Trading software comparison – which is the best? In this article we introduce CQG.

Inhaltsverzeichnis

What is CQG?

CQG, Inc. is an independent software vendor that provides integrated solutions for trade routing, market data and technical analysis.

The company was founded in 1980 and expanded to Europe in 1988 and to Asia in 1998.

CQG is headquartered in Denver and has offices in Chicago, New York, Denver, Glenwood Springs, London, Frankfurt, Tokyo, Sydney, Singapore and Moscow.

It partners with 18 universities and educational institutions around the world, including Hofstra University, Kent State, NYU Stern, Lehigh University, the New York Institute of Finance, University of Colorado at Denver, Northwestern University and the University of Houston.

CQG’s System One was one of the first platforms to offer the CBOT Market Profile.

CQG is now one of the market leaders in trade routing, market data and trading software solutions.

What products are available from CQG?

CQG offers the following products:

- CQG Integrated Client

- CQG Spreader

- CQG Q Trader

- CQG FX

- CQG Desktop

- CQG Mobile

- CQG APIs

- Historical Data

- CQG and Excel

What is the CQG Integrated Client?

The CQG Integrated Client – CQG’s flagship product – combines a wide range of trading, analysis and market data tools.

It features numerous functions and options geared toward the needs of professional traders, including charting, securities trading and portfolio monitoring. It also provides access to a multitude of exchanges and market data sources.

Traders can individualize their workstations any way they like.

Due to its extensive functionality, the CQG Integrated Client is well suited for all traders and trading styles.

The product includes the following features:

- Spread trading

- Charting, including trading from the chart

- DOM Trader and Level 2

- Alerts

- Quote Matrix

- One-click trading

- Numerous order types

- Search and filter functions

- A wide range of newsfeeds

- Market data for numerous markets

- TFlow

- Portfolio monitoring

- More than 100 indicators

- Options trading and analysis tools

- Backtesting

How does the CQG Integrated Client work?

The CQG Integrated Client is easy and straightforward to use.

The program can be launched directly from the icon on the desktop or via Start > All Programs > CQG > CQGNet > CQGNet. You just have to enter your login data.

The CQG Integrated Client offers various toolbars, pages and tools.

The Quote Window displays quotes and data for a variety of markets. You can integrate orders, Time & Sales and trading instruments.

All windows can be arranged individually.

You can open charts directly from the toolbar. You also have the option to assign hot keys to all the tools and functions – opening a chart window, say, by pressing the F2 key.

Indicators are selected and inserted using the Toolbar Manager.

You can place orders directly from the chart, the DOM, the Order Desk or the Order Ticket. Additional options for order placement include SnapTrader, Spreadsheet Trader, XLS Trader, hot keys and the Quote Board.

The following AlgoOrders are available from CQG:

- AlgoOrder DOM-Triggered Stop and Stop Limit (DTSL)

- AlgoOrder DOM-Triggered (DT)

- AlgoOrder Iceberg (ICBG)

- AlgoOrder Market-If-Touched (MIT)

- AlgoOrder Order-Places-Order (OPO)

- AlgoOrder Puncher (PNCH)

- AlgoOrder Replicator (REP)

- AlgoOrder Scaling Bracket (SB)

- AlgoOrder Time-Weighted Average Price (TWAP)

- AlgoOrder Volume-Triggered Cancel (VTC)

The AlgoOrder executes the order as specified, even orders that close a position. Individualized AlgoOrders can also be created.

It is also easy to implement other functions, including options analysis, research and backtesting.

What is the CQG FX?

The CQG FXallows you to trade forex through CQG.

It includes all the major and minor FX pairs, as well as the metals spot market.

You can monitor the quotes of all currency pairs on the Split QuoteBoard and trade directly from the board.

What is the CQG Desktop?

The CQG Desktopis the new web-based version of CQG’s software. It doesn’t need to be downloaded.

It includes all the popular features and tools of the other CQG products and is already highly popular among traders.

It’s particularly useful if you’re on the road and want to monitor your portfolio or quickly analyze a market.

What are the benefits of the CQG data feed?

The CQG data feed is one of the most comprehensive available.

CQG connects to over 85 global market data sources and 45 tradable exchanges. Its data feed thus enables you to analyze and trade markets around the world.

The use of redundant networks ensures the fastest transmission of real-time data.

Data can be exported at any time and displayed in Excel and many other programs. Data can also be used to create models and perform analysis. With the help of the CQG API, you can even trade from Excel sheets.

CQG provides decades of historical data drawn from over 60 exchanges worldwide. Clients have access to 20 years of end-of-day market data and seven years of intraday data, including Times & Sales (tick data), intraday bar data and trading volume. Additional data from as far back as the 1930s are also available.

Is there a CQG app?

Yes, there is, and it’s available for both IOS and Android.

No matter what product or version of CQG you’re running, you can easily log in to the app from any location with your CQG Trading ID. You can then view markets, trading information, and all your positions.

Login is uncomplicated and fast with TouchID or FaceID. You can also receive push notifications of order executions, news articles, alerts, etc.

Markets and charts can be analyzed in real time.

Order and trade management is also user-friendly.

Is cryptocurrency data also available from CQG?

Yes, data is also available for cryptos. You can receive cash and futures data from sources such as the Chicago Mercantile Exchange (CME), the Intercontinental Exchange (ICE), the CBOE Futures Exchange (CFE), the San Juan Mercantile Exchange, the ErisX and the DVeX.

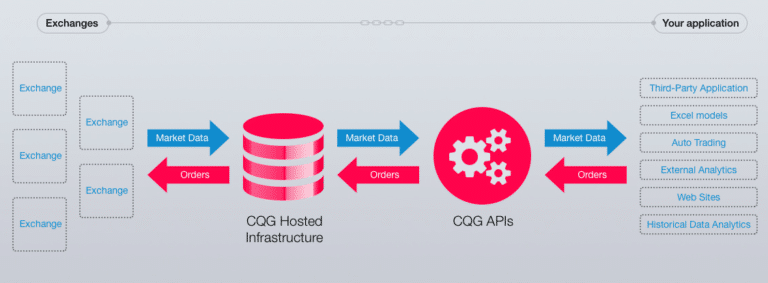

Is there a CQG API?

Yes, there are several CQG APIs.

To begin with, CQG offers the CQG Charting API, which allows third parties to publish custom analytics in CQG as studies, indicators, conditions or formulas to be used and displayed on various CQG interface such as charts, quote boards and trading interfaces.

The CQG Data API makes it possible to seamlessly deliver CQG’s market data and analytics to external applications. It is based on Microsoft COM server technology, and any programming language that supports COM can be used for development.

The CQG Trading API supports order routing for external applications.

There is also a Web API, which provides access to 1.) Level 1 and 2 streaming data, 2.) tick, intraday bar and daily bar data and 3.) unified exchange gateways for order execution, account summary, order history and post-trade analysis.

Does CQG offer a FX data feed?

Yes, CQG offers data for forex, which comes from Oanda.

What’s the difference between the CQG Integrated Client, the CQG Q Trader and the CQG Desktop?

These three products differ in terms of their functionality.

The CQG Integrated Client has the most extensive functionality and costs $595.

The CQG Q Trader costs only $75, with a $0.25 charge for each filled contract, capped at $595 (the price of the CQG Integrated Client).

The CQG Desktop costs $25. There is a charge of $0.25 for each filled contract, capped at $495.

The CQG Desktop is the simplest version, although it does offer numerous options. Charting, for example, is limited to three years, and some chart types are not available.

With the CQG Q Trader, only one chart can be displayed per page.

The CQG Integrated Client is the most comprehensive package, but it also costs significantly more. Which version is best for you depends on your individual requirements and trading strategy. Some traders don’t need extensive historical data or complex analysis tools, but if you want to enjoy the full functionality of CQG, the CQG Integrated Client is the ideal option.

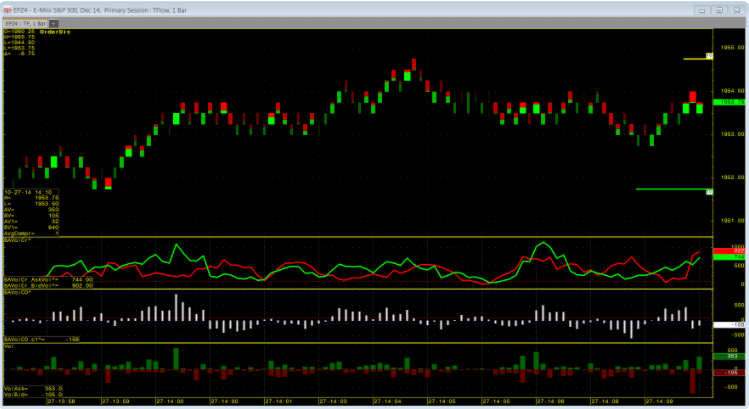

What are TFlow charts?

CQG’s TFlow charts provide an exclusive view inside markets, showing whether traders are hitting bids or lifting asks to generate the last price. The charts’ color-coding shows who is trading more aggressively: the buyers or the sellers.

The following TFlow chart types are available:

- Aggregated TFlow

- Range-Aggregated TFlow

- Smoothed TFlow

- Time-Based TFlow

Exchange and data connections

CQG connects to numerous exchanges and market data sources around the world.

They currently include:

- BM&F Brazilian Futures

- Cboe Chicago Board Options Exchange

- CBOT Chicago Board of Trade

- CFE CBOE Futures Exchange

- CME Chicago Mercantile Exchange

- COMEX Commodity Exchange

- ICE Futures US Intercontinental Exchange

- MGEX Minneapolis Grain Exchange

- Montreal Exchange Montreal Exchange

- Nasdaq NASDAQ Equities & Indexes

- NFX Nasdaq Energy Futures

- NYMEX New York Mercantile Exchange

- NYSE New York Stock Exchange Equities & Indexes

- OPRA

- PanXchange

- TSX Toronto Stock Exchange

- EMEA

- BALTIC Baltic Exchange

- BME IBEX Indexes

- Borsa Istanbul

- Borsa Italiana Italian Futures & Equities

- CBOE Europe CBOE Europe Equities

- Deutsche Boerse Deutsche Boerse

- DGCX Dubai Gold and Commodities Exchange

- DME Dubai Mercantile Exchange

- EEX European Energy Exchange

- Eurex

- Euronext Cash

- Euronext Derivatives

- FTSE

- ICE Futures Europe Commodities

- ICE Futures Europe Financials

- JSE Johannesburg Stock Exchange Derivatives

- Johannesburg Stock Exchange Equities

- LME London Metal Exchange

- London Metal Exchange

- MEFF Spanish Derivatives

- Moscow Exchange Currencies

- Moscow Exchange Equities

- Moscow Exchange Derivatives

- Nasdaq Commodities

- NASDAQ Nordic Derivatives

- NLX

- SWX Swiss Stock Exchange

- APAC

- APEX

- ASX Australian Securities Exchange Derivatives (previously Sydney Futures Exchange)

- Australian Securities Exchange

- Bursa Malaysia Derivatives Exchange

- CFFEX China Financial Futures Exchange

- DCE Dalian Commodity Exchange

- HKEX Hong Kong Futures Exchange

- HSI Hang Seng Indexes

- ICE Futures Singapore

- INE Shanghai International Energy Exchange

- JPX Japan Exchange Group

- KRX Korea Exchange

- NZX New Zealand Exchange

- SGX Derivatives Exchange

- SHFE Shanghai Futures Exchange

- TFX Tokyo Financial Exchange

- TSE Tokyo Stock Exchange

- TWSE Taiwan Stock Exchange

- ZCE Zhengzhou Commodity Exchange

- ErisX

- BGC Market Data

- BrokerTec

- Fenics Fenics

- GovPX

- Jump Liquidity

- Liquidity Edge

- Nasdaq Fixed Income (NFI)

- Tullett Prebon

- VFI

- CQG FX Data

- EBS Dealing Resources

- NEX

- Dow Jones Indexes

- RICI

- Russell Indexes

- S&P Indexes

- PLATTS

Does CQG offer a free trial?

Yes, you have the option to test the CQG Integrated Client for free over a 14-day period.

Register here.

What training courses does CQG offer?

CQG has a very comprehensive online manual that explains all the features of its software.

In addition, it has set up an online library that features a wide range of training videos. Many are also available on CQG’s YouTube channel.

Finally, customers can ask questions or share training content in a special CQG forum.

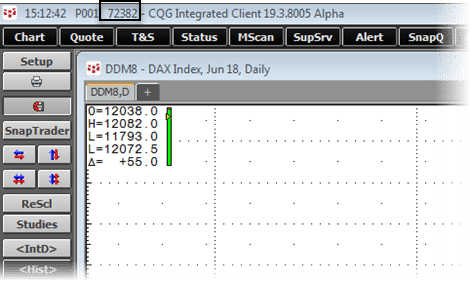

How do I reach CQG support?

You can reach CQG support by phone, email or live chat.

Because the company has offices around the world, customer support is available in all languages around the clock.

You can also contact CQG for a remote support session, in which experts connect directly to your PC.

You’ll need to have your system number handy – you’ll find it at the top of the platform as seen below.

Which broker work with CQG?

The brokers that work with CQG currently include:

- ABN AMRO

- ADM Investor Services

- AMP Global Clearing

- Aarna Capital Limited

- Advantage Futures

- BCS

- BMO Capital Markets

- BNP Paribas

- BOC International

- Bell Potter

- Best Efforts Bank

- Britannia Global Markes Limited

- CGS-CIMB Securities Singapore Pte Ltd

- CMS

- CSC Futures

- Citi

- DBS Bank Ltd

- Deutsche Bank

- Dorman Trading

- E*TRADE

- ED&F Man Capital Markets

- FXFlat

- GH Financials

- Gain Capital

- Guotai Junan International

- HGNH International

- Huatai USA

- INTL FCStone

- J.P. Morgan

- Jitneytrade

- Just2Trade

- KGI Securities (Singapore)

- Linn Group

- MBF Clearing Corp.

- MTS Gold Group

- Macquarie

- Marex Financial

- Mercantile Exchange of Vietnam

- Mizuho

- NORD/LB

- Nanhua USA

- Nissan Securities

- Oceanwide Securities

- Okachi & Co Ltd

- Orient Futures Singapore

- PT CGS-CIMB Futures Indonesia

- Phillip Capital Inc.

- Phillip Futures Singapore

- PhillipCapital Menkul Degerler

- RBC Capital Markets

- RHB Investment Bank

- RJO’Brien

- RJO’Brien UK

- Rosenthal Collins Group LLC

- Sacombank

- Shepard International Inc.

- Societe Generale

- Straits Financial

- Sucden Financial

- UOB Bullion and Futures

- VietinBank

- WH SelfInvest

- Wedbush

- Yutaka Shoji

- Orient Futures

- COFCO Futures

- BOCI Futures

- Minmetals & Jingyi Futures

- Huatai Futures

- Nanhua Futures

- SDIC Essence Futures

- Guotai Junan Futures

- Huishang Futures

- Xinhu Futures

- Founder CIFCO Futures

- Yongan Futures

- Haitong Future

- Galaxy Futures

Conclusion

CQG is one of the leading providers of trading software worldwide, offering a wide range of features and capabilities.

The software is simple, yet the comprehensive functionality is impressive.

The CQG data feed is one of the best in the world. Because of the large number of integrated exchanges and market data sources, data is available on all markets and securities worldwide, including bonds, stocks, cryptocurrencies, interest rates, forex, futures and options.

CQG’s various APIs allow you to implement CQG in other software programs or tools. The API for Excel is highly useful for analyzing and modeling data.

CQG support is easy to reach and provides answers to even the most complex questions.

CQG has been in existence for more than 40 years and is well established the trading industry.

The subscription packages offer good value for your money – CQG really leaves nothing to be desired.

Depending on your requirements and preferences, you can choose from a variety of products. These differ in terms of tools and functionality, giving everyone the opportunity to find just the right package for their needs.

Read more: