Broker comparison – who is the best? In this article, we are introducing FXCM.

Inhaltsverzeichnis

What is behind FXCM?

FXCM is an online broker that specializes in FX and CFD trading. Or in their own words:

„Founded in 1999, the company’s mission is to provide global traders with access to the world’s largest and most liquid market by offering innovative trading tools, hiring excellent trading educators, meeting strict financial standards and striving for the best online trading experience in the market.“

This online broker offers its clients a high-quality execution and plenty of liquidity. In addition, FXCM also provides educational courses on FX and CFD trading and a great range of helpful tools for its clients. FXCM is a Leucadia company.

Leucadia as majority shareholder

FXCM was taken over by Leucadia in January 2015, ever since when the online broker has been able to benefit from the new majority shareholder’s size. This for example also includes another subsidiary called Jefferies, a renowned US investment bank. Jefferies provides the online broker with prime brokerage services and liquidity for FX trading. This also ensures that FXCM clients can benefit from a competent and multi-facetted range of services.

The history of FXCM

Forex Capital Markets (FXCM) was established in 1999 in New York and was one of the first developers of electronic trading platforms for the foreign exchange market. Originally called Shalish Capital Markets, the company was renamed FXCM a year later. In the year 2003, FXCM expanded to another continent by opening an office in London, which was regulated by the British financial supervisory authority.

In the same year, FXCM entered into a partnership with the Refco Group, one of the USA’s largest futures brokers at the time. Refco filed for insolvency on 17 October 2005, however, upon the discovery of a $ 430 million fraud, only two months after its IPO.

In May 2010, the company acquired the British ODL Group, making FXCM the world’s largest forex retail broker with over 200,000 clients and assets of ca. 800 million US$. In June 2012, FXCM next acquired the majority shareholdings in Lucid Markets, a London-based trading group with a focus on forex.

On 15 January 2015, the online broker lost US$ 225 million in the wake of strong exchange rate fluctuations of the Swiss franc. In the course of this, the company took out a US$ 300 m loan from Leucadia to meet capital requirements, which was then also followed by the takeover.

Accolades won by FXCM

In the years since its inception, FXCM has been able to garner a variety of awards for its services. Please see their website for detailed information on all of them. We shall meanwhile restrict ourselves to some of the latest and most important ones here.

- Brokerchooser: 2019 FXCM Best Technical Tools

- FXEmpire: 2018 FXCM – Best Customer Service

- Deutsches Kundeninstitut: 2015 – 5-star rating for the customer service and price-benefit ratio

- Euro am Sonntag: 2014 – Best trading platform, very good customer service, very good website

Regulation of FXCM and safety of client deposits

As an operative subsidiary of the FXCM group of companies, FXCM Germany is a branch of “Forex Capital Markets Limited” and thus supervised and regulated accordingly by the British FCA (Financial Conduct Authority).

The online broker treats the capital paid in by its clients responsibly by safekeeping it in separate accounts held at renowned banks around the world. Client funds are thus protected from losses in accordance with the FCA regulations by keeping them in segregated accounts.

In the not very likely event of the broker going insolvent, clients will thus be refunded a portion of their invested capital. This insurance will recompense clients up to a sum total of 85,000 GBP, thus meeting the requirements of the „Financial Services Compensation Scheme“ (FSCS).

In addition, the company also banks on transparent processes and a structured overview of its current financial situation.

Which tradable markets are available at FXCM?

One of the most important aspects for choosing a suitable broker is doubtlessly the range of different markets available to traders there. FXCM is second to none of its competitors in this regard while also offering its clients a range of interesting trading tools on its website. Please see below for a quick list with brief explanations.

Forex

FXCM first and foremost offers its clients currency trading in the forex market. The forex market is the world’s largest market with a trading volume of more than US$ 5 trillion per day. With its tremendous size and very high liquidity, the forex market offers optimal possibilities for a multitude of ambitious traders.

An additional advantage is that the forex market can be traded around the clock on five days a week (24/5).

Forex baskets

Besides the classic trading in the forex market, FXCM clients can also trade so-called forex baskets. These baskets enable traders to also bet on volatile currencies while reducing the risk inherent in depending on just a single one. The forex baskets available at FXCM for example include “The Index Basket”, “JPY Basket – The Yen Index”, and the “EM Basket – Emerging Markets Index”.

Indexes

Besides the forex trading, FXCM also enables you to trade with company shares and/or index funds. Index trading offers traders the following advantages: There are few trade restrictions, and transaction costs are also kept quite low as a rule. In addition to which investors can also trade with leverages, relying on variable trade sizes in the process.

Commodities

In addition to the classic trading instruments listed above, the online broker will also let you trade in a variety of different commodities. In this regard, FXCM particularly banks on an improved trade execution and low transaction costs. The tradable commodities for example include gold, silver, natural gas, grains and copper. These commodities can also be traded on margin, to boot.

Cryptocurrencies

And last but not least, trading with digital cryptocurrencies is also possible at FXCM. Clients can trade in the king of cryptocurrencies, bitcoin, as well other interesting cryptocurrencies such as Ethereum, Litecoin, Ripple, and Bitcoin Cash ABC. Besides this, the trading with digital currencies also offers an opportunity for testing the so-called CryptoMajors Basket, which includes bitcoin as well as Ethereum, Ripple, Litecoin and Bitcoin Cash ABC, all combined in a single trading instrument.

Which platforms are available at FXCM?

Another decisive aspect for an online broker besides the tradable instruments detailed in the previous section is also always its selection of trading platforms. To enable optimal trading conditions for its clients with the aforementioned instruments, FXCM has specialized in three platforms: Trading Station, MetaTrader 4, and NinjaTrader. Please see below for details of the individual trading platforms‘ different functions and benefits.

Trading Station

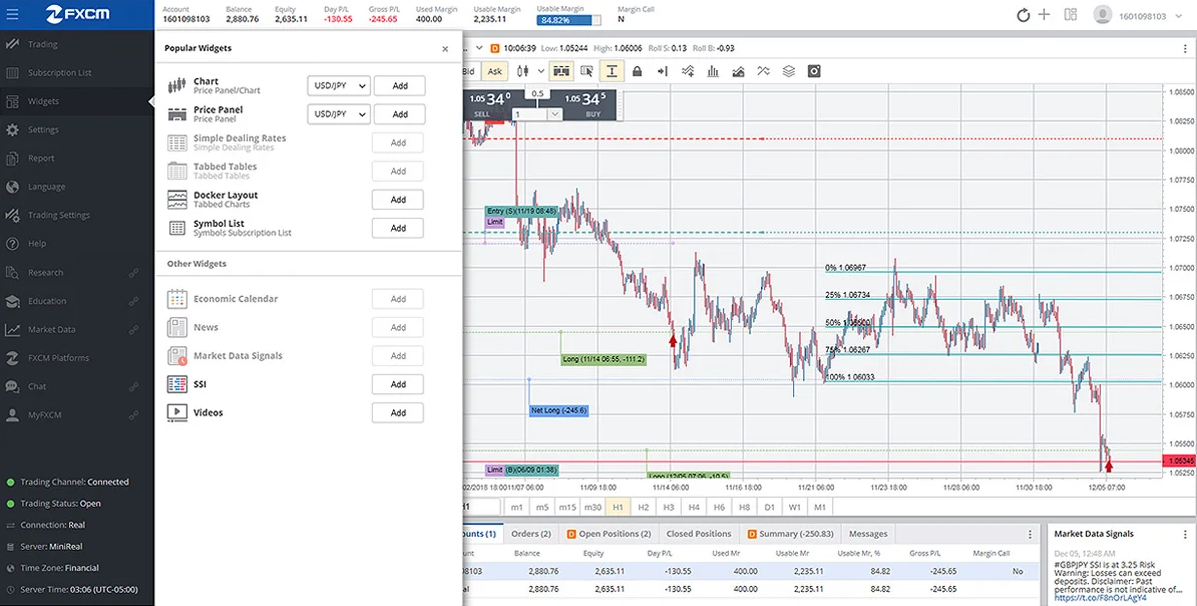

The proprietary Trading Station platform is the most popular alternative amongst FXCM’s clients and offers a broad range of useful charts, analysis tools, and various other functions. The user interface is also of a well-structured and easily manageable design, as the following screenshot from the trading platform illustrates.

In addition to the above, the online broker also provides a mobile version to its traders with its Mobile Trading Station, enabling them to trade on the go irrespective of the time and place.

The platform’s integrated charts can be individually customized to your own needs and requirements. Trading is also possible directly from the various charts, with users able to select from a range of different indicators.

MetaTrader 4

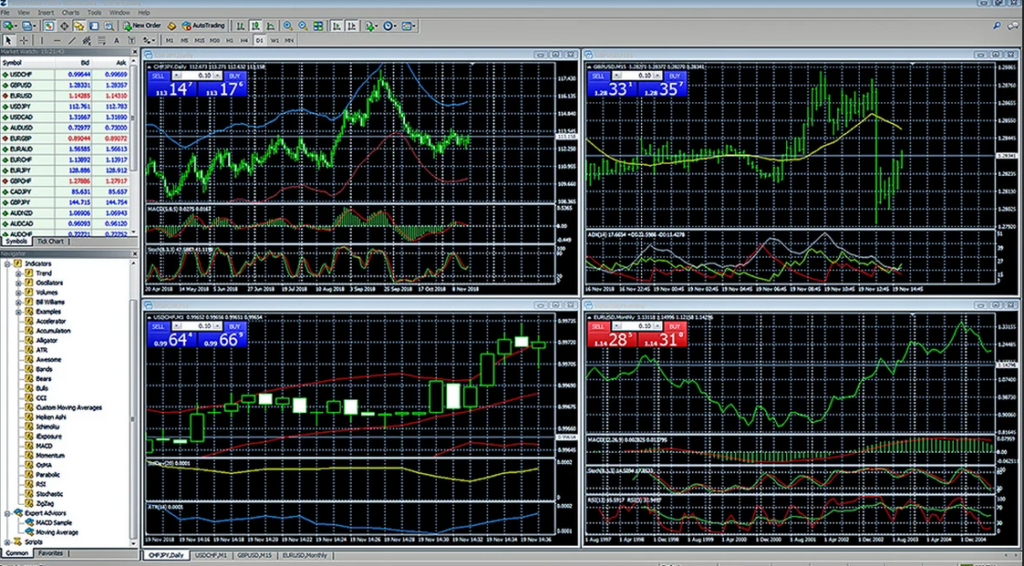

The MetaTrader 4 (MT4) trading platform is popular around the world and permits investors to trade in currencies, futures and CFDs, while offering interactive charts, many selectable order types, and sophisticated analyses. Added to this are many pre-set and user-customized indicators enabling clients to manage and optimize their trading processes in a targeted manner.

The illustration below shows a screenshot from the software.

Using MetaTrader 4 to trade with currencies and CFDs at FXCM will also bring a number of other advantages. One of them being the lifting of all trade restrictions. In addition to which most the available trading strategies are being supported (also Scalping).

The platform not least of all also offers the use of expert advisors and virtual private servers. Investors wishing to trade using the MetaTrader 4 trading platform can either do so with the web-based version, or download it to their own computer, laptop, etc. Besides which there is also the option of a mobile version.

NinjaTrader

The final option provided to FXCM clients is the NinjaTrader platform, which can be used for forex, but also futures and stock trading. NinjaTrader is particularly suitable for „the development of customer-specific strategies“ as it provides a so-called Strategy Builder and the corresponding programming language NinjaScript for this. Traders are thus enabled to develop their own automated trading strategies and apply them in their practice.

Added to all this is the Market Analyzer, which will provide you with a structured overview of the latest market conditions and fluctuations around the clock.

TradingView

The forex FXCM has also been represented in the TradingView platform since 2020.

The trading conditions at FXCM

With all the trading platforms available at FXCM highlighted above, this section will be dedicated to presenting an overview of the trading conditions at this online broker.

Spread prices

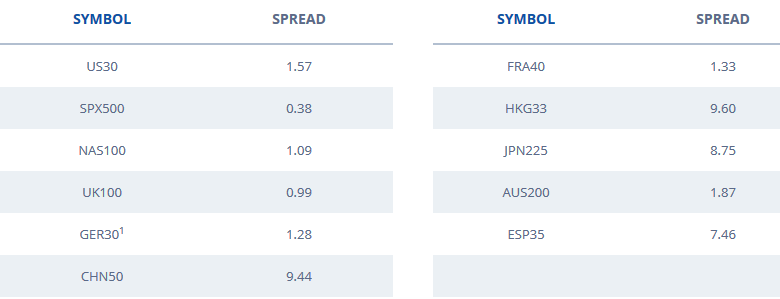

When it comes to spreads, the FXCM online broker offers its clients fair conditions for the available trading instruments. In the forex area, the spread for the EUR/USD currency pair will for example come to 1.3 pips, and 1.8 pips for the GBP/USD major. The spreads for index trading vary, as is illustrated by the table below.

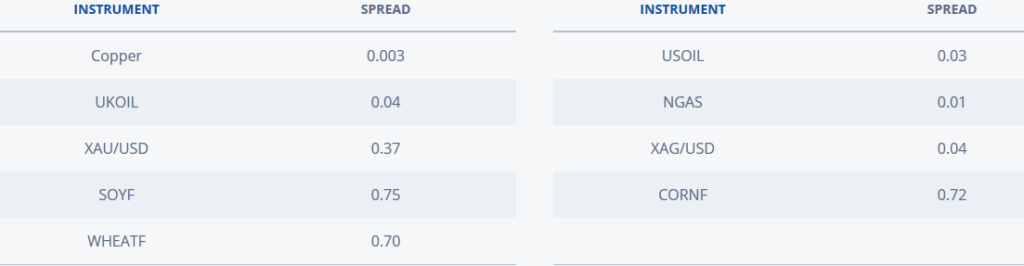

The spreads are also relatively inexpensive in comparison with other providers where the commodity trading is concerned.

As the trading costs are always automatically calculated in the trading platform when you trade at FXCM, you will always have an overview of the real time spread and pip costs as a client. The following equation can meanwhile be used for a precise calculation of the incurred trading costs:

- Spread x pip costs x number of contracts = total transaction costs

Leverages and margins

Besides the spreads, one should always take a closer look at the available leverages and margins for choosing a suitable broker. As with many other online brokers, forex and CFD trades can also be leveraged at FXCM. This enables profits to be made from even the smallest market movements.

Leveraged trading is tantamount to trading with borrowed money, so to speak. Various leverage ratios are available to choose from for this. If you decide to trade a sum of 10,000 euros with a leverage of 30 : 1, for example, you will only need to pay down 334 euros as a surety.

The online broker principally offers the following leverages for the various trading instruments:

- 30 : 1 for major currency pairs

- 20 : 1 for all other currency pairs, gold, and indexes

- 10 : 1 for commodities (apart from gold) and other stock indexes

- 2 : 1 for cryptocurrencies

Execution

Where the execution statistics are concerned, FXCM can boast of above average, positive figures. In the year 2019, more than 89 percent of the executions registered either a positive slippage or none at all. Clients are accordingly able to trade exactly at the selected price or even better prices, helping them to benefit from lower spreads as a consequence.

And the online broker can also score where its order execution speed is concerned. Especially as short latency periods have a major role to play if trading processes are to be effective. The average execution speed at FXCM amounts to a mere 0,017 seconds and/or 17 milliseconds, if you prefer.

Payments at FXCM

The range of options for making deposits at FXCM is also relatively broad, enabling clients to choose from several possibilities when it comes to capitalizing their accounts. The following payment options are available at FXCM:

- Debit and credit cards

- Bank transfer

- Skrill

- Neteller

- Klarna

- Rapid transfer

Upskilling services at FXCM

In addition to all the above, clients can also find further forex and other training courses at FXCM. Besides detailed treatments of relevant topics directly on the website, users can also benefit from their online seminars. In this context, renowned online experts additionally offer live webinars on various subject areas at regular intervals. Interested parties can furthermore view the individual webinars directly at the FXCM website.

Another perk available with this company are their regular seminars held by experienced speakers in Berlin that are suitable for trading novices as well as more advanced traders.

Demo account at FXCM

Anyone preferring to just give this online broker a try initially without running any direct financial risk would be well advised to try a demo account. Once you have registered for their demo account, you can use it permanently and free of charge. The buying and selling prices are shown in real time, and the virtual trading capital amounts to 50,000 euros to start with. In addition to which you can trade 24/5.

Experiences with FXCM

Looking around for online reviews of the broker FXCM, one quickly comes across various voices with positive ratings of their customer service. The spreads are tight, and their clients are offered a broad range of tradable assets as well.

The broker has attracted negative attention in the past when the National Futures Association (NFA) fined it US$ 2 million for „misconduct“ in August 2011. But all the clients affected by the drop in prices were compensated again within a month.

On the bottom line, the broker offers a meaningful alternative for novice and experienced traders nonetheless.

Further link: Wikipedia entry for FXCM

Read more: