The Australian dollar is the monetary currency in Australia issued by the Reserve Bank of Australia (RBA). In addition, the Australian dollar is also used as the official currency in several other places, namely, the island states of Kiribati, Nauru and Tuvalu.

On the current ranking list of the globally most-traded currencies, the Australian dollar ranks fifth, after the US dollar, the Japanese yen, the Swiss franc, the euro and the British pound. The common abbreviation for the currency within the country itself is the dollar sign $. In some cases A$ or AU$ is used to distinguish it from other dollar currencies.

Inhaltsverzeichnis

History of the Australian Dollar

Prior to the introduction of the Australian dollar in 1966, the Australian pound was used. When the new currency was introduced, it was initially pegged to the US dollar through the Bretton Woods system. However, this entanglement was dissolved in 1971.

Until the 1970s, not only was the Australian dollar largely under the control of the national government, but also the Australian financial market in general. This state control was then relaxed in the 1970s and 1980s. This was due, not least, to the economic crisis in Australia during this time, which resulted in increased unemployment and a high inflation rate.

In this context, the abolition of state interest rate control is also worth mentioning. In the years following, the Australian market was finally opened to banks from abroad, and, at the end of 1983, the currency was able to be traded on the currency market for the first time.

From the 1990s onwards, the Australian financial market picked up again, and the economy was increasingly brought into a global context. Nowadays, the RBA only intervenes, on average, on 5% of all trading days.

Recent Developments

In 2012, the Australian dollar reached a peak (at that point in time you only got 1.16 Australian dollars for 1 euro), which was partly due to China’s economic power, which purchased a considerable amount of commodities in Australia. Another reason for this was the low interest rate policy of American and European banks.

After the Australian dollar had reached this peak, its exchange rate against the euro weakened again somewhat, which was due in particular to the high interest rate policy on government bonds of the countries during the euro crisis. At the moment, you get about 1.61 Australian dollars for one euro.

Stock Market in Australia

Stock trading in Australia is basically represented by the Australian Securities Exchange (ASX), previously known as the Australian Stock Exchange. The headquarters of the exchange is located in Sydney. The main indices are the S&P/ASX 200, the S&P/ASX 50 and the All Ordinaries.

The ASX was founded in 1987 after the six exchanges from Australia’s largest cities merged. It wasn’t until 2006 that the name was changed. The Australian Securities Exchange ranks among the top 20 largest exchanges in the world in terms of market capitalization.

Trading Hours in Australia

Before going into more detail on the trading hours of the forex market regarding the Australian dollar, I will first briefly discuss the trading hours for Australian stock trading.

There are many different trading times in the ASX exchange, which can be seen in detail on the exchange’s website www.asx.com.au. Pre-market trading takes place from 7:00 a.m. to 10:00 a.m. (AEST). During this time window, the traders prepare their orders for the main trading time.

Orders can already be submitted then and are placed in a „queue.“ Only when the main trading begins, however, will these submitted orders be processed, one after the other. The main normal trading then runs from 10:00 a.m. to 4:00 p.m. (AEST). Converted to the time in Germany, the main trading takes place between 01:00 a.m. and 07:00 a.m.

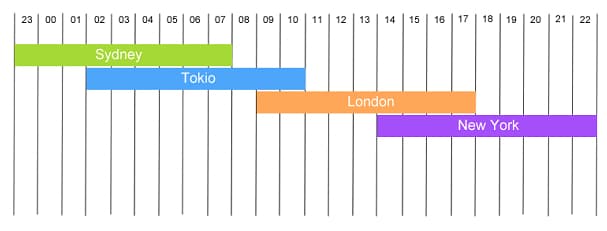

In forex trading, however, the trading hours are quite different. Basically, the Australian dollar (AUD) can be traded around the clock – except on weekends. Since trading in currencies is decentralized and takes place without stock exchanges, market participants trade among themselves largely regardless of time. With some brokers (especially ECN brokers), forex trading is also possible on weekends, but the market is not really active during this time as the institutional market participants are no longer available.

The trading hours are therefore mainly influenced by the time difference between the time zones in different countries. The forex market in Sydney opens around 10 p.m. (UTC) and closes in New York around 11 p.m. (UTC) on Friday. The following graph provides a clearer picture of the different time zones.

The graph shows that the opening times overlap at times in which a large number of investors and traders are active. For investors from the Middle European Time Zone, trading is therefore particularly interesting from 1 p.m. onwards because both the U.S. and European markets are active at this time.

Since the trading hours on the Forex market are far more flexible compared to those on the stock market, there are no opening gaps during the week.

Risk-on/Risk-off and the Australian Dollar

Another special feature of the Australian dollar is that it is a high-interest currency that is very influenced by the market environment. This is also referred to as a “risk-on” or “risk-off” setting. Risk-on is a market sentiment in which investors take higher risks when trading and use higher-interest investments. In risk-on periods, there is usually an economic upswing, which is why investors choose to invest in high-interest asset classes such as the Australian dollar.

As a result, high-interest currencies such as the Australian dollar will appreciate. For this reason, the Australian dollar is not regarded as a “safe haven” for investment opportunities, not least due to its economic dependence on China. For example, noticeable price changes can be seen whenever new economic data for China is published.

In recent years, for example, the Australian dollar has lost value again and again in comparison to the euro when economic data from China was published, which indicated that the country’s growth rate was falling.

When the opposite is true, however, the Australian dollar generally benefits in times of economic boom in China and on a global scale. The dependence on China is mainly due to the export of commodities. The proportion of commodities exported to China is over a third.

In risk-off periods, on the other hand, the market sentiment tends to be negative, which is why investors look for supposedly safe currencies as an investment. These include, for example, the Japanese yen (JPY) or the Swiss franc (CHF).

Economic Situation in Australia

Australia has one of the world’s strongest economies. Average annual earnings “Down Under” are around 71,518 Australian dollars (study conducted by https://www.averagesalarysurvey.com/australia). Australia is characterized by its diverse labor market as well as a low level of unemployment and a generally high standard of living.

With its high economic growth rate, Australia has been high on the list among OECD countries since the beginning of the 1990s. In 2018, the unemployment rate was around 5.3 percent (source: Statista). The high immigration of skilled foreign workers is also significant for the working world in Australia.

Important Trading Partners

The U.S., South Korea, New Zealand, China, Japan, Singapore and Germany are among Australia’s largest trading partners. As previously mentioned, the economic powerhouse China has a particularly important position; in 2017, goods worth over 85 billion dollars were exported to the country (source: OEC).

Natural Resources and Commodities in Australia

These high export sums are primarily made possible by the country’s wealth of natural resources and commodities. Trade in commodities accounts for almost a quarter of Australia’s GDP. The most important commodities include:

- Iron ore

- Coal

- Gold

- Zinc

- Silver

- Uranium

- Petroleum

- Natural gas

The value of the coal deposits Down Under is currently estimated at 1.7 trillion euros; oil is estimated at approx. 258 billion euros. Apart from the classic natural resource commodities, some other commodities also play an important economic role. These also include livestock breeding (especially cattle and sheep), with the raw commodities wool and meat.

Agriculture

Approximately 2.55% of the people (source: Statista) in Australia are still active in the primary agricultural sector, from which a full 80% of the goods produced are subsequently exported.

Service Sector

Big cities like Sydney and Melbourne play an essential role here. Over 78% of people in Australia currently work in the tertiary sector.

The Australian Dollar and Trading

Now we will examine trading with the Australian dollar on the forex market in more detail. As mentioned in the previous chapter, there are a variety of currency pairs with the Australian dollar that are traded on the foreign exchange market. With an approximate trading volume equal to 174 billion US dollars, the Australian dollar ranks fifth on the list of the world’s most traded currencies (source: Bank for International Settlements – BIS).

The Australian dollar has a high level of liquidity, which is also always a good prerequisite for successful trading on the Forex market. However, a high level of liquidity is itself no guarantee of effective trading in the Forex market.

In order to be able to trade profitably with the Australian dollar, in addition to an appropriate trading strategy, a certain amount of specialist knowledge and expertise on the various factors influencing the Australian currency is necessary. And at this point it should be said that it is not enough to simply take a look at certain charts. Instead, it is important to take a broad look at the Australian dollar and all its influencing factors.

If you break it down, the Australian dollar is, first of all, influenced by supply and demand. If a large company, such as Amazon, wants to convert its profits made in Australia into US dollars, then this has – depending on the volume of money moved – a corresponding influence on the price (even if only in the short term).

Reserve Bank of Australia (RBA)

One factor that has a stronger influence on whether the price of the Australian dollar rises or falls is the monetary policy of the national central bank. This, in turn, is generally influenced by the key interest rate, which is responsible for controlling bank lending.

The central bank of Australia is the Reserve Bank of Australia (RBA), which was founded in 1960. The head office is located in the metropolis of Sydney. This bank is responsible for regulating the domestic currency and managing the issuance of banknotes and coins. In addition, the RBA is also responsible for managing Australia’s gold reserves and foreign exchange reserves.

The tasks of the central bank of Australia are thus relatively varied. At the center of its range of tasks, however, is the general control of financial market policy. This is to be made possible in particular through a low inflation rate. Of course, the Reserve Bank of Australia has a few other important tasks. These include the following:

- Manage foreign money reserves

- Issue Australian dollars

- Carry out customary banking tasks for its own government

- Play a part in Australia’s economic growth

- Positively influence the employment rate

- Ensure financial stability and currency stability

In carrying out these tasks, interest rate policy also plays a decisive role. For this reason, the interest rate policy background and developments will be discussed in more detail in a later chapter.

Australian Dollar – Currency Pairs

The Australian dollar is now traded worldwide on the forex market with other currencies. The currency is known on the foreign exchange market as “AUD” and is also one of the major currency pairs, i.e. the most widely traded currency pairs. The AUD/USD currency pair in particular is very popular with traders. The following is a brief overview of all currency pairs related to the Australian dollar.

- AUD/USD

- GBP/AUD

- EUR/AUD

- AUD/NZD

- AUD/JPY

- AUD/MXN

- AUD/ZAR

- AUD/CAD

- AUD/CHF

- AUD/NOK

- AUD/SEK

- AUD/SGD

- AUD/HUF

- AUD/HKD

- AUD/CZK

- AUD/PLN

- AUD/DKK

Due to the country’s numerous commodities, Australia possesses one of the so-called “commodity currencies.“ The result of the large commodity trade worldwide is an equally high trading volume of the Australian dollar on the forex market. In the following sections, some popular currency pairs with the Australian dollar are explained in more detail.

The EUR/AUD Currency Pair

Even if the trading volume of the cross currency pair EUR/AUD is not quite as large as that of the EUR/USD major, it is nonetheless one of the most important Euro Crosses on the global Forex market. As an investor, you can choose to rely on the euro to become stronger in relation to the Australian dollar. In this case you are trading a long position in EUR AUD. However, if you want to bet on an appreciation of the Australian dollar in relation to the euro, a short position is required.

Trading with the EUR/AUD currency pair is generally considered to be risky, which is due, among other things, to frequent price fluctuations. Thus, the cross currency pair is particularly suitable for traders who like to take risks when trading.

The mini future long strategy, which is based on the assumption that the EUR/AUD price will rise in the long term, is particularly popular with this type of trader.

As a trading beginner, however, the EUR/AUD currency pair should, if possible, be traded in very narrow spreads and at low trading costs. The cross currency pair can take place within the Sydney session from 22:00-7:00 GMT or during the London session from 8:00-17:00 GMT.

The AUD/USD Currency Pair

The currency pair AUD/USD falls into the grouping of the forex majors, i.e. one of the major currency pairs in global foreign exchange trading. As a trader, you can either trade a long position if you are betting on an appreciation of the Australian dollar or a short position if you bet on the appreciation of the U.S. dollar.

With its very high liquidity, AUD/USD is an especially lucrative currency pair and is particularly popular in options trading.

In addition to the current economic data, the behavior of the U.S. central bank and the Australian central bank should always be kept in mind when trading the AUD/USD currency pair. The Australian central bank is discussed in more detail below.

One of the most popular trading strategies with the AUD/USD currency pair is the carry trade strategy. This strategy often proves to be effective, especially in times of economic growth, and can ensure that long-term profit potential can be achieved.

What factors affect Australian dollar forex trading?

Interest Rate Situation of the AUD

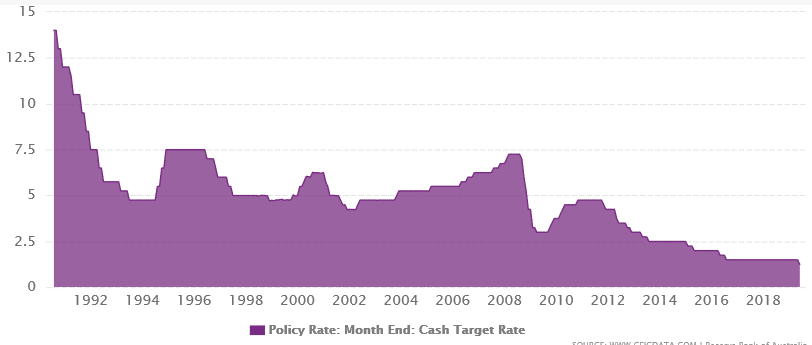

The key interest rate as well as other types of interest in general play an important role in the Australian monetary system. As previously mentioned, interest rates are mainly regulated by the Reserve Bank of Australia (RBA), whose objectives include, in particular, achieving a low, stable inflation rate. In the context of interest rates in Australia, one speaks of the Official Cash Rate (OCR), Cash Rate for short, or Cash Rate Target.

The OCR can also be influenced by the Reserve Bank of Australia, for example, by buying or selling government-issued securities. If the OCR increases or decreases, this then leads to a change in the interest rates, for example, of mortgages and loans that have been taken out.

If you look at the development of Australia’s Official Cash Rate over the past few years, you can see that it has fallen further and further since the 1990s. While the Australian key interest rate reached its peak of 14.00% in September 1990, currently it is only around 1.00%.

The data relating to the Australian key interest rate is updated every month and is always announced at the end of the month. The following is a graph showing the development of the Cash Target Rate from 1990 up to the current point in time. The graph is from www.ceicdata.com and was personally published by the Reserve Bank of Australia.

In this context, it also makes sense to take a look at the loans Down Under. First, there is the interest rate for short-term loans to consider. With a value of 1.20% (June 2019), this is currently at a very low level (for comparison: in 1974 the percentage was up at 21.75%).

For traders, the short-term interest rates are one of the most important factors in valuing currencies – most of the other indicators are only used to predict how interest rates will change in the future.

The interest rate for long-term loans has shown similar behavior. In 1982 it was at 16.50%, and in June 2019 it was down to only 1.38%.

Jobs and Unemployment Rate

The chapter on the economic situation in Australia already briefly touched on the subject of unemployment on the “fifth continent.” In particular, the unemployment rate also has a significant influence on the direction in which the prices on the Forex market develop.

But, on the other side of the equation, the creation of new jobs should also not be ignored. The extent to which jobs are created gives important signals about consumer spending, which, in turn, has a corresponding impact on the economy as a whole.

The unemployment rate in Australia has remained relatively constant over the past few years and generally levels off between 5 and 6 percent. In comparison, the rate in Germany in 2018 was around 3.4%, in the U.S. it was 3.8%. Australia’s unemployment rate still puts it high on the list in an international comparison, which thus has a correspondingly positive effect on the currency.

At this point, one more thing should be mentioned: although the unemployment rate is generally seen as a lagging indicator, it is still an important signal for macroeconomic health, as consumer spending is highly correlated with labor market conditions. Therefore, this does not always have to be a negative indicator in trading.

G7 Summit

Another influencing factor that is also interesting for traders are the meetings and results of the G7 (“Group of Seven”). The G7 is an informal gathering of the economically strongest nations in the West. The heads of state of the respective countries meet at regular intervals to discuss certain problems and challenges of the global economy. The following nations come together at this summit: Germany, France, Italy, Japan, Canada, England and the U.S.

The G7 is characterized by economic strength in global comparison. Added up, the member states only have only 10.5 percent of the world’s population, but they generate 67 percent of the global gross national income.

The international organization was founded in 1975. Russia was accepted as a member in 1998, but was excluded again in March 2014, due to the annexation of Crimea by the former Eastern Bloc state.

How important is this for the individual trader?

Even if the G7 is not actually an official institution, it is a powerful, high-level political body and its initiatives and strategies can have a significant impact on the foreign exchange markets.

CPI Inflation Data

In connection with the inflation rate, the CPI or Consumer Price Index is of considerable importance.

The CPI is used to determine the rise or fall in certain prices. The index measures the extent to which prices of goods in a shopping basket have developed over a certain period of time.

The “shopping basket” includes all consumer goods used in everyday life, such as food, clothing, rental costs, but also cars and certain services. Based on the information obtained from this, conclusions are drawn about the development of inflation or deflation.

How is this relevant for the trading scene? Well, consumer prices have a major impact on overall inflation. And the development of inflation is essential for the valuation of foreign currencies, since a rise in consumer prices leads to the central banks raising interest rates in order to counteract this. The role that interest rates play for traders is already known.

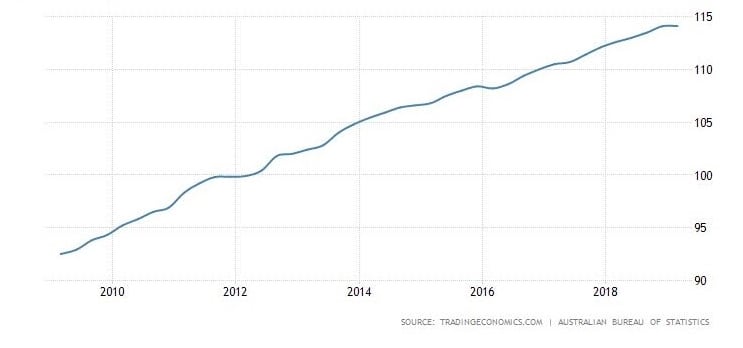

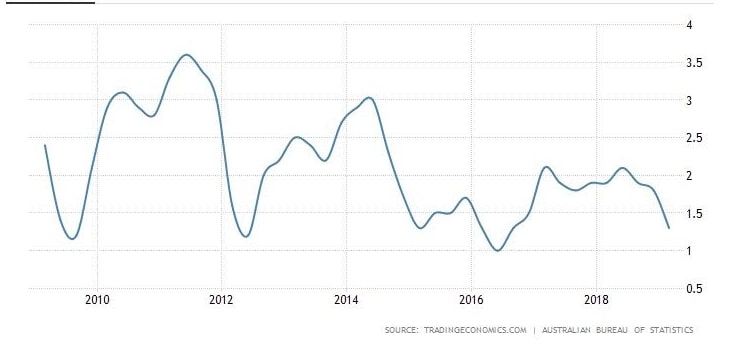

How is the Consumer Price Index doing in Australia? The value of the CPI has risen constantly over the last few years, which can be seen in the following graph.

If you look at the development of the inflation rate over the last 10 years, you can see that it has recorded an annual increase of between 1 and 3 percent on average. This graph provides a clear overview.

The original measurements were made by the Australian Bureau of Statistics (ABS).

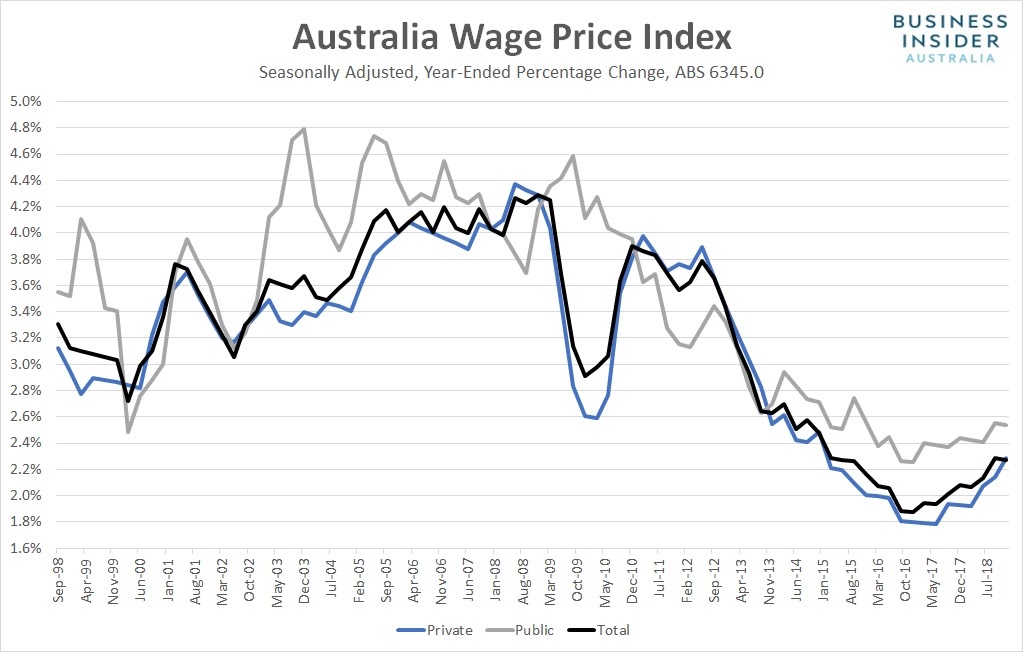

Wage Price Index

The Wage Price Index is another factor that has an impact on Forex trading. The WPI measures the change in normal hourly rates. The number of hours worked and the composition of the workforce are not taken into account, only the hourly rates without bonuses. The WPI is remeasured every quarter and the data is then published by the Australian Bureau of Statistics.

Thus, it is also a measure of inflation. As soon as business costs rise, they usually spill over to the individual consumer.

If you consider the impact that wage developments have on household income and expenditure and, consequently, on developments in the economic situation in general (in Australia, household consumption accounts for almost 60% of GDP), then WPI is one of the main indicators. Both the CPI and the WPI therefore have an enormous influence on consumer behavior and, thus, on the entire economy.

If the wage level remains low over a longer period of time, this increases the downside risk for inflation and thus also the pressure on the RBA to cut the Australian key interest rate again.

The graph below from businessinsider.com.au shows past developments of the WPI.

OPEC Meeting

The next factor to be mentioned at this point is OPEC. OPEC stands for Organization of the Petroleum Exporting Countries and refers to the global organization with headquarters in Vienna, which was founded in 1960. Currently, the following nations are OPEC members:

- Algeria

- Angola

- Equatorial Guinea

- Ecuador

- Gabon

- Iran

- Iraq

- Republic of the Congo

- Kuwait

- Libya

- Nigeria

- Saudi Arabia

- United Arab Emirates

- Venezuela

Iran, Kuwait, Saudi Arabia and Venezuela are among the countries that produce the most oil in the world. All the members of the Organization of the Petroleum Exporting Countries together currently provide around 40 percent of the global production of oil, and they even have more than 75 percent of the global oil reserves.

The OPEC meetings usually take place in Vienna. There, the member states discuss a number of questions in connection with the energy markets and, above all, agree on how much oil they will produce in the future. While the sessions are usually closed to the press, those present usually speak to reporters. At the end of each meeting, a formal statement on policy changes and the objectives of the meetings is published.

The main aim of the meeting is basically to control oil prices at an international level. The oil policy of all member nations is therefore to be controlled and standardized accordingly. In addition, it’s also meant to protect the individual and common interests of these countries.

This goal is to be achieved through a controlled shortage or increase in the production of oil reserves worldwide. As a result, the oil price is then to be lowered, fixed or increased accordingly so that it is within a certain target price zone.

How large of a role does OPEC play when it comes to foreign exchange trading?

As previously mentioned, OPEC represents around 40% of the world’s oil supply and is unified in the production of oil. With such a high degree of control over oil supply, production postponements can have a significant impact on the development of oil prices. And oil prices, in turn, have a major impact on the economic well-being of a country.

Development of the Retail Industry

At this point, the retail aspect will be briefly discussed. Specifically, the change in total retail sales. Because this can also provide important indicators and clues for future developments on the Forex market. As a trader, one should always look first to the developments in the retail sector.

Statistics for this data are also collected every month by the Australian Bureau of Statistics and published on its website. In Australia this is called “retail sales.” The statistics collected on retail sales can be used to measure consumer spending, which is known to make up a large part of the overall economy. Statistics provided by ABS show the change in consumer behavior in recent years (“Australia Consumer Spending”). This is shown below.

Gross Domestic Product (GDP)

Of course, gross domestic product (GDP) also plays a major role when it comes to assessing a country’s economic strength. It is THE most important measure of the state of an economy and should therefore always be used by traders. According to the definition by the German Federal Agency for Civic Education, GDP describes the “value of all goods and services that are generated within the national borders of an economy in one year.”

In English, this value is called “Gross domestic product” or GDP. The following graph provides an overview of the development of GDP in Australia over the past decade.

The numbers on the vertical axis are in USD trillions.

Conclusion

Even though the Australian dollar does not have centuries of history behind it, it is still an interesting currency and it is not without reason that it is one of the major currencies on the Forex market. The country’s enormous variety of commodities enables it to profitably export large quantities worldwide.

Now that the economy Down Under has grown steadily over the past quarter century, investors will be able to see how things will go for the nation and the Australian dollar in the future.

Read more: