Broker comparison – who is the best? In this article, we are introducing tastyworks from the USA.

Inhaltsverzeichnis

Who is tastyworks?

Tastyworks is an online broker from the USA, where it is based in Chicago. The idea since its inception in 2017 is to make option and futures trading affordable and effective for retail investors. To this end, they created a high-performing trading platform that is easy to manage and intuitive to operate.

The business operations of tastyworks are overseen by the US Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA). For more details, see the FINRA BrokerCheck.

Its low fees and uncomplicated account opening also make this broker interesting for traders from the European region.

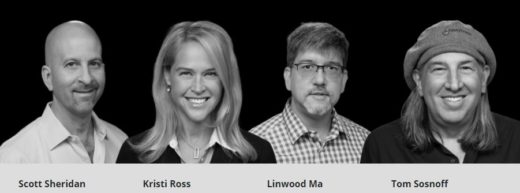

The people behind tastyworks

- Scott Sheridan, the CEO of tastyworks, Inc., is a former CBOE (Chicago Board Options Exchange) floor trader and has already made a name for himself as a co-founder of the platform thinkorswim

- Kristi Ross, co-CEO and president of tastytrade, also joined the team in the thinkorswim period

- Linwood Ma, CTO of tastytrade, Inc., is another old acquaintance who proved himself as the CTO of thinkorswim

- Tom Sosnoff, co-CEO of tastytrade, Inc., is probably the team’s best-known face. With his experience as a CBOE floor trader, he decisively contributed to the development of thinkorswim, and now of tastytrade and tastyworks.

Which markets are tradable?

- Futures and Micro futures of the CME Group (across all major asset classes such as equities/interest rates/currencies/energy/precious metals/agricultural products, source: CME Group)

- Small futures of the Small Exchange (SMFE), a new futures exchange founded by the tastyworks team (smallexchange.com)

- Options on the aforementioned futures

- Options on micro futures

- Shares and ETFs

- Options on shares and ETFs

Which platforms do they have?

Effective trading calls for the right software. Besides popular charts and filters, the makers of tastyworks also contributed their options trading experience in the development of the trading platform. This with a focus on fast execution, intuitive operation and an optimized way of working.

Desktop installation of the trading software

To install the software package, you need to have an active trading account at tastyworks and 200 MB minimum of free disk space. The application can run on computers from 2 GB RAM and with an internet connection over 1.5 Mb/sec. Installation is possible with these operating systems:

- Windows 8 and above (Win 10 recommended)

- Mac OS X from 10.13 (10.14 recommended)

- Linux: Ubuntu 18.04 LTS (minimum)

The desktop version offers expanded chart functions as well as a variety of Indicators and drawing tools.

Browser-based trading platform

Your trading can also be handled on the web application of the tastyworks Trading software without compromising the functionality. Apart from the access data for your trading account and a minimum screen resolution of 1024×768 pixels, you will also need one of the following browsers:

- Chrome from version 50

- Microsoft Edge version 38 and up

- Firefox version number 48 and up

- Safari from version 8

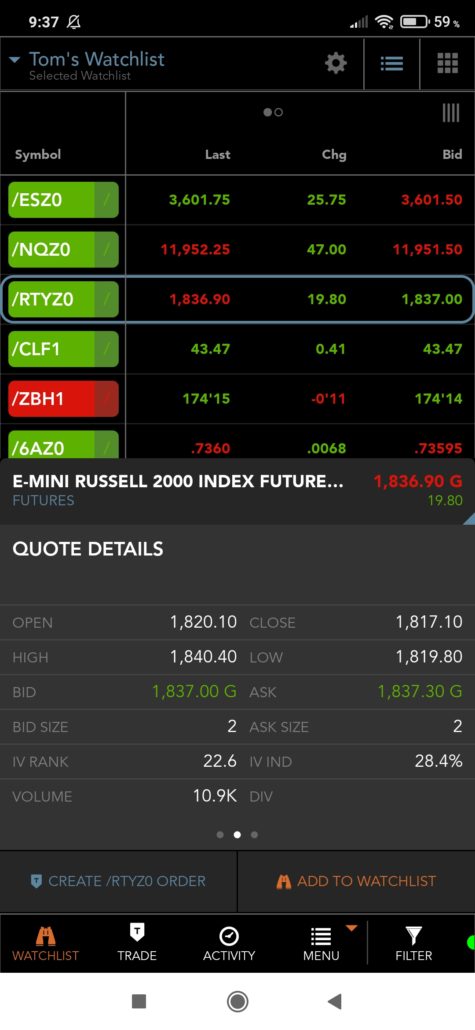

Mobile trading with the app for iOS and Android

For mobile access to your trading account and portfolio management on the go, they also have a powerful app. This can be installed on iPhones from iPhone 6 and all commercially available Android smartphones (comparable from Nexus 6).

The app features the same selection of option strategies as the main platform, along with its possibility to create watchlists and view the lists of tastyworks traders.

Unique features for option traders at tastyworks

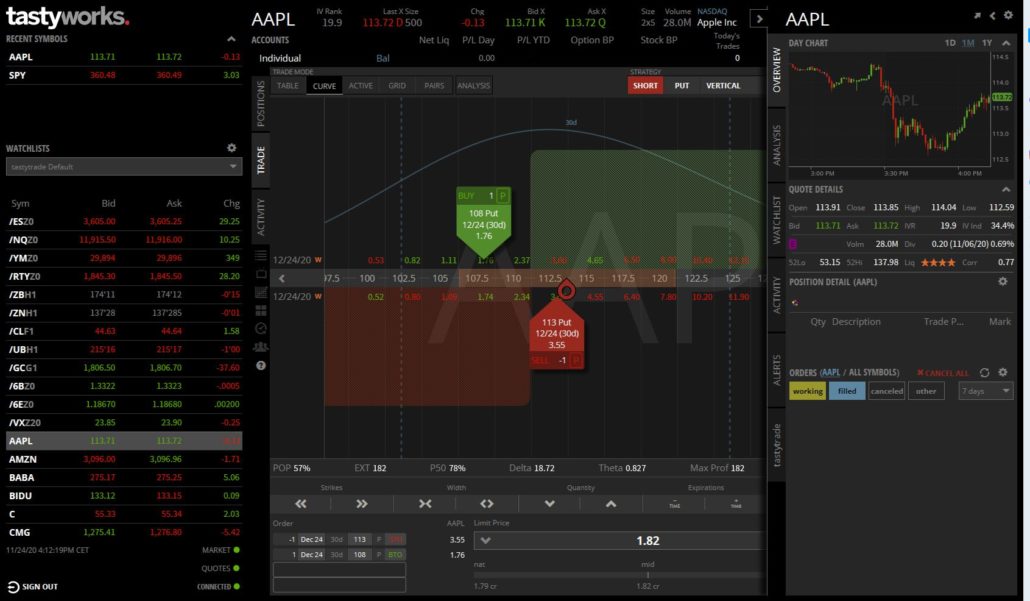

Based on their own experience and the contents of the tastytrade online video service, the developers have specialized in options trading. The trading platform thus offers a number of interesting tools for finding suitable underlying assets. Suitable option trades can then be selected straight from the listed results and the corresponding orders created.

Filters and analysis

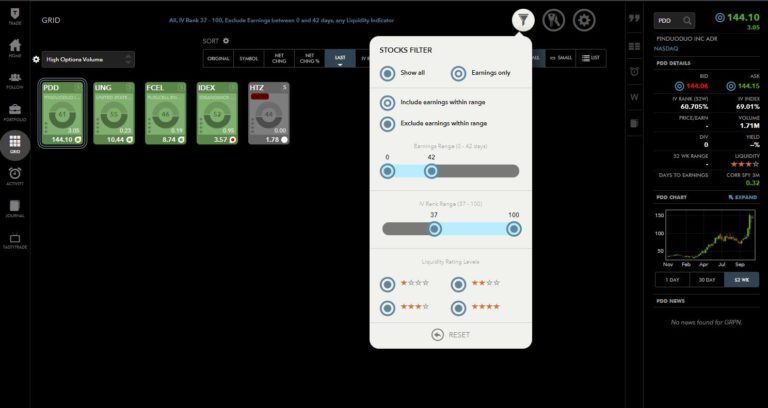

One of the most important parameters in option trading is the price. The price development of options is reflected in their Implicit volatility (IV). The IV Ranking (IVR) factor has established itself as a fast assessment of the IV as high or low. In keeping with the tastytrade philosophy, the trading strategies pursued there are largely based on the interplay between this IVR and the POP (probability of profit).

Accordingly, these parameters are also shown in the selection of the underlying, in the order mask and in the ongoing trades. Over and beyond the IVR, the stock market can similarly also be filtered by upcoming earning dates and the liquidity of the options.

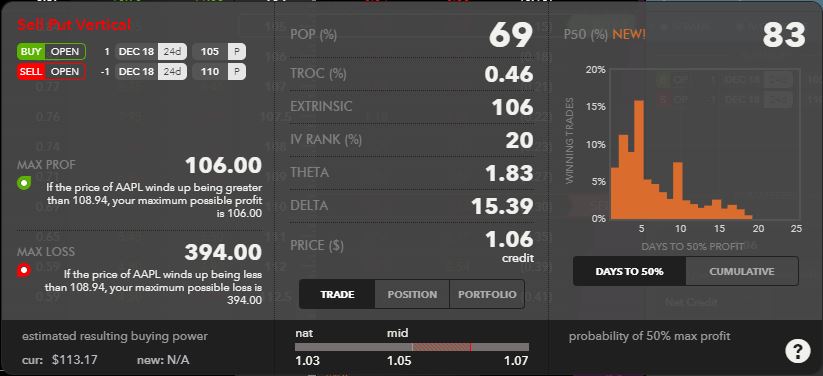

Profit and loss profile

Just as appreciated in option trading is a visualization of an option strategy’s profit and loss zones. Which is why this function has been integrated in the option chain as well as the open positions. Even the sum of all ongoing trades can be shown as a P&L chart. The rather schematic nature of these charts is more than made up for by the possibility of viewing option-specific parameters for the chosen strategy, including the Greeks.

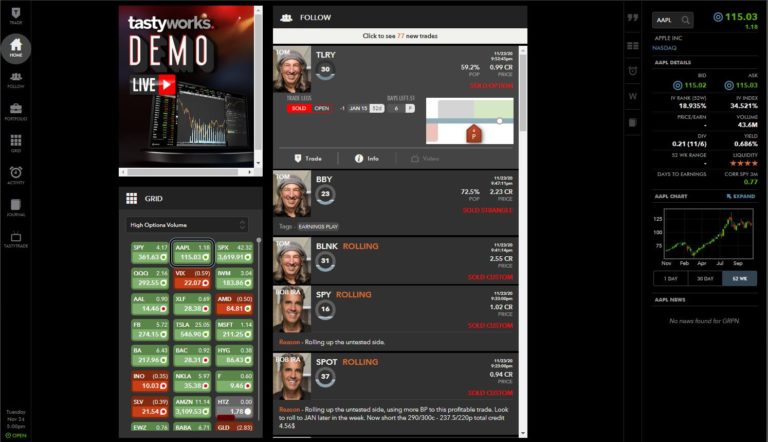

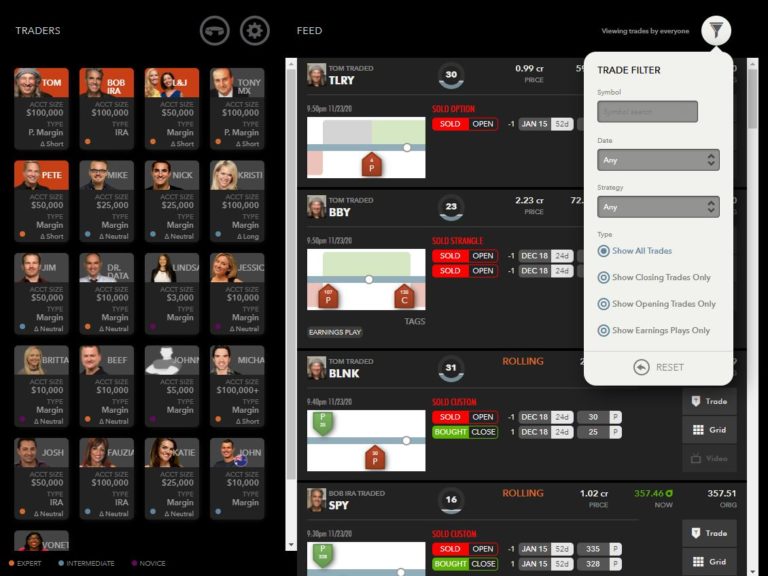

Trading ideas / social trading

Another unique feature at tastyworks is their Follow Feed that continuously shows the trades of selected tastytraders. Each trader is introduced by a brief portrait showing their trading experience, trading style and success rate. This can be helpful for finding fresh inspiration or verifying ideas of your own.

All the published trades can be copied to the order screen by a single click to make them yourself. The number of contracts and limits can then be adjusted before sending the order.

Which account types do they offer at tastyworks?

The Works

„The Works“ is their most flexible account package for active retail traders. Portfolio Margin, which gives you access to a higher amount of leverage, is possible from an account equity of $ 150,000. In addition to which you can trade all the available products, partly following a separate application.

Individual

This is their standard account for natural persons, permitting you to select either a margin or cash account. Please see the table at the end of this chapter for their margin rates.

Joint

This is an account type for two persons, e.g. a married couple or life partners. You can also choose between a margin and cash account here. In the TIC (Tenants in Common) version, each of the two owners have a specific proportion of the account’s assets. If one of the account holders dies, their share is passed on to their heirs.

An alternative to this is the WROS (With Rights of Survivorship) version, a joint account where two owners hold equal shares of the assets. If one of them dies, the surviving owner will have full rights to the account.

Retirement

This is based on US regulations for individual retirement accounts, and offers you various account types that help you benefit from them with tax breaks. As a consequence, this account type is only available to US citizens.

Corporate

Accounts for enterprises and self-employed persons – also only if they are based in the USA.

Trust

This could probably be best described as an escrow account.

International

This version is probably the most interesting one for readers of this article outside the USA. Tastyworks is open to international customers, offering them cash and margin accounts, as well as their Portfolio Margin. You can choose your preferred version in the relatively uncomplicated account opening process, and then change or supplement it later at any time.

How do I open a real money account?

Simply click this recommendation link to go to the start page for opening an account.

This will open a screen where you can enter all the required data. The website will guide you through the account opening process step by step. Opening and holding an account are both free of charge. Funds can be transferred to your account in various ways.

What are the options for making deposits?

Tastyworks offers you a variety of methods for funding your trading account. But the only really meaningful one for clients outside the USA is bank transfer (‚Deposit by Wire‘), as all the others are only possible with accounts or brokers in the USA.

These bank transfers may be subject to extra fees, depending on the financial institute. It is therefore recommended to make enquiries at the respective bank beforehand so that you won’t be surprised by the costs. The following needs to be noted on the tastyworks side: While deposits in their trading accounts are free of charge, withdrawals to a German bank account will set you back $ 45.00 each. Anyone planning to make regular withdrawals should take this into account.

If you already have an account at Interactive Brokers (or a partner broker such as CapTrader, for example), funds can also be transferred to tastyworks from there free of charge. This process is similar to a bank transfer. At IB, the first payout per month is free of charge.

How high are the margins?

The margin rate depends on the account size with a base rate of 7%. See the table below for the respective levels:

What fees do they charge?

The fee structure at tastyworks is not that complicated and quite transparent. You should note that you will need to pay clearing fees at the respective exchanges even if no fee is charged for the trades themselves. These clearing fees depend on the place of exchange and instrument, but are usually quite low, with $ 0.0008 due for each share, $ 0.10 per contract for stock options, and $ 0.30 for futures options, for example. A full price list with all the details is available at the following link: Price overview

Stock options cost $ 1.00 per contract at the opening, the closing is free. The fees are capped at $ 10.00 per leg, so that all contracts from the 11th are free.

The broker lets you trade stock positions without commissions, leaving only the exchange fees to pay.

The illustration below gives a short overview of the broker’s fees for the most popular trade instruments:

How much is the minimum deposit?

There is no minimum deposit for opening an account. But note that you will only see delayed price data without a credit balance. Real-time prices become available as soon as you make a deposit. There are no additional fees for the price data.

Is there a demo account or paper trading?

As things stand now on 24/11/2020, tastyworks is not offering any options for Demo or paper trading.

Does tastyworks offer a training section?

A video channel called tastytrade that is also operated by the organizers of tastyworks has been up and running since 2011. The Broker platform was developed from those ideas. Besides nearly eight hours‘ worth of livestream on trading days, there is also an extensive library of training videos for option and futures trading. And the trading platform’s functions are also explained in a number of videos in the help section.

Each presenter has a special field for which they publish videos and comment market developments. There are also regular live shows in various cities. The whole program is rounded off by topical blog posts on the platform. All the contents can be found at the Website or in the relevant video portals.

In addition to this extensive range, they have also launched a financial magazine under the name of „Luckbox“ recently „that helps you shape the way you live, trade, invest, and cultivate your own stacked probabilities“, as they put it.

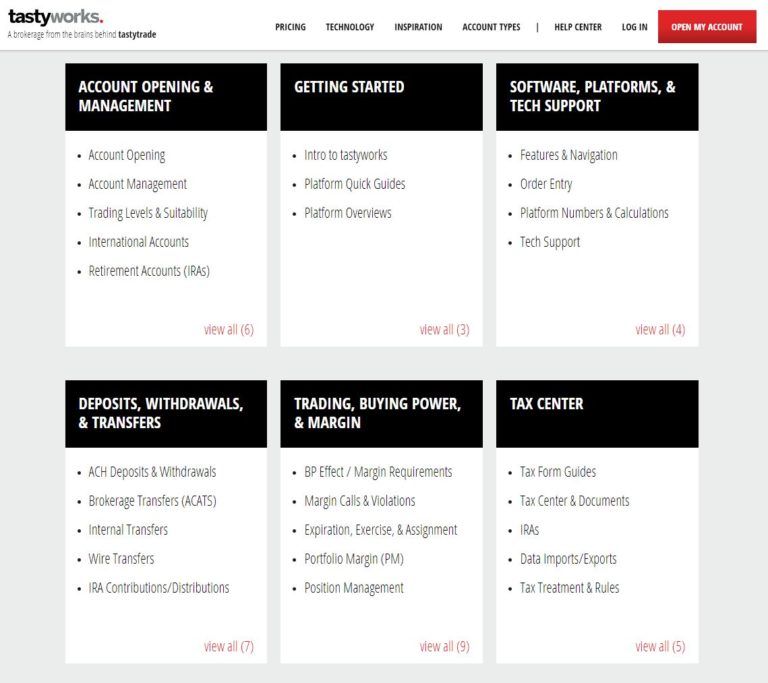

What about the customer support?

The first port of call for asking questions is the tastyworks Help desk where you will find answers and tutorials for the most common situations,

instructive videos explaining the first steps after opening an account and how to operate the trading platform. If you encounter problems beyond that, you will also get a prompt answer if you use their contact form.

What are the experiences with tastyworks like?

The research in blogs and forums largely comes up with positive reviews. And the support’s response time to emailed enquiries are a few hours at most. Deposits and withdrawals are executed correctly and promptly, as are the orders.

An order placed at tastyworks will be routed directly to the exchange and immediately appear on the bid and/or ask side. This is verifiable with an account at another broker with illiquid options.

Conclusions for the US broker tastyworks

The easy account opening process and intuitive software make tastyworks an ideal broker for option traders. The inexpensive trading with stocks and futures is another plus. Real-time prices become available from a low deposit, enabling novices to take their first steps with Puts and Calls without extra payments for price data too.

The tastytraders‘ trade feed is an interesting tool for inspiring new trading ideas. Option trades can be found for every account size using their special filters.

For all the positive features, there are also some drawbacks. The fee for deposits is quite pricey for one. And then the account can only be held in US$. Anyone trading larger sums and making corresponding profits should ask their tax consultant if in doubt.

Further reading: