The New Zealand Dollar to US Dollar (NZD/USD) exchange rate is one of the world’s most traded currency pairings.

In this article we make a New Zealand Dollar / US-Dollar price forecast and long-term price prediction. We would like to give an assessment of the future price development of New Zealand Dollar / US-Dollar. We look at the short term chart like the daily chart, the medium term chart like the weekly chart and monthly charts, and also the long term charts for NZD/USD which are the quarterly and yearly charts. The basis of our analysis is the Price Action and Technical Chart Analysis.

The charts used are from TradingView and the prices are from FXCM.

NZD/USD Forecast: Daily chart

Last update: April 28, 2021

In the Daily chart we see the NZD/USD recovering from support of the 2019 high at 0.6941 and trading close to 0.7200.

Resistance: 0.7240 | 0.7315

Support: 0.7176 | 0.6942

NZD/USD forecast: After falling back to the levels around the high from 2019, we expect to see broader sideways action. The next drop below 0.7000 could force negative expectations.

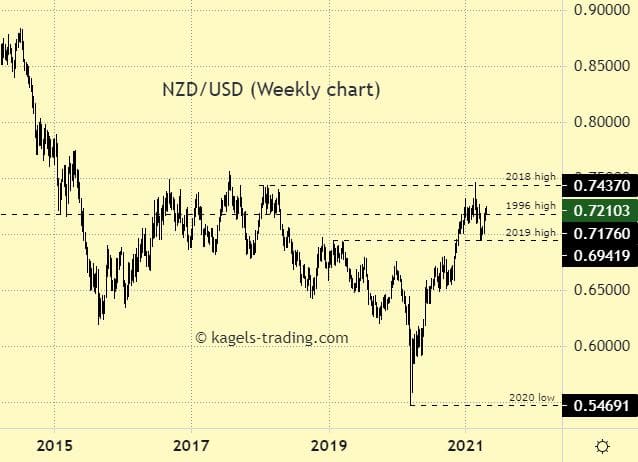

NZD/USD Forecast: Weekly chart

Last update: April 28, 2021

In the weekly chart we see NZD/USD trading around 0.7210 after a strong recovery from the 2020 low.

Resistance: 0.7437

Support: 0.7176 | 0.6942

NZD/USD forecast: We expect to see a continuation of the NZD strength against the USD. Only a drop below the 2019 high could turn the positive chart picture to neutral or negative. The 2018 high above could turn out to be strong resistance.

NZD/USD outlook: Monthly chart

Last update: April 28, 2021

In the monthly chart we see NZD/USD trading above the 1996 high experiencing the next resistance level around 0.7437

Resistance: 0.7437

Support: 0.6942

NZD/USD prediction: We expect to see a continuation of NZD strength against the USD. Next important resistance is around the 2018 high at 0.7473. By the strong April-candlestick it seems the resistance at the 1996 high could have been overcome.

NZD/USD prediction: Quarterly chart

Last update: April 28, 2021

In the quarterly chart we see NZD/USD now trading around the price level of the 1996 high

Resistance: 0.7437

Support: 0.6942

NZD/USD prediction: We expect to see a continuation NZD strength against the USD. Next important resistance level is around the 2018 high.

NZD/USD forecast: Yearly chart (Historical chart)

Last update: April 28, 2021

In the yearly chart we see NZD/USD now trading above the 2019 high. The yearly candle of 2020 shows a strong and powerful reversal.

Resistance: 0.7437

Support: 0.6942

New Zealand Dollar forecast: We expect to see a continuation NZD strength against the USD. Next important resistance is the 2018 high at 0.7437.

What is the current price of NZD/USD ?

The current price of NZD/USD you can see here.

About NZD/USD

NZD/USD, often referred to as “Kiwi”, a foreign exchange term used to describe the New Zealand Dollar vs the US dollar, is one of the oldest traded currency pairs. The Currency Pair NZD/USD is the shortened term for the New Zealand Dollar against U.S. dollar pair, or cross for the currencies of New Zealand (NZD) and the United States (USD). … For example, if the pair is trading at 0.6500, it means it takes 0.6500 U.S. dollars to buy 1 New Zealand Dollar.

*This price prediction is based on the data collected from various sources. This should not be considered as an investing parameter and user should do their own research before investing.

Do you think our predictions are accurate? What are your thoughts on the methods used to reach our conclusions? Let us know in the comments below.