In this article, I’d like to explain the bid price, or bid, which plays an important role in trading. The opposite of the bid is the ask price.

The bid is the highest price at which someone is willing to buy a security in the market. By contrast, the ask is the lowest price at which someone is willing to sell. The difference between the bid and the ask is the spread.

The bid price in practice

Current bid and ask

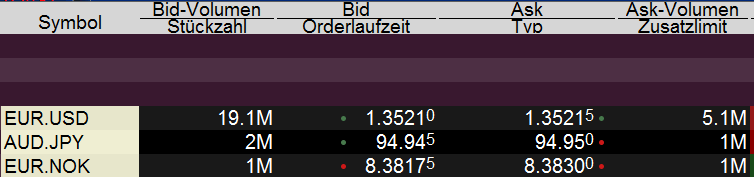

If we access market information, it might look something like the table in the above image.

I took the screenshot on Monday, July 21, 2014, at 17:18. It shows the current spread for the currency pairs EUR/USD, AUD/JPY and EUR/NOK. The data comes from my broker’s trading platform (Interactive Brokers).

For the EUR/USD currency pair, we see the current bid at 1.35210 and the current ask at 1.35215. The spread between the two is 0.5 pips. Volume is also displayed: bid volume is 19.1 million and the ask volume is 5.1 million. It is crucial to get bid and ask volume from your broker.

This means there are buy orders worth 19.1 million at a price of 1.35210. On the other hand, there are sell orders totaling 5.1 million at an ask price of 1.35215.

The orders shown at the bid and ask price in the market are always limit orders.

Now, if we were to use a market order to buy, say, 100,000 euros against US dollars, we would get a price of 1.35215. Conversely, if we wanted to sell 100,000 euros at the market, we would get a price of 1.3521.

The bid price when entering the position

In my trading, I regularly use the bid price to enter a long position – for example, when I want to buy below the current price level using a buy limit order.

For example. Let’s assume EUR/USD is at 1.3521, but I want to enter at 1.3500 and not pay more. I place a buy limit order at 1.3500. If the price falls and the bid is displayed at 1.3500, my buy order will be executed as soon as someone sells at the market. My buy order will also be executed if the ask falls to 1.3500.

The bid when closing a position

On the other hand, I also use the bid price when I want to close a short position with a buy limit order.

Suppose I sold the EUR/USD currency pair at 1.3520, expecting it to fall to 1.3470. I place a buy limit order at 1.3470, and if EUR/USD falls to 1.3470, my bid price will be executed as soon as someone sells at the market. My buy order will also be executed if the ask declines to 1.3740.

Read more