Ed Seykota is a trading legend.

He was born in 1946 and earned a degree from the renowned Massachusetts Institute of Technology. He is considered the first system trader. By 1970, he had achieved phenomenal success using computers and automated systems for futures trading.

Inhaltsverzeichnis

The first computerized trading systems

At the start of his career, working with Michael Marcus, Ed Seykota developed a computerized trading system for the brokerage firm Commodities Corporation. Marcus is said to have turned an initial stake of $30,000 into $80 million over 20 years (see Pit Bull by Martin Schwartz). Seykota taught Marcus the most important money management rules for trading.

Seykota’s trading was influenced by Richard Donchian, who developed the first non-computerized trend-following systems based on 5- and 20-day moving averages.

Edwin Lefevre’s book Reminiscences of a Stock Operator also made a strong impression on Seykota.

His first trading system used exponential moving averages.

A continuously optimized trading system

Over the years, Ed Seykota has constantly improved his trading system, adapting it to his own trading style and personality. It was initially a very rigid system, but Seykota made it more flexible by adding new rules, chart patterns and money management algorithms.

Ed Seykota – a market wizard

In his influential bestseller Market Wizards: Interviews with Top Traders, Jack Schwager devoted an entire chapter to Ed Seykota, describing him as “one of the best traders of our times.”

In addition to Ed Seykota and the aforementioned Michael Marcus, Schwager interviewed many other trading legends, including Bruce Kovner, Paul Tudor Jones, Michael Steinhardt, Van K. Tharp, and James B. Rogers.

Ed Seykota and the Whipsaw Song

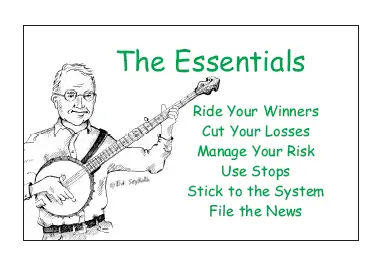

Ed Seykota is not only an excellent trader, but also a talented musician. In the video below, you can see and hear him performing “The Whipsaw Song” with the Trading Tribe Band.

The song describes the six most important rules (“essentials”) of trend-following trading. These apply to every trader, beginner or professional.

“Whipsaw” describes the sudden reversal in the price of a security in a volatile market.

The essentials of trend-following trading are:

- Ride your winners (hold on to winners as long as possible).

- Cut your losses (sell losing positions quickly).

- Manage your risk (determine how much you can afford to bet and know when you’re getting out).

- Use stops (get out automatically).

- Stick to the system (don’t improvise).

- File the news (don’t be influenced by news – disregard it).

Final observation:

If you want to get into the right state of mind before each trading session, watch and be inspired by Ed Seykota’s music video. The song describes all the most important trading rules. Even if you have trouble understanding the lyrics the first time you listen, don’t worry, you’ll understand more when you listen a second and third time.

Read more