Markets. Because demand in this new segment was low, the exchange sold seats for 10,000 dollars, far below the normal price of more than 100,000 dollars.

His brother helped him out once again, letting him use his own seat and loaning him 5,000 dollars. McKay used 2,000 of the loan as start-up capital for his trading, and in a little less than six months, he had turned it into 70,000 dollars.

He made his first million with a trade in British pound futures (GBP/USD). After the British government announced it would cap the exchange rate at 1.72 dollars, McKay speculated that the pound would move about this mark. He significantly increased his position, speculating on a breakout. After a consolidation phase lasting several weeks, the price jumped to 1.75 dollars and he bought even more. When his price target of 1.90 dollars was reached, he sold his remaining contracts, making a profit of 1.3 million.

McKay uses a swing approach based on a combination of price action and fundamentals. He tries to catch medium-term trends and prefers trading breakouts. Once a trade shows a profit, he usually increases his risk. In phases where his performance is poor, he reduces risk.

The best traders and their trading performance: conclusion

The five best traders in the world use different trading approaches and different risk and money management strategies, but each is highly successful with their own method. This shows that there is no such thing as the “best” trading approach or strategy. Everyone has to find the approach that suits them best. This is work you have to do for yourself because you have to feel comfortable and identify with your trading style.

Read more: