In this article I’d like to take a closer look at correlations in the forex market. Correlation is a measure of association. It can arise because of causal or stochastic relationships.

A distinction is made between positive and negative correlation. In this article I’d like to share some thoughts on currency correlations.

Inhaltsverzeichnis

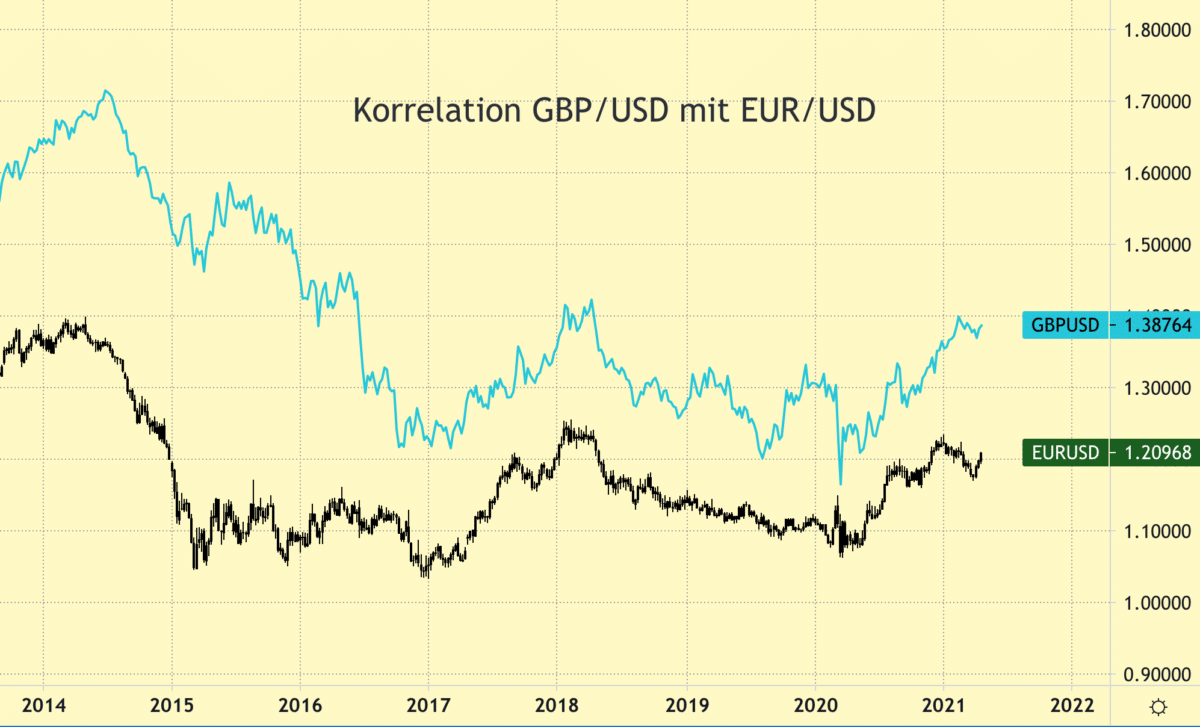

The correlation between EUR/USD and GBP/USD

As a forex trader you need to pay close attention to correlations – by which I mean the degree to which currency pairs move in unison. For example, if you have a short position in EUR/USD and open an additional short in GBP/USD, you increase your overall risk because EUR/USD and GBP/USD tend to move in the same direction. Let’s take a look at some current correlation coefficients between these two currency pairs:

- Over the last 10 days, the correlation was relatively low at 0.3 or 30 percent.

- Over the last 25 days, though, it reached 0.91 or 91 percent.

- Over the last 50 days, the movements of the two forex pairs were even more similar, with a correlation of 0.98 or 98 percent.

The chart above compares the currency pairs EUR/USD and GBP/USD. By clicking and enlarging the daily chart of EUR/USD and GBP/USD, you can view the price movement of the two currency pairs over the last 50 days. The similar price action catches the eye.

Over the last ten days (shown in the yellow box), the correlation between EUR/USD and GBP/USD has only been around 30 percent. The chart shows the reason for this: whereas the euro has hit new lows against the US dollar, the pound has essentially moved sideways against the same currency. In other words, the two currency pairs have stopped moving in lockstep.

The longer-term correlation can be viewed on a weekly chart. By clicking and enlarging this chart, you can see the price movement of the two currency pairs over the past two years. There are periods marked by close correlation, but sometimes EUR/USD and GBP/USD become disconnected.

It’s interesting to take a closer look at the period in the summer 2014 when sterling did not begin declining against the dollar until 12 weeks after the euro, marking a shift to falling prices.

Calculating the correlation between forex pairs

You can easily plot and see the relationship between two or more currency pairs on a chart, as I did above with my comparison of EUR/USD and GBP/USD.

A number of websites offer a correlation calculator or show the correlation coefficients for all the major currency pairs. Here are a few:

- Correlation calculator from Investing.com

- Representation of the correlations

- Mataf: Correlation values

- myfxbook: Forex correlations

The correlation calculator and correlation matrix

A correlation calculator measures the correlation between currencies. It’s easy to build one yourself in Excel by downloading historical data from platforms such as MetaTrader or ProRealTime.

With the help of the correlation calculator, you can quickly get an idea of the relationship between the respective currency pairs. It allows you to answer two important questions:

- How strong is the correlation?

- What is the direction of the correlation?

Correlation strength measures the extent to which a connection exists. It ranges from zero (no correlation) to one (strong correlation).

The direction of correlation tells you whether the markets move in the same or opposite directions. Markets that are positively correlated move in the same direction, whereas markets that are negatively correlated move in opposite directions. If the correlation is positive, the coefficient value is anywhere from zero to plus one (+1). If there’s a negative correlation, it ranges from zero to minus one (-1). Markets that move in perfect unison have a correlation of +1, while markets that move in the exact opposite direction of each other have a correlation -1. A correlation coefficient of 0 means that there is no meaningful relationship between two markets.

Currency pairs with a negative correlation are also referred to as opposing currency pairs and are well suited as hedges.

On the basis of a correlation matrix, you can easily see that EUR/USD and GBP/USD have a correlation of nearly 100 percent. You should be aware of this relationship if you want to take a position in both. Correlation should also be considered for EUR/USD and USD/CHF. They have an extremely high negative correlation and are thus seen as opposing currency pairs. If you’re a day trader, you can look at the same matrix for one to five-minute charts. I’ve built my own correlation matrix that shows correlations on a 30-second chart and the difference to average correlation over the last 36 minutes.

The correlation of AUD/USD with other asset classes

In addition to looking at the correlations of currency pairs have with each other, it’s also important to know whether a currency is correlated with commodities. After all, some currencies have high correlations with commodities because the countries that issue them are dependent on the export of one or two raw materials. The currencies AUD, CAD and NZD are the best-known examples.

As far as AUD/USD goes, you should keep in mind that around 25 percent of Australian GDP is generated by the commodities industry. As a result, commodities have a significant impact on the currency. AUD, for example, exhibits a strong positive correlation of around 0.88 with iron ore. In recent years, this correlation has increased considerably.

So it’s important to understand what correlations exist and why. In 2015 iron ore exports grew, but an important threshold was probably crossed earlier on, in September 2014. You should also look at the entire cycle of commodity prices, which is determined by supply and demand and gives you additional insight into iron ore and its correlation with AUD. Finally, falling prices on exchanges tend to lead to higher correlations than rising prices. This is related to the asymmetrical thinking of many investors and is a psychological phenomenon in the markets.

How can you trade and profit from correlations in the forex market?

There’s not much sense in knowing something about correlations if you can’t profit from this knowledge as a trader. I know a lot of people who are extremely knowledgeable about a subject, but whose knowledge is of little value in trading. Analysts are the best example. Knowing more than other people doesn’t automatically make you a better trader, but a proper understanding of correlation is certainly valuable. In my opinion, it’s the most important component of trading, along with fundamentals. I don’t think there’s any point in trying to distinguish between correlations in day trading and swing trading, because they work in very similar ways.

Using correlations to reduce exposure

Exposure is another term for risk. So why don’t I write “risk” in the first place? Because I want to introduce you to the language of professionals —learning to trade starts with language and thinking. You should try to use correlations to reduce the overall exposure at a given point in time. Now, if you know which currency pairs correlate with other pairs and in what way, you can use this knowledge to manage your risk better. For example, it usually doesn’t make sense to go long both EUR/USD and GBP/USD because you’re almost doubling your risk. If you have to double your risk in order to potentially double your performance, the trade usually isn’t worth it. It’s a different matter if you’re able to significantly increase the probability of success.

Using correlations to profit from strength or weakness

Another trading strategy is to use correlations to profit from emerging strength or weakness. For example, if you know the correlations that exist between currency pairs in smaller time frames and notice, say, that the euro is currently quite strong, while another currency pair that has the euro as its base currency is slightly weaker, you can buy this currency pair when it triggers a long signal. There’s a good probability that it will continue strengthening. The same applies to weak currency pairs. Here I believe the principle works even better.

But what I find most interesting is when a currency pair breaks out of a correlation for a short period of time and then moves in the opposite direction. You can also profit from such action in the stock market, as reflected in relative strength or weakness. For example, you can look for stocks that show weakness despite a strong market and thus develop their own dynamic. These stocks are interesting. The same is true in forex. Currency pairs that develop weakness and their own dynamic despite strength in the base currency are interesting to trade. Coupled with the above-mentioned knowledge of the asymmetry of investors, you have a good tool to work with.

Conclusion of my article on correlation in currency pairs

Knowing and using the correlations between the currency pairs you trade is one of the more important challenges for a forex trader. Every additional position you enter can increase – or minimize – your risk. As a trader, your goal should always be to maximize performance and minimize risk. By using correlations correctly, you can get a bit closer to achieving this goal. In addition, correlations are well suited for discretionary trading, especially in smaller time frames, and thus for scalping.

If you have any questions about currency correlations in the forex market, please post them in the comments section at the bottom of this page.

Read more: